Sharp Surge Followed by Plummeting Trading Volume in Early Listing

Stormtech, Hanseon Engineering, Inswave Systems, etc.

IPO Price Bubble Concerns Raised... Need for Improved Demand Forecasting

It is not uncommon for newly listed companies entering the domestic stock market to see their stock prices surge sharply compared to the initial public offering (IPO) price, only to then halve shortly thereafter. Financial authorities have expanded the price fluctuation range on the listing day to maximize the rapid discovery of equilibrium prices. However, there are concerns that the expanded fluctuation range on the first day of listing leads to overheating in demand forecasting, preventing proper verification of the IPO price.

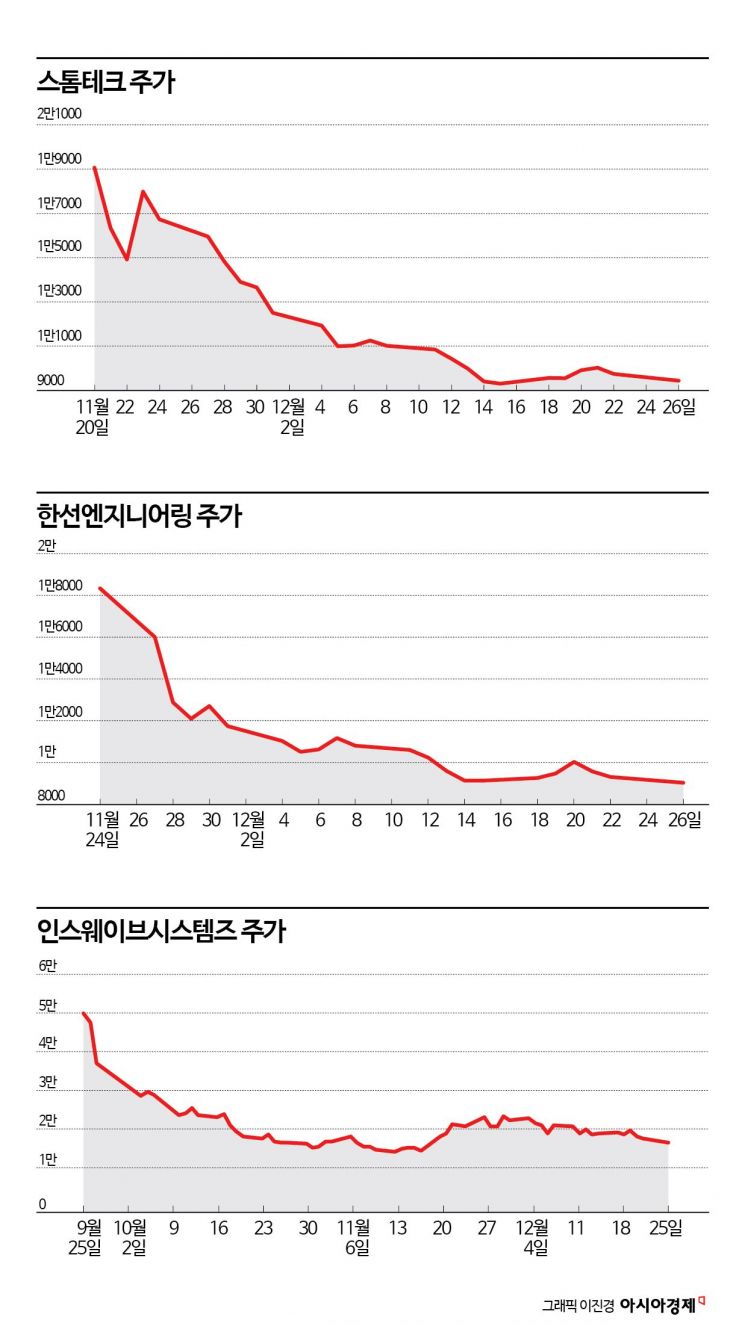

According to the financial investment industry on the 27th, the stock price of Stormtech, which was listed on the KOSDAQ market on the 20th of last month, fell by 53.7% from its peak within about a month. Although the stock price rose 85.4% from the IPO price of 11,000 KRW to 20,400 KRW on the first day of listing, it started to decline from the following day.

Stormtech, a manufacturer of water purifier parts, conducted demand forecasting for institutional investors over five business days from October 31 to November 6. The IPO price was set at 11,000 KRW, exceeding the expected range of 8,000 to 9,500 KRW. Out of 1,000 institutions participating in the demand forecast, 997 proposed an IPO price above the upper limit of the expected range. As a result of the public subscription for general investors, subscription deposits amounted to 2.3353 trillion KRW.

Although there was significant interest before listing, trading volume sharply declined shortly after listing. The average daily trading value this month is only 3.5 billion KRW, which is less than 1% compared to the 460 billion KRW traded on the first day of listing.

Hansun Engineering, which was listed on the 27th of last month, shows a similar stock price graph to Stormtech. On the first day of listing, it closed at 18,330 KRW, up 161.9% from the IPO price of 7,000 KRW. The stock price rose to 20,650 KRW the next day but then dropped to 16,000 KRW.

Despite successful demand forecasting and public subscription, it has been neglected by investors after listing. The IPO price is 16.7% higher than the upper limit of the expected range (5,200 to 6,000 KRW). Subscription deposits reached 4.244 trillion KRW.

Founded in 2012, Hansun Engineering manufactures fittings and valves for measuring equipment that control the flow and speed of fluids and gases. Last year, it achieved sales of 41 billion KRW and operating profit of 7.2 billion KRW. Its customer base is expanding in petrochemical, energy, shipbuilding, and marine industries. It is also playing an increasing role in growth markets such as hydrogen fuel cells and secondary batteries. The fact that it secured core source technology in the hydrogen fuel cell sector was a positive factor in demand forecasting. It is the only company in Korea collaborating with Samsung SDI and LG Energy Solution and has obtained UL certification for direct injection fire extinguishing system standards. Despite high growth expectations, trading value has decreased over time. The trading value on the previous day was 2.1 billion KRW, down to 11% compared to 18 billion KRW at the beginning of this month.

Inswave Systems, which rode the theme stock wave of Han Dong-hoon, the emergency committee chairman of the People Power Party, also fell more than 70% from its peak on the first day of listing within three months. Inswave Systems, a digital transformation solution provider, was listed on the KOSDAQ market on September 25 this year. It was mentioned as a theme stock of Chairman Han as it was known to have participated in the next-generation immigration administration system construction project. Although it surged in mid-last month, the stock price remains around 18,000 KRW, which is a significant difference from the 69,900 KRW it reached on the first day of listing. This is 25% lower than the IPO price of 24,000 KRW.

A financial investment industry official explained, "As the number of newly listed companies surging sharply compared to the IPO price on the first day increases, many institutional investors try to secure shares unconditionally during demand forecasting," adding, "The rate of setting IPO prices above the upper limit of the expected range has increased." He continued, "There is a need to review the demand forecasting system to eliminate IPO price bubbles," and added, "As dissatisfaction with newly listed companies grows, the trust in the IPO market will decline."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)