November Monetary and Credit Policy Report

Domestic Economy Showing Improvement Centered on Exports

Lee Chang-yong, Governor of the Bank of Korea, is holding a press conference after the Monetary Policy Direction Decision Meeting of the Monetary Policy Committee held at the Bank of Korea in Jung-gu, Seoul, on the 30th of last month. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is holding a press conference after the Monetary Policy Direction Decision Meeting of the Monetary Policy Committee held at the Bank of Korea in Jung-gu, Seoul, on the 30th of last month. Photo by Joint Press Corps

The Bank of Korea plans to maintain its monetary tightening stance sufficiently and for a prolonged period until it is confident that the inflation rate will converge to the target level, as the domestic economy continues its growth momentum and the inflation path is expected to be higher than initially forecasted.

In the 'Future Policy Direction' section of the Monetary and Credit Policy Report released on the 14th, the Bank stated, "Going forward, we will monitor the growth trend and operate monetary policy with attention to financial stability, ensuring that the inflation rate stabilizes at the target level (2%) over the medium term."

In this process, the Bank plans to assess the need for additional rate hikes by reviewing the inflation slowdown trend, risks to financial stability, downside risks to growth, trends in household debt, monetary policy operations of major countries, and developments in geopolitical risks.

Secondary ripple effects persist long-term, delaying inflation slowdown

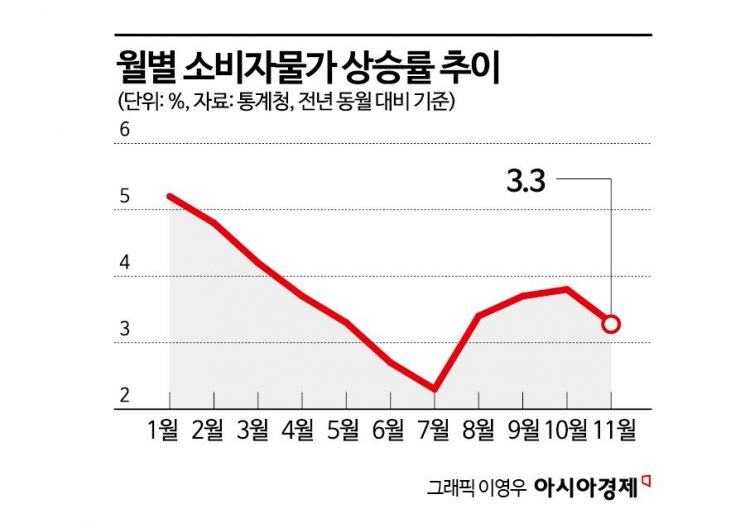

The domestic consumer price inflation rate increased for three consecutive months after August, rising to the high 3% range, and recorded 3.3% in November, indicating a delayed slowdown in the upward trend. The Bank of Korea analyzed that this is due to the prolonged secondary ripple effects caused by high external dependence on raw materials, despite the base effect from falling energy prices having disappeared.

Expectations of inflation among economic agents also slightly increased to 3.4% for the general public and 3.0% for experts compared to the previous quarter, reflecting concerns that the period required for inflation rate deceleration may be longer than expected.

The Bank expects the domestic inflation rate to resume its slowdown trend, but it assessed that various uncertainties remain regarding the timing of inflation convergence to the target level. In particular, it pointed out the need to carefully monitor risk factors related to the secondary ripple effects from accumulated cost increases, fluctuations in international oil prices and exchange rates, government policies on public utility charges, and the possibility of concentrated price adjustments at year-end and the beginning of the year.

It also added that, over the long term, attention should be paid to the possibility that volatility in external conditions may increase structurally due to the fragmentation of the global trade system, climate change, and the transition to an eco-friendly system, which could structurally raise inflationary pressures.

Household debt-to-nominal GDP ratio expected to stabilize downward for the time being

The domestic economy is experiencing delayed recovery in private consumption and continued sluggishness in private investment due to the high inflation and high interest rate environment. However, exports of goods, centered on semiconductors, are expected to improve, and service exports are projected to gradually increase supported by the recovery in travel demand. Major risks include prolonged monetary tightening by major countries, weakening economic recovery in China, delayed recovery in private consumption, and sluggish facility investment.

The outlook for the housing market is assessed to be highly uncertain. If the supply of new housing units in the Seoul area decreases next year, the jeonse (long-term lease) prices may rise further, exerting upward pressure on sales prices. However, strengthened government management of household loans and an increase in apartment listings are expected to exert downward pressure on housing prices, making it difficult to predict the future direction of the housing market.

Going forward, the scale of household loans is expected to be constrained due to a decrease in housing sales transactions and the full effect of strengthened government management, leading to a downward stabilization of the household debt-to-nominal gross domestic product (GDP) ratio for the time being. The Bank stated, "Given that the scale of household and corporate loans remains high, it is necessary to be cautious about the possibility of financial instability in the future through rising delinquency rates in the high interest rate environment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)