China Stock Market Underperforms Alone

Shanghai Composite Index and CSI300 Index Fall 6% and 14% Respectively

Investors Taking It as a Buying Opportunity

Is It a Wise Choice?

Although global stock markets, led by the United States, have continued their rally this year, the Chinese stock market has been unable to escape a ‘solo slump.’ The Chinese stock market is one of the markets that failed to provide significant returns to investors even during the COVID-19 pandemic. Given that the stock market of China, the world’s second-largest economy, has fallen considerably, many investors are looking for buying opportunities at the bottom, expecting a ‘bull market’ next year. Is this a wise choice?

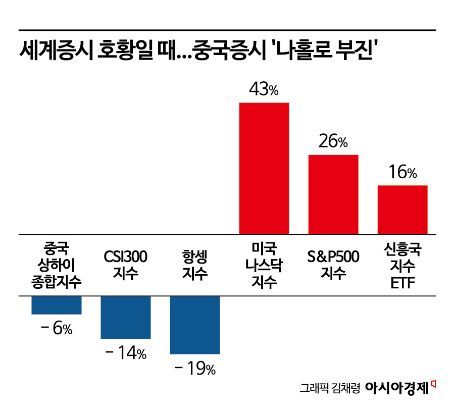

This year, dark clouds have hung over the Chinese stock market. The Shanghai Composite Index hit its lowest point in 1 year and 2 months as of the close on the 26th, following the Chinese authorities’ announcement of stringent regulations on online gaming. The Shanghai Composite Index has fallen about 6% this year, marking a decline for the second consecutive year. The CSI300 Index, composed of the top 300 Chinese companies, dropped 14% this year, showing the lowest stock price trend since 2019. The Hong Kong Hang Seng Index, which includes many Chinese companies, has been in a bear market for four years.

Unlike the sluggish Chinese stock market this year, global stock markets recorded gains. The U.S. Nasdaq Composite Index posted a significant increase of 43% this year. The Standard & Poor’s (S&P) 500 Index is on the verge of hitting an all-time high for the first time in two years. This is driven by the Federal Reserve’s (Fed) expectations of interest rate cuts next year, which have stimulated global investor sentiment. Emerging market stocks also performed well. The ‘iShares MSCI Emerging Markets ex China’ (EMXC), an exchange-traded fund (ETF) tracking emerging markets excluding China, rose 16% this year. The stock markets of Korea, India, and Taiwan are generally considered to have held up well. Kamakshya Trivedi, a Goldman Sachs analyst, analyzed that “the early and aggressive interest rate hikes by emerging market central banks to prepare for the upcoming inflation shock had a significant impact on the rise in emerging market stock prices.”

The Chinese stock market is said to be particularly difficult to predict. Many had expected a tailwind for the stock market as China abandoned its ‘zero COVID’ policy this year and began reopening. This was based on the expectation of a virtuous cycle in production, consumption, and investment sectors. However, Goldman Sachs, which predicted a 15% rise in the Chinese stock market this year, was proven wrong. Bloomberg reported that “China’s real estate slump, declining household incomes, and uncertain regulatory policies likely acted as downward pressure factors on the stock market.”

As the Chinese stock market has steadily declined, there are investors looking for ‘bottom-fishing’ opportunities. They believe that improvements in the profitability of Chinese companies and the Chinese government’s support for renewable energy will lead the Chinese stock market to a bull market. Goldman Sachs and Morgan Stanley forecast that the CSI300 Index will rise by 16% and 8%, respectively, next year.

On the other hand, the Wall Street Journal (WSJ) advised prospective investors in Chinese assets to “better do something else.” Although China’s stock market, which is competing with the U.S. as a great power, has fallen significantly this year, there is no guarantee it will not fall further next year. WSJ cited Japan during the time when it posed the greatest threat to U.S. hegemony as an example. WSJ stated, “The Japanese stock market collapsed in the early 1990s and experienced a prolonged slump for decades, while the bond market provided meager returns for years.” Additionally, WSJ presented forecasts that China’s aging population and heavily indebted companies and households will focus more on debt repayment than investment.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)