Over the past six years, it has been revealed that one out of every two startups that received venture investment is located in Seoul's Gangnam and Seocho districts. Startups that received large-scale investments exceeding 100 billion KRW were also concentrated in Gangnam and Seocho districts.

On the 14th, Startup Alliance announced the results of an analysis of the addresses of 3,496 startups that received external investments from venture capital (VC), accelerators, corporate venture capital (CVC), and financial institutions from 2018 to this year. Private investments, mergers and acquisitions (M&A), and initial public offerings (IPO) were excluded.

Among startups that received venture investments, 67.4% (2,359 companies) were concentrated in Seoul. Startups located in the metropolitan area (Seoul, Gyeonggi, Incheon) numbered 2,877, accounting for 82.29% of the total. Following were 5.11% (179 companies) in the Busan, Ulsan, and Gyeongsang regions, and 4.34% (152 companies) in the Daejeon and Chungcheong regions.

Startups headquartered overseas or founded abroad accounted for 116 companies, or 3.31%. Among these, 84 startups were located in the United States, representing 72% of overseas startups. Many of these were located in Silicon Valley, USA, known for its concentration of IT companies.

Looking at the industry sectors by region, in Daejeon, the majority of startups were located in Yuseong-gu, home to the Daedeok Research and Development Special Zone, KAIST, and Chungnam National University. Hardware and robotics companies, representing typical manufacturing, accounted for 15.04% (17 companies), while cross-industry solution startups in the B2B sector accounted for 11.50% (13 companies). Green and environment startups also ranked high at 8.85% (10 companies).

In Gangwon Province, known for operating the Digital Healthcare Regulatory Free Zone, healthcare startups were the most numerous. Among 34 startups located in Gangwon, 32.35% (11 companies) were healthcare companies. In Gwangju, mobility startups accounted for 20% (4 companies) of all companies, followed by content and social startups at 15% (3 companies).

In Busan, healthcare startups accounted for 14.44% (13 companies), while e-commerce and logistics startups and manufacturing startups each accounted for 13.33% (12 companies). Due to its geographic advantage for exports and logistics, many platform startups were located in Busan. The combined Gyeongsang region of Gyeongnam and Gyeongbuk had food and agriculture startups as the largest group at 22.54% (16 companies).

In Jeju, the travel and leisure sector was the largest. Among all startups in Jeju, 23.4% (11 companies) were travel and leisure startups, followed by mobility startups at 14.89% (7 companies).

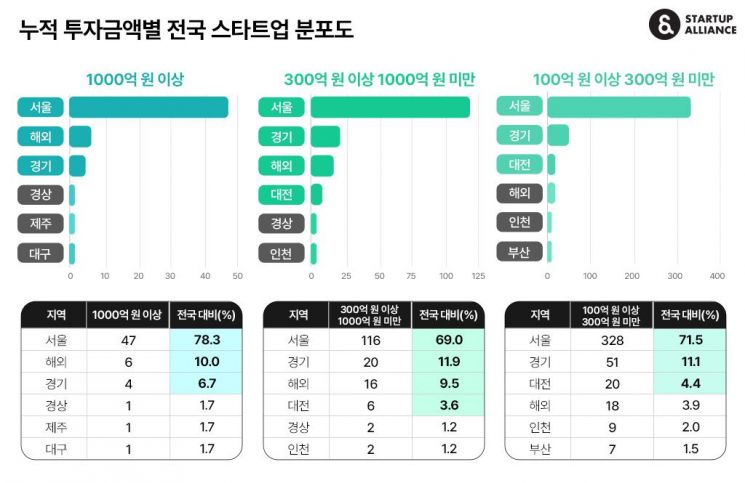

Looking at investment amounts, Seoul had the most startups receiving large-scale investments, consistent with its high number of startups. Among 60 startups that received large-scale investments exceeding 100 billion KRW, 47 were concentrated in Seoul, accounting for 78.3%. Of 168 startups that received investments over 30 billion KRW, 116 (69%) were in Seoul, and of 459 startups that received over 10 billion KRW, 328 (71.5%) were located in Seoul.

In the Gyeonggi region, which includes Pangyo and has many ICT companies, many startups receiving large-scale investments were located following Seoul. Among startups receiving over 30 billion KRW, 20 (11.9%) were in Gyeonggi, and among those receiving over 10 billion KRW, 51 (11.1%) were in Gyeonggi.

Among startups located overseas, many received large-scale investments. Sixteen startups (9.5%) that received over 30 billion KRW were located abroad. Among startups receiving over 100 billion KRW, six were headquartered overseas, accounting for 10% of the national total.

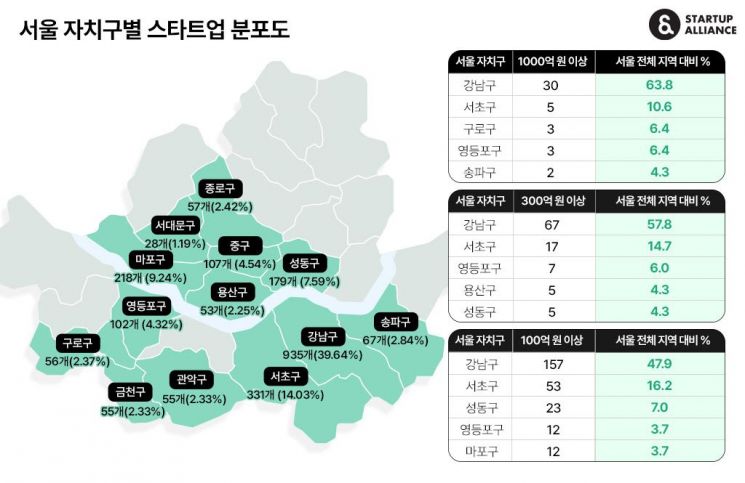

Looking at Seoul's districts, 53.6% of startups that received external investments were concentrated in Gangnam-gu and Seocho-gu. Startups located in Gangnam-gu accounted for 935 companies (39.6%) of all startups, and those in Seocho-gu accounted for 331 companies (14%).

Mapo-gu (9.24%, 218 companies) and Seongdong-gu (7.59%, 179 companies), ranking third and fourth, are also noteworthy. Mapo-gu hosts startup spaces such as the Seoul Startup Hub Gongdeok by the Seoul Business Agency (SBA) and Front1, a space run by the Banks Foundation for Young Entrepreneurs. This influence is believed to have attracted many startups to Mapo-gu. Seongdong-gu has many startups concentrated in Seongsu-dong, where accelerators such as Heyground, SoPoong Ventures, and FuturePlay are located.

Looking at investment amounts, most Seoul-based startups that received over 100 billion KRW in investments were located in Gangnam-gu and Seocho-gu. Among Seoul startups receiving over 100 billion KRW, 30 (63.8%) were in Gangnam-gu, and 5 (10.6%) were in Seocho-gu. Following were Guro-gu, home to Gasan Digital Complex, with 3 startups (6.4%), Yeongdeungpo-gu, where Yeouido is located, with 3 startups (6.4%), and Songpa-gu with 2 startups (4.3%).

Among startups receiving over 30 billion KRW, 67 out of 116 (57.8%) were in Gangnam-gu, and 17 (14.7%) were in Seocho-gu. Yeongdeungpo-gu had 7 (6%), and Yongsan-gu and Seongdong-gu each had 5 (4.3%).

Among startups receiving over 10 billion KRW, 157 out of 328 (47.9%) were in Gangnam-gu, and 53 (16.2%) were in Seocho-gu. Seongdong-gu had 23 (7%), and Yeongdeungpo-gu and Mapo-gu each had 12 (3.7%).

Yeongdeungpo-gu and Guro-gu were not among the districts with the highest number of startups in Seoul, but they had many startups that attracted large-scale investments. Conversely, Mapo-gu and Seongdong-gu had many startups in the seed to Series A stages.

By industry, all sectors were evenly distributed in Gangnam-gu and Seocho-gu. Among them, content and social startups, which include many IT platform companies, ranked high with 128 in Gangnam-gu and 38 in Seocho-gu, followed by healthcare (89 in Gangnam-gu, 52 in Seocho-gu) and e-commerce and logistics (86 in Gangnam-gu, 26 in Seocho-gu).

In Mapo-gu, content and social startups were the most numerous, accounting for 39 companies (17.8%) of all companies. In Seongdong-gu, fashion and beauty startups were the largest group with 17 companies (9.5%). In Jung-gu, travel and leisure startups were the most common, with 14 companies (13.08%). In Songpa-gu, healthcare startups numbered 12 (17.9%), followed by e-commerce and logistics startups with 10 (14.9%).

Additionally, in Yeongdeungpo-gu, finance and insurance startups accounted for 35 companies (34.3%) of all companies. Fintech startups were concentrated in Yeouido, a district specialized in the financial industry.

A representative from Startup Alliance explained, "Startups that received venture investments are concentrated mainly in Gangnam-gu within the metropolitan area, where many VCs and infrastructure are located. However, startups are also increasing in regions based on specialized industries, and within Seoul's districts, startups tend to be dispersed in districts where support organizations exist."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)