Increase in Number of Stores and Sales per Store Boosts Offline Sales

Online Sales Also Trending Upward... Expecting Late 30 Trillion KRW in Sales This Year

Avoided Billions KRW in Fines from Fair Trade Commission

"Attempts to Secure EB Brand Will Continue"

CJ Olive Young is expected to gain momentum in its record-breaking performance, supported by balanced growth both online and offline, as concerns over fines from the Fair Trade Commission have eased. There are even forecasts that it will join the 5 trillion won sales club next year.

According to the distribution and securities industries on the 11th, CJ Olive Young's estimated annual sales this year are around 3.6 to 3.9 trillion won. Recording 1 trillion won in sales in the third quarter, CJ Olive Young has earned 2.7 trillion won so far this year, and it is estimated to have earned over 1 trillion won in the fourth quarter as well. This marks an increase of 1 trillion won in sales in just over two years.

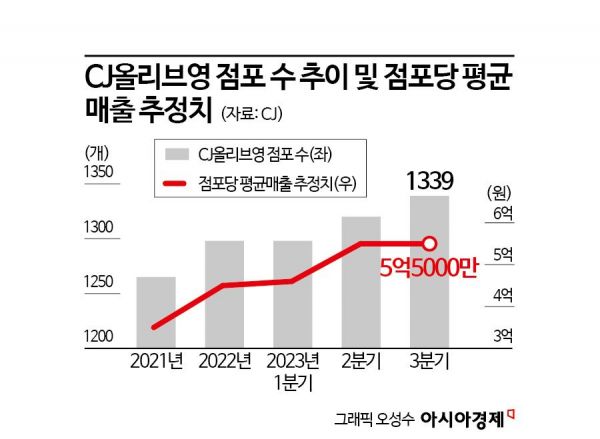

This year, offline store growth was particularly prominent. With increases in both the number of stores and sales per store, CJ Olive Young has achieved growth in both scale and substance. As of the third quarter, CJ Olive Young had 1,339 stores. The number of stores, which was 1,265 in 2021, increased to 1,298 last year, and with the endemic phase fully underway this year, the number of stores rose to about 1,340. During the same period, average sales per store also grew significantly, rising from 350 million won in 2021 to 550 million won in the third quarter of this year. This increase in sales is attributed to the endemic effect and securing competitive cosmetic brands.

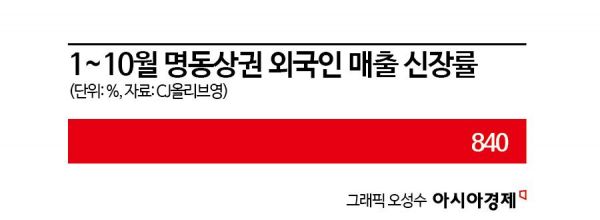

Another key factor in the sales increase is foreigners. From January to October this year, foreign sales at six stores in the Myeongdong commercial district of Jung-gu, Seoul, grew by 840% compared to the same period last year. As customers from Southeast Asia, English-speaking countries, and Japan visited stores this year, the customer base expanded globally, and with the continued influx of Chinese group tourists (Youke), the sales growth in the Myeongdong commercial district stood out. The proportion of foreign sales in total offline sales is also estimated to have increased from single digits at the beginning of the year to 12%.

In addition, the online sector continues to grow. Alongside offline, online sales have shown a steady upward trend, and their share is increasing. As of the third quarter last year, online sales amounted to 166.6 billion won, accounting for 24.5% of total sales. This year’s third-quarter online sales grew to 256 billion won, reaching a 26% share. The increase in users was driven by services such as 'One Day Dream,' which delivers products within three hours, and 'Olive Young Live.' CJ Olive Young is focusing on strengthening the online sector to enhance synergy between online and offline. As part of strengthening the One Day Dream delivery service, it is securing urban logistics warehouses by utilizing basements of existing stores.

The market expects CJ Olive Young's explosive growth to continue for the time being. Assuming the current growth rate is maintained, CJ Olive Young's estimated sales next year are expected to be in the mid-4 trillion to 5 trillion won range. Especially, with the Fair Trade Commission’s recent decision easing uncertainties regarding the exclusive brand (EB) policy, momentum is expected to build for the EB policy as well. The EB policy involves signing contracts with small and medium cosmetic brands to sell their products exclusively at CJ Olive Young, without dealing with competitors, in exchange for benefits such as advertising expenses and guaranteed participation in events, effectively securing loyal customers. The Fair Trade Commission responded to claims that "CJ Olive Young's EB policy constitutes an abuse of market dominance in the health & beauty (H&B) market" by stating that "CJ Olive Young's market scope is not limited to H&B, and the judgment on market definition is deferred," removing legal obstacles to promoting the EB policy. CJ Olive Young has shown a cautious stance, saying, "We will re-examine the policy and seek improvement measures to avoid any issues," but it is expected to continue efforts to secure various brands through the EB policy. Kim Suhyun, a researcher at DS Investment & Securities, said, "As it holds hegemony as a small and medium cosmetics channel, high growth close to 40% is expected to continue next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.