[K-Convenience Store Global 1000th Store Era]⑦

Domestic Convenience Stores Began in 1982 in Sindang-dong, Seoul

Rapid Growth Over 40 Years... Surpassing 50,000 Stores

Government Regulations Hurting Convenience Stores Need to Be Eased

The first convenience store in Korea was 'Lotte Seven,' which opened in March 1982 at the entrance of Yaksu Market in Sindang-dong, Jung-gu, Seoul. At the time, Lotte Seven operated in a 132㎡ (39.9 pyeong) space, stocking around 2,000 items including daily necessities and instant foods. However, Lotte Seven closed its doors in less than a year after opening, largely due to the perception that convenience stores were more expensive than regular supermarkets.

Convenience stores reappeared six years after Lotte Seven closed, in 1989. In May of the same year, 'Seven Eleven Olympic Branch (Store No. 1)' opened at the entrance of the Olympic Apartment shopping area. This first Seven Eleven store was the first convenience store in Korea to operate 24 hours a day. As the store became known and its operations stabilized, sales grew to about 4 million KRW per day on average. Considering that the sale price of a 13-pyeong apartment in Jamsil Jugong Apartments was about 40 million KRW in 1989, this daily sales figure shows how high Seven Eleven’s sales were at the time.

Exterior view of Lotte Seven, which opened at the entrance of Yaksu Market in Sindang-dong, Jung-gu, Seoul in March 1982.

Exterior view of Lotte Seven, which opened at the entrance of Yaksu Market in Sindang-dong, Jung-gu, Seoul in March 1982. [Photo by Seven Eleven]

42 Years of the Convenience Store Market... Embedded in Daily Life

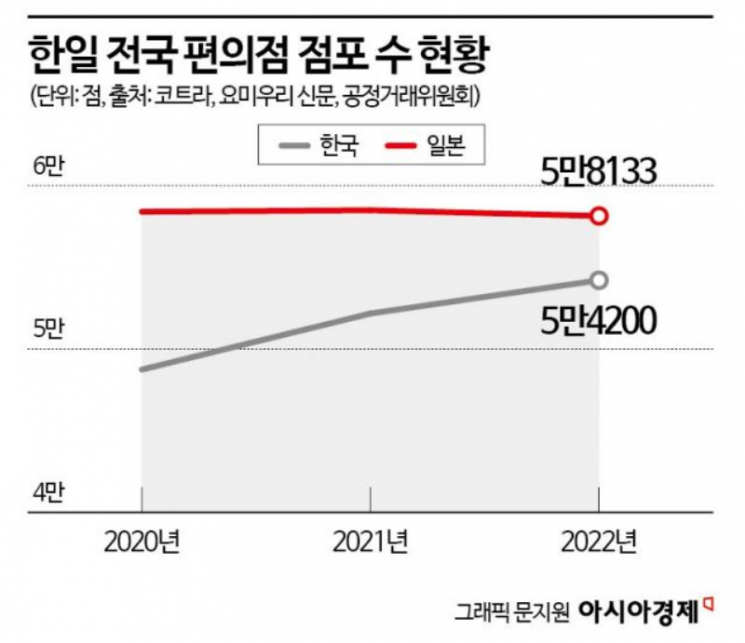

Since its introduction in Korea, the number of convenience stores has rapidly increased over 40 years, experiencing rapid growth. The number of stores surpassed 1,000 in 1993, then ▲10,000 in 2007 ▲20,000 in 2011 ▲30,000 in 2015 ▲40,000 in 2019 ▲50,000 in 2021.

The sales volume is also estimated to have reached about 35 trillion KRW as of last year. This means it has more than tripled in 12 years since reaching 10 trillion KRW in 2011. This sales volume exceeds that of large supermarkets and approaches the level of department stores. According to the sales composition ratio by business type of major distribution companies compiled by the Ministry of Trade, Industry and Energy, convenience stores recorded a sales share of 15.9% in 2021, surpassing large supermarkets (15.7%) and maintaining the second place among offline channels after department stores. As of the first half of last year, convenience stores accounted for 16.6%, 3.3 percentage points higher than large supermarkets (13.3%), and only 1 percentage point behind department stores (17.6%).

The primary reason for the rapid growth of convenience stores is demographic changes. As the proportion of single-person households increased, consumption patterns shifted toward nearby shopping and small-quantity, small-package purchases, leading to more people using convenience stores. The addition of various lifestyle convenience services also acted as a growth catalyst. Since 2000, convenience stores have successively incorporated lifestyle convenience services such as ATMs, parcel delivery, and in-store pickup of online purchases, changing social perception of convenience stores from simple retail outlets to convenient lifestyle consumption spaces.

Another factor is excellent accessibility. Convenience stores are distributed across various commercial areas such as apartments, offices, and university districts, typically located on the first floor. This means they are easily accessible to residents, workers, and passersby.

The Shadow Cast Over Rapid Growth

However, there is growing skepticism about whether this growth rate can continue. Currently, the average sales per convenience store have reached a saturation point, hovering around 1%. The decline in sales per store means that the number of stores is increasing relatively faster than total sales growth.

As growth stagnates, convenience stores are focusing on enhancing competitiveness. First, they are upgrading store systems to improve management efficiency. Efforts are being made to improve store management systems; for example, GS25 recently enabled store management via mobile devices in addition to PCs, and CU introduced a search engine and continued IT infrastructure upgrades such as Self POS 2.0 integration to enhance system convenience.

To increase sales per store, online and offline linkage efforts are underway. GS25 is strengthening its O4O (Online for Offline) strategy. Recently, it joined KakaoTalk's 'Neighborhood News,' allowing users to check notifications from nearby offline stores based on their location, aiming to boost store competitiveness through local marketing centered on neighborhood living areas. CU recently reorganized its marketing team into brand marketing and has introduced online content with enhanced entertainment elements in brand storytelling. The 'Convenience Store Veterans' series, targeting the MZ generation, has accumulated 300 million views.

The exterior of the 'No. 1 CU Kurly Specialized Convenience Store' launched by CU at the Tower Palace branch in December last year. [Photo provided by BGF Retail]

The exterior of the 'No. 1 CU Kurly Specialized Convenience Store' launched by CU at the Tower Palace branch in December last year. [Photo provided by BGF Retail]

Based on thorough commercial area analysis, premium stores and specialized stores are also being introduced. CU recently opened a 'Kurly Specialized Store' in Tower Palace, Gangnam-gu. This store features fresh foods such as meat, seafood, eggs, and vegetables sold on Kurly, as well as Kurly’s private brand (PB) products to attract consumers. At the end of last month, CU also opened a ramen specialty store with the 'Ramen Library' concept in Hongdae Sangsang Store, Mapo-gu. GS25 launched 'Door to Seongsu' in Seongsu-dong last November, focusing on GS25’s PB products and exclusive items. Emart24, which entered the convenience store business late, has focused on developing stores centered on specialized stores, with liquor specialty stores serving as nearby liquor warehouses.

Government Regulation Easing That Burdens Convenience Stores: A Challenge

Despite these efforts by the convenience store industry, frequently changing government regulations are hindering growth. Because of the franchise nature of convenience stores, when regulations are introduced or changed, not only the headquarters but also about 50,000 store owners are affected. Outdated policies continue, causing increasing social costs due to inefficiencies.

A representative example is the removal of semi-transparent sheets applied to glass walls to cover cigarette advertisements just two years after their introduction. In July 2021, these sheets were installed on the exterior glass walls of convenience stores as a reluctant measure by the industry following threats from the Ministry of Health and Welfare that stores would be penalized if cigarette advertisements inside the store were visible from outside.

At the time, the convenience store industry argued that the belief that invisibility would reduce smoking rates was outdated and that the sheets could compromise employee safety. However, the Ministry of Health and Welfare insisted on the principle that cigarette advertisements must not be visible. Yet, two years after the sheets were applied, crime incidents at convenience stores increased exponentially, and youth smoking rates actually rose, leading to the withdrawal of the sheet regulation.

The prolonged delay in expanding the list of safety over-the-counter medicines also significantly harms consumer convenience. Currently, convenience stores sell 13 items including five types of antipyretic analgesics, two cold medicines, four digestive aids, and two types of patches. Since the production of 'Tylenol 160mg tablets' and 'Children’s Tylenol 80mg tablets' was discontinued, no substitute medicines have been designated. A convenience store industry official lamented, "It is regrettable that the number of items has remained the same for 10 years, but with the discontinuation of the most sought-after over-the-counter medicines, store owners are bearing the full brunt of consumer dissatisfaction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)