Financial Authorities Began Curbing Household Debt Last October

Banks Raise Interest Rates and Market Rates Also Surge

Increase in Mortgage Loans with Interest Rates in the 5% Range

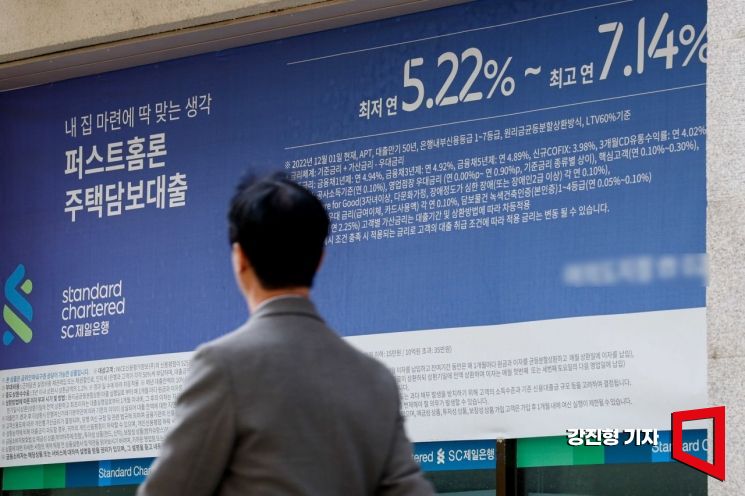

On the 23rd, as domestic market interest rates and bank loan interest rates rapidly rise, a banner displaying loan interest rates is hung on the exterior wall of a commercial bank in Seoul. Photo by Jinhyung Kang aymsdream@

On the 23rd, as domestic market interest rates and bank loan interest rates rapidly rise, a banner displaying loan interest rates is hung on the exterior wall of a commercial bank in Seoul. Photo by Jinhyung Kang aymsdream@

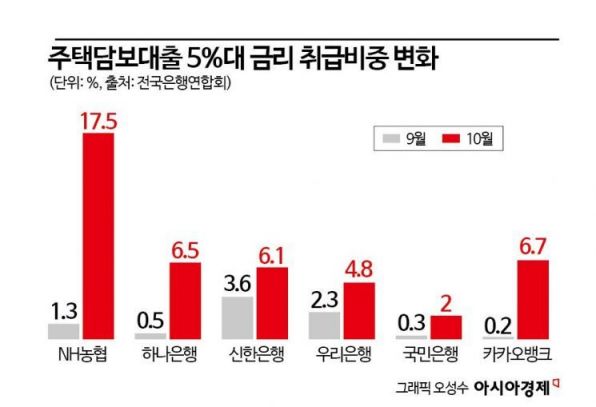

Last October, the proportion of mortgage loans with interest rates in the 5% range at commercial banks increased significantly. At that time, financial authorities had requested banks to raise interest rates as a way to curb the rising trend of mortgage loan growth amid increasing household debt. Coinciding with the rise in bank bond yields, loans with annual interest rates in the 5% range noticeably increased.

According to the Korea Federation of Banks on the 6th, comparing September to October, the share of mortgage loans by interest rate range (in installment repayment method) at the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) and internet banks (KakaoBank, K Bank) showed that the proportion of loans with 5% interest rates jumped across most banks within a month.

The largest increase was at NH Nonghyup, rising from 1.3% in September to 17.5% in October. Hana Bank increased from 0.5% to 6.5%, Shinhan Bank from 3.6% to 6.1%, Woori Bank from 2.3% to 4.8%, and Kookmin Bank from 0.3% to 2%. Among internet banks, KakaoBank also saw a sharp rise from 0.2% to 6.7% in the share of loans with 5% interest rates.

A representative from a commercial bank said, "Until September, it was no exaggeration to say that 99% of mortgage loans at commercial banks were issued at interest rates in the 4% range, but in October, the increase in 5% range mortgage loans was noticeable enough to feel the rate hike."

The increase in mortgage loans continued throughout this year. According to the Financial Supervisory Service, household loans from banks increased by a total of 46.7 trillion KRW from January to November. The growth accelerated particularly in the second half of the year, with a total of 29.9 trillion KRW issued from July to November.

An official from the Financial Supervisory Service explained, "The increase in mortgage loans from banks in November was 5.9 trillion KRW, similar to October's 5.8 trillion KRW, and lower than August's 7 trillion KRW and September's 6.1 trillion KRW. However, the increase in bank mortgage loans was mainly due to policy fund loans targeted at actual demand borrowers." In November alone, out of the total 5.9 trillion KRW, 4.8 trillion KRW were policy fund loans such as special Bogeumjari loans, Didimdol loans, and Beotimmok loans, while bank-originated mortgage loans amounted to only 1.1 trillion KRW.

Interest rates have been on a rollercoaster ride. In December, mortgage loan interest rates showed a slight decline. On the 5th, the mixed-type mortgage loan interest rates at the five major banks ranged from 3.76% to 6.77%. Compared to December 1st’s 4.39% to 6.39%, both the lower and upper bounds dropped by about 0.6 percentage points.

The Financial Services Commission plans to launch a 'Mortgage Loan Refinancing System' as early as this month. This is an expanded version of the 'One-Stop Refinancing Service' for unsecured loans introduced in May this year. Soon, mortgage borrowers will be able to compare mortgage and jeonse deposit loan interest rates by bank remotely via smartphones and switch to loans offering lower interest rates.

A commercial bank official said, "To prevent customers from moving to other banks, the only way banks can compete is by lowering interest rates," and predicted, "There will likely be strong demand from consumers who took out loans at high interest rates during the rate hike period starting last year." However, the official advised, "Borrowers who have had loans for less than three years should carefully consider whether refinancing is beneficial, taking into account early repayment penalties."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)