Koreans Drank an Average of 405 Cups of Coffee This Year

More Than Twice the Global Average of 152 Cups

Busy Corporate Culture and High Accessibility Drive Consumption

Last Year's Export Value Exceeded 300 Billion Won... Up 30% in 4 Years

This year, coffee consumption in South Korea was found to be more than twice the global average coffee consumption.

According to market research firm Euromonitor on the 26th, the annual per capita coffee consumption in South Korea this year was 405 cups, more than twice the global annual per capita coffee consumption of 152 cups. Domestic per capita coffee consumption increased by an average of 2.8% annually from 363 cups in 2018, and this year, South Koreans consumed more than 80 cups of coffee compared to the United States, where the average was 318 cups.

Rapid Pace and High Concentration Work Environment... Domestic Coffee Consumption Surges

The increase in domestic coffee consumption is attributed to the busy corporate culture, high accessibility, and the launch of various products. The unique Korean work culture, which demands a fast pace and high concentration, has led to increased coffee intake for fatigue relief and improved focus. Additionally, the well-established consumption environment, such as cafes that are easily found even outside major commercial areas, is also considered a growth factor for the coffee market. Furthermore, the availability of various products in the market, including brand coffee, convenience store coffee, mix, and drip coffee depending on the place or situation, has influenced the increase in consumption.

In South Korea, coffee is mainly sold at independent supermarkets and large retail marts, with a tendency for certain companies to have high market shares. According to market research firm Market Link, as of October this year, in the domestic retail market, both instant and prepared coffee brands 'Maxim' by Dongseo Food recorded overwhelming sales with market shares of 73.3% and 87.4%, respectively. During the same period, for whole bean coffee, Starbucks led with a market share of 35.4%, showing the dominance of the leading company, but Kanu (9.3%), store brands (8.6%), McNulty (8.6%), and Maxim (7.6%) followed, showing a relatively even distribution.

However, while the instant and prepared coffee market, which is virtually a monopoly, shows a clear shrinking trend, the whole bean coffee market is evidently growing. In fact, as consumer interest in stick-type whole bean coffee has recently increased, coffee specialty stores have also launched stick-type whole bean coffee, entering this market one after another. As of the first half of 2020, the retail sales of instant coffee decreased by 26.1% over three years from 449.7 billion KRW to 332.5 billion KRW in the first half of this year, and prepared coffee also decreased by 10.4% from 514 billion KRW to 460.6 billion KRW. On the other hand, during the same period, whole bean coffee sales grew by about 20%, from 29.4 billion KRW to 35.1 billion KRW.

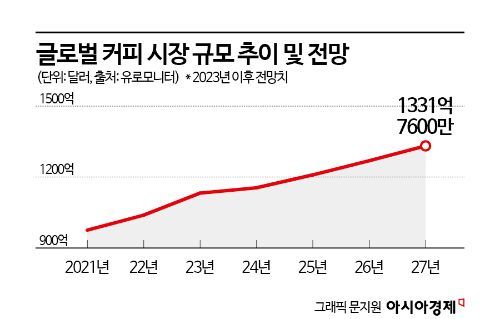

Global Coffee Market Worth 147 Trillion KRW... 9% Growth

Coffee consumption is expanding not only domestically but also globally. Drinking coffee has become a common culture enjoyed in most countries regardless of borders. In particular, the caffeine contained in coffee helps relieve fatigue and promotes alertness, enhancing attention, which is highlighted as an advantage in busy modern society by improving concentration and work efficiency, leading to steady growth in consumption. According to Euromonitor, the global coffee market size this year is estimated at 113.1526 billion USD (approximately 147 trillion KRW), a 9.0% increase from last year. The coffee market, which was about 97.46 billion USD (approximately 127 trillion KRW) in 2021, is expected to grow at an average annual rate of 4.3%, expanding to 133.1575 billion USD (approximately 173 trillion KRW) by 2027.

As the coffee market size grows, domestic companies' exports are also becoming active. According to the Korea Customs Service, South Korea's coffee export value, which was about 175.79 million USD (approximately 229 billion KRW) in 2018, increased to about 231.04 million USD (approximately 301 billion KRW) last year, showing a growth of over 30% in four years. Korean stick-type instant coffee has become known overseas through dramas and movies, and the global demand for K-coffee, which emphasizes convenience and various flavors, is expanding. Representative examples include Lotte Chilsung's 'Let's Be,' the originator of K-coffee, leading the export of various RTD coffees and instant coffees, and recently, hy has exported three BTS special edition coffees, attracting significant attention from overseas consumers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)