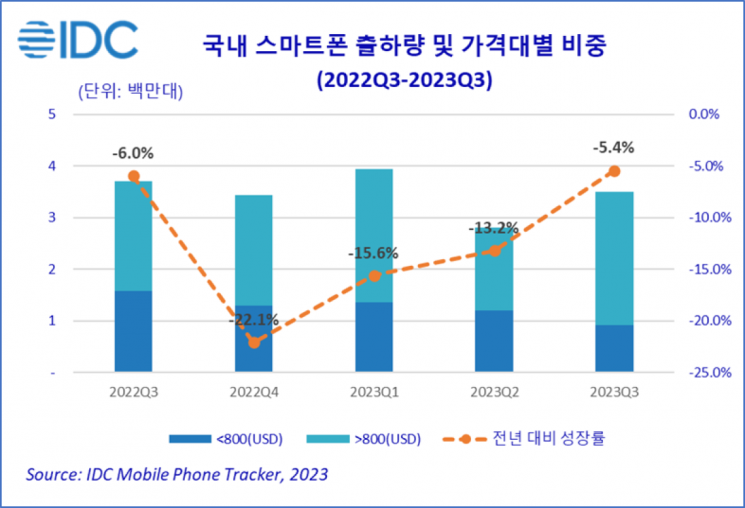

In the third quarter, domestic smartphone shipments in South Korea fell by 5.4% compared to last year, while the market share of premium smartphones priced over 1 million KRW significantly increased. Seven out of ten smartphones shipped domestically are premium models.

IT market research firm International Data Corporation Korea (Korea IDC) announced on the 13th that the domestic smartphone market shipments in the third quarter of 2023 amounted to approximately 3.49 million units.

However, supported by a recovery trend in overall consumer sentiment, the decline in total smartphone market demand has somewhat slowed. Major brands released flagship new products to meet the increased demand for premium product lines and improve profitability. At the same time, they showed efforts to alleviate consumer burden by launching mid- to low-priced models.

Notably, the market share of 5G devices in the domestic smartphone market in the third quarter rose sharply to 92.3%. This is attributed to the launch of new 5G smartphones by major Android brands such as Samsung Electronics, Motorola, and Nothing. By price range, the flagship product segment priced above $800 (approximately 1.05 million KRW) recorded a 16.4 percentage point increase, reaching 73.7%. The release of Samsung Electronics’ Galaxy Z Fold and Flip5 series and the price increase of new premium product lines are analyzed as the main causes. Additionally, the ongoing polarization of consumer demand contributed to the rise in market share of ultra-premium product segments with high demand.

The domestic foldable smartphone market shipped about 1.51 million units, down 5.2% compared to the same period last year. Its share within the total smartphone market remained similar to last year at 43.3%. Samsung Electronics’ Galaxy Z Fold and Flip5 series led strong consumer demand despite uncertain economic conditions, featuring larger cover displays and improved hinges. Furthermore, Motorola became the first foreign brand to enter the domestic foldable market by launching the foldable Razr 40 Ultra, challenging Samsung’s previously dominant position. Going forward, the foldable market is expected to see intensified competition in sales and market share as technology maturity improves.

Kang Jihae, a researcher at Korea IDC, stated, "As consumer demand polarization continues, major brands are focusing on the premium market to maintain solid demand and improve profitability." She added, "Conversely, the mid- to low-priced smartphone market, which is most affected by uncertain economic conditions, is rapidly shrinking." She also noted, "Rising smartphone prices and a limited range of mid- to low-priced products are major causes of market demand decline, as they increase household economic burdens and reduce consumer choice." Kang concluded, "In the second half of the year, major brands will continue efforts to promote sales and drive market demand by launching mid- to low-priced models to ease consumer purchasing burdens."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.