Deterioration of Financial Structure Due to Borrowing and CB Issuance Early This Year

BW Issuance Through Public Offering Planned... Credit Rating Agency Assigns 'B-' Grade

DYD plans to raise funds for debt repayment and operating expenses by issuing bonds with warrants (BW) through a public offering.

According to the Financial Supervisory Service's electronic disclosure system on the 12th, DYD will issue BWs worth 25 billion KRW through a shareholder priority public offering. Existing shareholders are granted priority subscription rights, allowing them to participate in the offering at 478 KRW per existing share. If there is any remaining balance after subscriptions, the lead underwriter, SangSangIn Securities, will underwrite it. The guaranteed yield at BW maturity is 5.0%, with a coupon rate of 3.0%.

Of the funds raised through the BW issuance, approximately 20 billion KRW will be used for early repayment of a stock-secured loan and the 5th tranche of convertible bonds (CB). Earlier, in February, DYD pledged shares of Sambu Construction as collateral and borrowed 10 billion KRW from SangSangIn Securities. The interest rate is 10%, which will help reduce financial costs upon debt repayment.

In February, DYD raised 10 billion KRW by privately issuing the 5th tranche of CBs. The conversion price is 969 KRW, and the guaranteed yield at maturity is 10%. Considering that the current stock price is below the conversion price, DYD expects early redemption requests. The initial early redemption payment date is February 14 next year, and it can be exercised every three months thereafter.

Korea Ratings assigned a 'B- (negative)' rating to the BW issued by DYD. They evaluated that the cosmetics division, which accounts for the largest portion of sales, continues to operate at an operating loss, and the newly initiated construction division has yet to demonstrate stable profit-generating capability. The construction division operates based on support from major shareholders and related parties, but recent order performance has been poor.

DYD, which previously sold its own brand cosmetics, obtained a general construction business license in April last year and started its construction division. The construction division recorded sales of 6.4 billion KRW last year. Without new orders, construction sales for the third quarter of this year amounted to 400 million KRW from ongoing projects carried over. Most of the construction projects DYD undertakes are subcontracted works commissioned by general contractors. Due to the recent downturn in the domestic construction market, new order volumes have decreased.

Jin Jung-hak, a researcher at Korea Ratings, explained, "Projects ordered this year have been delayed due to licensing issues," adding, "Several planned projects have also faced contract cancellations, project financing delays, and delays in golf course land acquisitions." He further noted, "As the timing of revenue generation in the construction division has become uncertain in the short term, performance volatility has increased."

NICE Credit Rating also rated DYD's BW as 'B- (stable)'. They noted that although DYD owns its own cosmetics brand products, its competitive position within the industry is not strong. They have four in-house brands, including the color cosmetics line 'LilybyRed' and the basic cosmetics brand 'DearOwn'. Following the COVID-19 pandemic, demand for color cosmetics has increased, and sales in the cosmetics division are expected to grow. Although the scale of losses has somewhat decreased, profit realization is expected to be limited due to selling and administrative expenses.

Baek Ju-young, a senior researcher at NICE Credit Rating, assessed, "With weak internal cash generation and insufficient liquidity relative to short-term borrowings, the short-term liquidity risk is high." She added, "The scale of cash assets is limited, and shares of Sambu Construction have been provided as collateral for short-term borrowings, resulting in low additional collateral capacity."

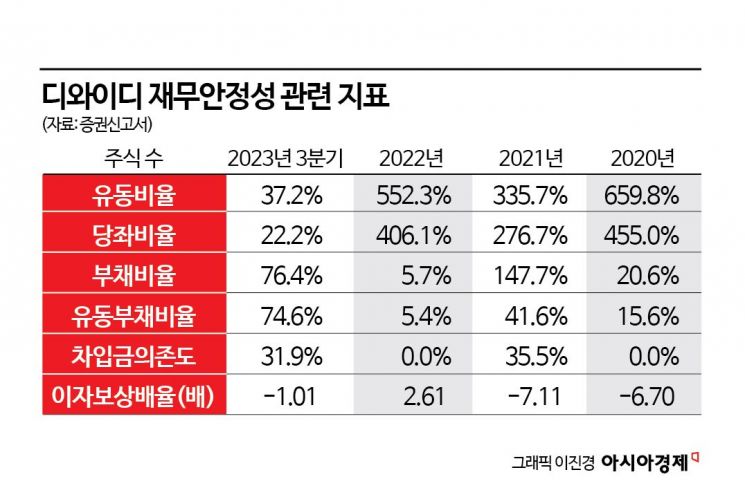

As of the third quarter of this year, DYD's current ratio and debt ratio were 37.20% and 76.43%, respectively, deteriorating from 552.29% and 5.74% at the end of last year. The company explained that to strengthen financial stability, it will actively pursue new product development and marketing activities to maximize profits in its main business, the cosmetics division.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)