Total Investment Executed of 90.04 Billion KRW

Final Recovery Completed for Portfolio No.1 'Valof'

First Invested and Recovered Company Achieves Success

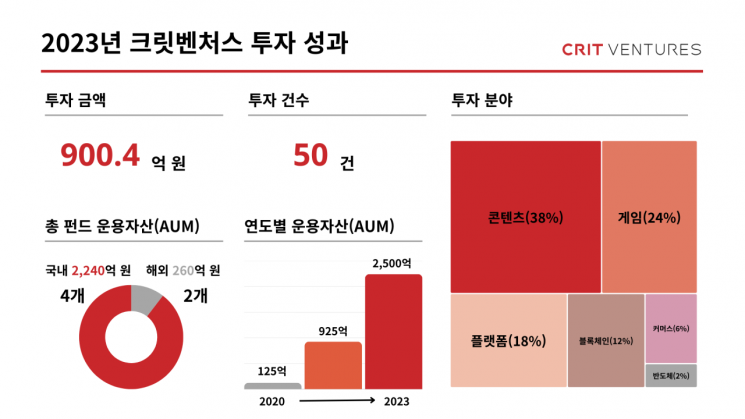

Crit Ventures, a venture capital (VC) firm in its fourth year since establishment, announced on the 18th that it executed a total investment of 90.04 billion KRW despite last year's investment winter. This amount significantly exceeds the cumulative investment of about 70 billion KRW over the past two years, primarily investing in K-content sectors such as video, music, and games, as well as blockchain-based business model innovation.

Crit Ventures conducted a total of 50 investments last year. The sector distribution was ▲Content 38% ▲Games 24% ▲Platform 18% ▲Blockchain 12% ▲Commerce 6%. Notably, it executed a total of 12 project investments in various cultural content fields such as music (albums) and dramas. Some of these were successfully exited early.

Key invested companies include, in the ‘Content’ sector, ▲Runup Company (video) ▲Diodi (music) ▲Hello A2 (music distribution) ▲Post Creative Party (animation); in the ‘Games’ sector, ▲Game Tales (MMORPG) ▲Puzzle Monsters (RPG) ▲Carbonated (shooting); in the ‘Platform’ sector, ▲Buffet Seoul (health) ▲Funderful (investment); and in the ‘Blockchain’ sector, ▲SAGA (infrastructure) ▲Pudge Penguin (NFT) ▲KTX (DeFi) ▲IntellaX (games).

There were also achievements from previously invested portfolio companies. The first investment portfolio company, ‘Velop’, completed its final exit last year after listing on the KOSDAQ SPAC at the end of 2022, becoming the first invested and exited company. The space startup ‘Contec’, invested through the KIP-CRIT Interactive Content Fund co-managed with Korea Investment Partners, successfully listed on the KOSDAQ market in November last year. Online furniture distribution company ‘Studio Samik’ is preparing for a KOSDAQ IPO at the end of this month. Swedish game company ‘Snowprint’ and Silicon Valley-based manufacturing data platform ‘Glassdome’, both invested in 2021, also exited their investments after about two years.

Crit Ventures is also focusing on post-management of existing portfolio companies through follow-up investments and linkages. In particular, it supports the growth of portfolio companies in new ways not previously attempted in the venture capital industry, such as investing in music (album) projects conducted by portfolio companies.

Currently, Crit Ventures manages assets under management (AUM) of 224 billion KRW in Korea and 26 billion KRW overseas, including the United States. It operates a total of six funds. Since establishing its U.S. branch in 2022, it has formed a blockchain-based global Web 3.0 fund and is actively discovering and investing in promising global companies.

Song Jae-jun, CEO of Crit Ventures, said, “Despite the difficult market environment, we discovered and invested in excellent startups across various fields. This year, we will continue our efforts to revitalize the startup ecosystem along with stable growth through new venture investment methods.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)