Berkshire Hathaway Expands Stake to 27%

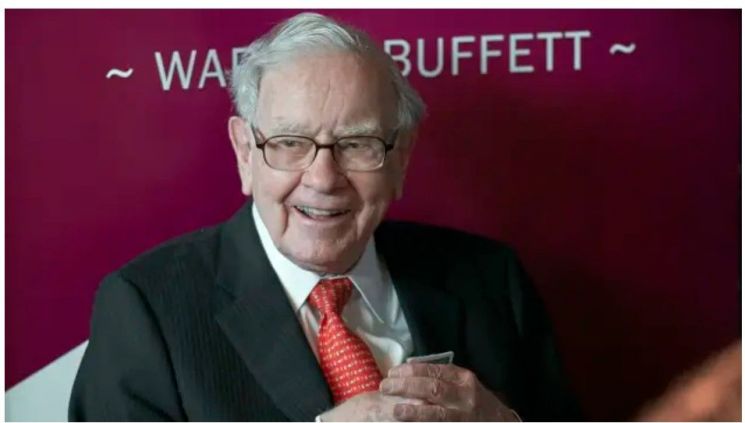

Berkshire Hathaway, led by 'investment genius' Warren Buffett, has increased its stake in the U.S. energy company Occidental Petroleum.

According to foreign media including Bloomberg on the 13th (local time), Berkshire Hathaway submitted documents to the U.S. Securities and Exchange Commission (SEC) showing that the company purchased 10.5 million shares of Occidental this week for approximately $588.7 million (about 760 billion KRW).

With this stake acquisition, Berkshire Hathaway's ownership in Occidental has increased to about 27%. Berkshire Hathaway also holds the right to acquire an additional 83.8 million shares of Occidental for $4.7 billion (about 6.1 trillion KRW), and if exercised, its stake in Occidental would rise to 33%.

Occidental, whose shares Berkshire Hathaway additionally purchased this week, announced on the 11th that it would acquire CrownRock for $12 billion (about 15.56 trillion KRW). The company stated that there was no financial support from Berkshire Hathaway and that it plans to issue new bonds and new shares worth $9.1 billion (about 11.8 trillion KRW) and $1.7 billion (about 2.2 trillion KRW), respectively, to finance the acquisition. Bloomberg reported, "Occidental CEO Vicki Hollub had said Buffett's financial support was not necessary," but added, "However, Berkshire Hathaway's stock purchase this week is likely to be seen as a signal supporting the deal."

Berkshire Hathaway first purchased Occidental shares in 2019 when Occidental acquired its competitor Anadarko Petroleum. At that time, Berkshire Hathaway provided funding for the Anadarko acquisition and steadily increased its shares over the following three years to its current stake. Occidental's debt surged during the 2019 bidding war with Chevron, and it suffered significant losses when international oil prices plummeted due to COVID-19. However, after Russia invaded Ukraine in February last year, oil prices soared, leading to a record profit of $13.3 billion, and the company successfully completed the CrownRock acquisition.

Occidental's stock closed at $57.22 on the New York Stock Exchange that day, up 3.01% from the previous trading day.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)