Nongshim's 'Meoktaekkang' Launch Causes Sold-Out Frenzy

Orion Counters with 'Pocachip Max'

Every year, Nongshim and Orion fiercely compete for the top spot in the domestic snack market, and their rivalry continued intensely last year as well. Nongshim strengthened its lineup centered on the Kkang snack series, including ‘Saewookkang,’ by adding ‘Meoktaekkang,’ while Orion solidified its position by adding variety to its existing lineup such as ‘Pocachip.’

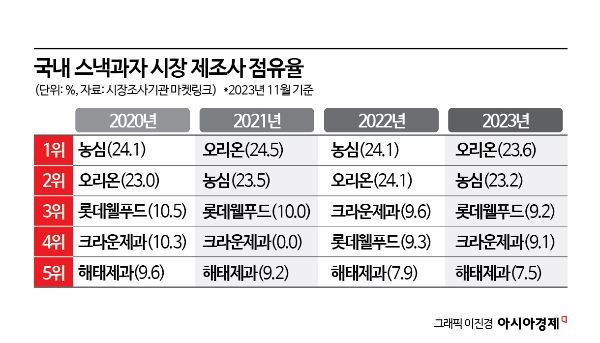

According to market research firm Market Link on the 10th, Orion secured the top position in the domestic snack retail market last year (January to November) with a market share of 23.6%. Meanwhile, Nongshim, which was number one in 2022, slipped to second place with a 23.2% share.

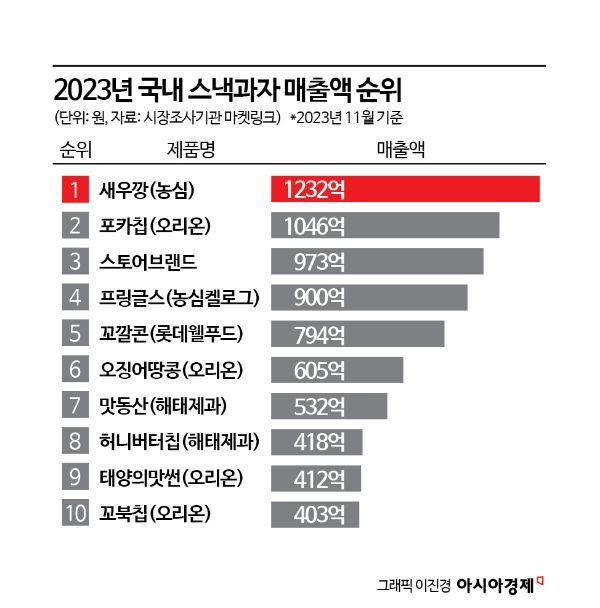

The leading position in the domestic snack retail market has been exchanged repeatedly between Nongshim and Orion every year. In 2020, Nongshim demonstrated overwhelming competitiveness with its flagship product Saewookkang, which was the only single brand to surpass 100 billion KRW in sales, achieving a market share of 24.1% and ranking first. However, the following year, Orion raised its market share to 24.5%, pushing Nongshim to second place. Although Saewookkang remained strong, its total sales decreased by 6.7% compared to the previous year, affecting the decline in market share. Nevertheless, Nongshim bounced back in 2022, with Saewookkang sales exceeding 130 billion KRW, reclaiming the throne.

Last year also started well for Nongshim. In the first half, Nongshim’s snack sales (234.1 billion KRW) increased by 5.1% compared to the same period the previous year (222.7 billion KRW), maintaining its lead. However, the tide changed in the second half. Orion, led by Pocachip, began to surpass Nongshim in monthly sales, and by November, Orion had regained first place after one year. However, since December’s results have not yet been announced and the gap between the two companies is narrow, the final outcome remains to be seen.

Aside from the battle for the top spot, the domestic snack market experienced an overall uptrend last year. Total sales reached 1.8541 trillion KRW as of November, a 9.4% increase compared to 1.6948 trillion KRW in the same period the previous year, and if December sales are included, last year’s total sales (1.9008 trillion KRW) are expected to be comfortably surpassed. By company, Orion’s sales increased by 7.4%, and Lotte Wellfood and Nongshim also grew by 7.4% and 5.0%, respectively, with all of the top five companies successfully expanding their market size.

The strong performance in the snack market last year is attributed to the popularity of new products. Notably, Nongshim’s ‘Meoktaekkang,’ launched in June last year, caused a sold-out frenzy, selling over 12 million packs in just six months and dominating the snack market in the second half. The ‘Bbangbujang,’ released in October, also contributed with over 4 million packs sold. Nongshim plans to solidify the ‘adult snack’ market pioneered by Meoktaekkang and maintain its buzz by launching ‘Potato Chip Meoktae Cheongyang Mayo Flavor’ as its first snack new product this year.

Orion quietly showed strength by focusing on strengthening its existing product lineup. Orion introduced ‘Pocachip Max,’ followed by ‘Kkobukchip Spicy Flavor,’ ‘Jjikmeok Nacho Chipotle Mayo Sauce Flavor,’ and ‘Hot Goraebab Spicy Seasoned Flavor,’ achieving both increased sales and regaining the top spot with practical and reputational benefits. Additionally, Lotte Wellfood launched ‘Oing Nogari Chip,’ and Haitai Confectionery introduced ‘The Bbase’ and ‘Snapy Crisp,’ among others.

Meanwhile, by brand, Nongshim’s Saewookkang maintained its position as the undisputed number one, remaining a steady seller and bestseller, but its sales decreased by 7.6% compared to the same period last year, providing an opportunity to lose the top spot. On the other hand, Pocachip played a leading role in Orion’s return to first place with sales of 104.6 billion KRW, a 13.6% increase compared to the same period in 2022. Additionally, Nongshim Kellogg’s ‘Pringles’ sold 90 billion KRW, a 4.5% increase from the previous year, moving closer to joining the 100 billion KRW brand club.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)