"YouTubers Live Mostly in Incheon Songdo, etc."

Due to Tax Reduction System for Young Entrepreneurs

Up to 100% Reduction Depending on Age and Region

There is an opinion that the reason why famous YouTubers and streamers often live in suburban areas outside Seoul, such as Songdo in Incheon, is due to 'tax benefits.'

On the 21st, Kim Gyeran and Gong Hyukjun revealed tax-saving methods for YouTubers on the YouTube channel 'Physical Gallery.'

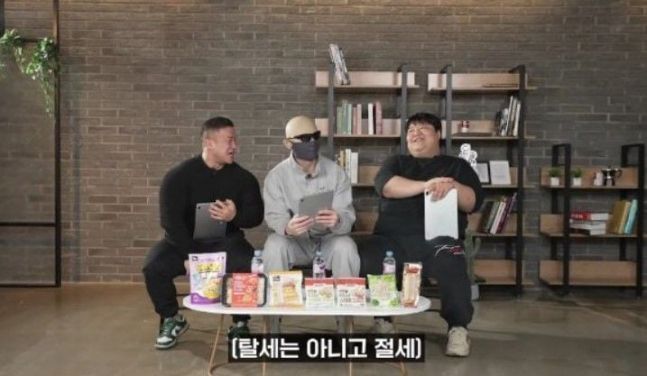

On the 21st, Kim Gyeran and Gong Hyukjun revealed tax-saving methods for YouTubers on the YouTube channel 'Physical Gallery.' [Photo by YouTube 'Physical Gallery']

On the YouTube channel 'Physical Gallery,' a video featuring Kim Gyelan, Gong Hyukjun, and Jang Seongyeop was uploaded on the 21st, where they had a discussion. The host, Kim Gyelan, introduced YouTuber Malwang, saying, "I know he lives in the suburbs of Seoul," and mentioned, "Many creators tend to live in the outskirts rather than the metropolitan area."

In response, Gong Hyukjun said, "It's to reduce taxes." He added, "Ordinary people might not know, but (YouTubers) as young entrepreneurs get a 100% tax exemption."

Kim Gyelan agreed, saying, "As far as I know, there is a lot of support around Songdo, Incheon." Gong Hyukjun added, "That's why streamers live there," and drew a line by saying, "It's not illegal." Through subtitles in the video, they emphasized once again that this is "tax saving, not tax evasion."

On the 21st, YouTube channel 'Physical Gallery' featured Kim Gyeran and Gong Hyukjun revealing tax-saving methods for YouTubers.

On the 21st, YouTube channel 'Physical Gallery' featured Kim Gyeran and Gong Hyukjun revealing tax-saving methods for YouTubers. [Photo by YouTube 'Physical Gallery']

The tax benefit they mentioned is the 'Young Startup Small and Medium Enterprise Tax Reduction System,' which provides up to a 100% exemption on income tax or corporate tax for five years to young entrepreneurs who have started a business.

The representative at the time of startup must be between 15 and 34 years old, and if they have completed military service, the period of service can be deducted for up to six years. To promote regional balanced development, the tax reduction rate varies depending on the startup location. If the startup is in the metropolitan area regulation zone, only 50% of the tax is exempted, but in other areas, 100% exemption applies.

The metropolitan area regulation zone includes most areas of Seoul, Gyeonggi-do, and Incheon, but some parts of Incheon, Namyangju, and Siheung have different tax exemption rates of 50% or 100% despite being in the same administrative district. For example, Songdo and other parts of the Incheon Free Economic Zone, Namdong Industrial Complex, and Siheung Banwol Special Zone are excluded from the metropolitan area regulation zone and can receive a 100% exemption.

Also, freelancers cannot benefit from this system, but YouTubers who establish their own corporations and operate under Article 6 of the Restriction of Special Taxation Act are classified as small and medium enterprises and can receive such tax reductions. There is no limit on the exemption amount, so the tax reduction can range from a few million won to hundreds of millions of won.

Meanwhile, according to data from the National Tax Service, as of 2021, the total income reported by 'one-person media creators (YouTubers)' for comprehensive income tax was 858.898 billion won, nearly ten times more than two years ago. In particular, the top 1% of YouTubers, numbering 342, earned 243.865 billion won, with an average annual income per person of 713 million won. The top 1% of YouTubers took about 25% of the total YouTuber income.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.