Up to 40% Support for Insurance Premiums for Solo Small Business Owners

In Line with Government Policies Supporting Low-Income and Small Business Owners

Gyeongbuk Province Employment and Industrial Accident Insurance Premiums Up to 40%

#1. Mr. A, who runs a one-person restaurant in Gyeongbuk, sighs often these days as prices rise but customers decrease. Although business owners can receive unemployment benefits if they enroll in employment insurance for the self-employed, the insurance premiums are burdensome, making them reluctant to do so.

#2. Mr. B, who operates a manufacturing business alone, recently slipped on an icy road on his way to work and injured his wrist. As a business owner, he was unable to receive industrial accident compensation. He wants to enroll in industrial accident insurance for business owners to prepare for risks, but worries about the cost of the premiums.

To ease the worries and burdens of such business owners and allow them to work with peace of mind, the Korea Workers' Compensation & Welfare Service and Gyeongbuk Province have joined hands. The two organizations will support up to 40% of employment and industrial accident insurance premiums for one-person small business owners.

On the 18th, the Service and Gyeongbuk Province signed a business agreement at the Gyeongbuk Provincial Office to support one-person small business owners with employment and industrial accident insurance premiums, aiming to help small business owners struggling in the era of high prices.

Under this agreement, one-person business owners enrolled in employment insurance for the self-employed can receive up to 100% support when combined with subsidies from the Small Enterprise and Market Service. Industrial accident insurance premiums for small and medium-sized enterprise business owners can also be supported up to 40%, which is expected to be a great help to small business owners.

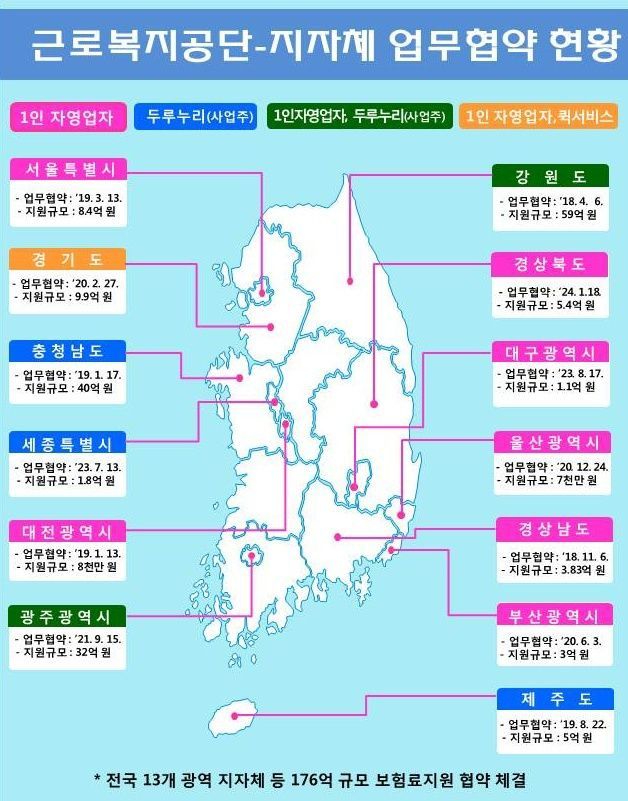

Since 2018, the Service has signed business agreements with 13 out of 17 metropolitan governments and 8 local governments nationwide to support insurance premiums, striving to reduce blind spots in social insurance and alleviate the premium burden on small business owners.

Employment insurance for the self-employed is available for those who do not employ workers or employ fewer than 50 workers. Industrial accident insurance for small and medium-sized enterprise business owners is available for those who do not employ workers or employ fewer than 300 workers. However, employment insurance for the self-employed is restricted in certain industries such as real estate rental.

Insurance enrollment can be applied for through the Employment and Industrial Accident Insurance Total Service. For more details, contact the Korea Workers' Compensation & Welfare Service customer center or refer to the Service's website.

Gyeongbuk Province's social insurance premium support can be applied for by submitting the required documents to the Gyeongsangbuk-do Economic Promotion Agency. For inquiries, contact the Happiness Economy Support Team at the Gyeongsangbuk-do Economic Promotion Agency for detailed guidance.

Director Park Jong-gil said, “In line with the government's policy direction to protect low-income earners and small business owners, we will do our best to strengthen the social safety net by continuously expanding support systems for industrial accident insurance that provides peace of mind in small business workplaces and welfare for workers to ensure livelihood stability.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)