The Only Emperor Stock This Year, Ecopro, Plummets to 'Zero'

Expectations for New Emperor Stocks Next Year Lowered Due to Fundamental Deterioration

Samsung Biologics Named the Only Candidate by Securities Firms

The so-called 'Emperor Stocks' priced over 1 million KRW per share have disappeared from the domestic stock market. Over the past two years, due to sluggish market performance and increased volatility, these stocks have gradually vanished, and now not a single one remains. Stocks priced above 500,000 KRW per share are also rarely seen. While a high stock price does not necessarily mean a good stock, the symbolic value of Emperor Stocks influences investor sentiment. Moreover, since stock prices are fundamentally based on company fundamentals, the decline in high-priced blue-chip stocks indicates that the business environment for companies is challenging.

Vanished Emperor Stocks... Ecopro's Fall

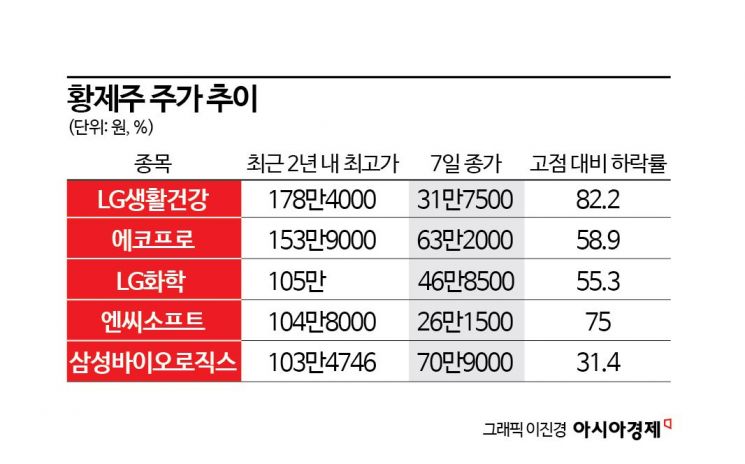

As of the market close on the 7th, there are no 'Emperor Stocks' priced over 1 million KRW per share in the domestic market. Ecopro, which ascended to Emperor Stock status by reaching 1,539,000 KRW on July 26, now remains in the 600,000 KRW range. It has fallen by more than half from its peak. Over the past two years, LG Household & Health Care, NCSoft, LG Chem, and Samsung Biologics have each relinquished their Emperor Stock status one by one.

The reasons these stocks fell from Emperor Stock status include deteriorating external conditions leading to market sluggishness, fundamental damage, and worsening investor sentiment. Along with high interest rates and inflation trends, the domestic stock market has faced downward pressure since mid-2021, causing Emperor Stocks to collapse simultaneously. Stocks with worsened fundamentals experienced particularly steep declines.

The plight of Ecopro, the only stock to achieve Emperor Stock status this year, is bleak. Due to earnings falling short of forecasts and ongoing overvaluation controversies, sell recommendations have been frequent in the securities industry. Hyunsoo Kim, a researcher at Hana Securities, estimated Ecopro's fair value at 10.9 trillion KRW and lowered the target price to 420,000 KRW. Kim warned, "The current stock price is essentially in a valuation vacuum," adding, "Engaging in volatility battles in the bubble zone exceeding intrinsic value will ultimately result in penalties."

Among past Emperor Stocks, LG Household & Health Care has recorded the largest decline. Its highest price in the past two years was 1,784,000 KRW, but it closed at 317,500 KRW on the 7th, a drop of 82.2% from its peak. The cause of the price decline is an earnings shock. In the third quarter of this year, sales decreased by 6.6% year-on-year to 1.7462 trillion KRW, and operating profit fell by 32.4% to 128.5 billion KRW. The prevailing forecast is that operating profit for the year will not even reach 500 billion KRW. LG Household & Health Care's cumulative operating profit for the first three quarters was about 432.3 billion KRW, down approximately 26% from the previous year. Seung Eun Lee, a researcher at Yuanta Securities, noted, "Considering conservative estimates for duty-free and China performance in the fourth quarter, increased marketing investments for major brands, and expanded costs related to overseas restructuring, LG Household & Health Care is expected to face its most challenging period of the year."

NCSoft also experienced a 75% decline from its peak within two years. NCSoft's market capitalization fell below 5 trillion KRW for the first time in seven years. The securities industry analysis suggests that recovery will be difficult without new growth drivers. With no new game releases and intensifying competition causing existing game users to leave, earnings deterioration is inevitable.

LG Chem and Samsung Biologics also saw declines of 55.3% and 31.4%, respectively, when comparing their two-year highs to the closing price on the 7th. LG Chem's investor sentiment has yet to recover since the spin-off and listing of its subsidiary LG Energy Solution last year. The separation of the battery business ultimately led to a decline in corporate value. Poor earnings performance has also negatively impacted the stock price. LG Chem recorded an operating profit of 860.4 billion KRW in the third quarter. By business segment, operating profit in advanced materials such as cathode materials fell 31% quarter-on-quarter to 129 billion KRW. The securities industry expects continued business weakness and has lowered target prices accordingly. Kiwoom Securities lowered its target price from 830,000 KRW to 670,000 KRW. Samsung Securities (750,000 KRW → 700,000 KRW), Hi Investment & Securities (930,000 KRW → 660,000 KRW), and Mirae Asset Securities (800,000 KRW → 620,000 KRW) also reduced their targets. Jaerim Lee, a researcher at Shinhan Investment Corp., explained, "The Emperor Stocks' poor performance is ultimately due to deteriorating fundamentals, and investor sentiment will revive only when there is momentum for earnings improvement."

Stocks Over 500,000 KRW Also Scarce... Samsung Biologics Expected to Become Emperor Stock

There are not many stocks priced over 500,000 KRW. As of the closing price on the 7th, stocks priced above 500,000 KRW per share include Samsung Biologics (709,000 KRW), Ecopro (632,000 KRW), Taekwang Industrial (614,000 KRW), Young Poong (538,000 KRW), and Korea Zinc (522,000 KRW), totaling five stocks. Two years ago, LG Household & Health Care was the only Emperor Stock, followed by Taekwang Industrial, Samsung Biologics, LG Chem, Samsung SDI, NCSoft, Young Poong, Hyosung Advanced Materials, Krafton, and Hyosung TNC, making ten stocks in total. However, one year later, only Samsung Biologics, Young Poong, Taekwang Industrial, LG Chem, Samsung SDI, LG Household & Health Care, Korea Zinc, and LG Energy Solution remained, reducing the number to eight. This year, due to worsening market conditions, only Samsung Biologics, Taekwang Industrial, Young Poong, and Taekwang Industrial remain, with Ecopro newly appearing.

Since stock prices fundamentally move based on earnings and growth prospects, the current decline in blue-chip stocks reflects the challenging business environment for domestic companies. In fact, among stocks that have fallen from Emperor Stock status (excluding stock splits), deteriorating earnings is a common characteristic.

Expectations for the emergence of Emperor Stocks next year are low. According to current forecasts, earnings revisions for listed companies are expected to continue downward through the first half of next year. According to FnGuide, the consensus operating profit for listed companies in 2024 has been revised downward by about 5.3% over the past three months. The downward revisions have not stopped since the end of July. Mirae Asset Securities Research Center noted, "Considering the economic situation and the extent of downward revisions, the possibility of earnings momentum improvement is low at least until the first quarter of next year, and there is also a possibility of prolonged earnings downward revisions."

Although the emergence of Emperor Stocks is not expected soon, there is a stock receiving positive attention from the securities industry. The protagonist is Samsung Biologics. Ten securities firms have set target prices above 1 million KRW for Samsung Biologics. This optimism is due to expectations that investment sentiment in the pharmaceutical and bio sectors will improve thanks to the short-selling ban and technological innovation. Samsung Biologics recorded consolidated sales of 1.034 trillion KRW in the third quarter, surpassing 1 trillion KRW in quarterly sales for the first time since its founding. Haesoon Kwon, a researcher at Eugene Investment & Securities, set a target price of 1.1 million KRW for Samsung Biologics, stating, "The CDMO (Contract Development and Manufacturing Organization) division benefited from sustained high exchange rates, and the start of commercial production at Plant 4 contributed to strong third-quarter results," adding, "With Plant 4's operation, earnings growth is expected to continue through 2025."

Especially, the outlook for the bio sector next year is bright. Shinhan Investment Corp. identified bio and healthcare as key themes to watch next year. The core variable is the fundamental inflection point, with current earnings per share (EPS) improving from the bottom. Donggil Roh, a researcher at Shinhan Investment Corp., said, "The trading volume proportion within the index, which was around 2%, indicates its status as an overlooked stock with sparse supply and demand. This variable, coinciding with the arrival of the fundamental inflection point, can enhance returns. Considering the possibility of earnings improvement next year, bio has the conditions to become a leading theme."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)