Possibility of Compensation for Losses in DLF Again

40-80% Variation Depending on Sales Procedures and Investment Experience

Losses Not Yet Occurred, No Evidence of Mis-selling

"Mentioning Compensation Now Is Premature," Some Warn

As investors in Hong Kong H Index-linked Equity-Linked Securities (ELS) prepare for significant losses in the first half of next year, the Financial Supervisory Service (FSS) has begun reviewing compensation standards, drawing attention to whether and how much compensation will be provided. Commercial banks maintain that "it is premature to discuss compensation when losses have not yet occurred and it has not been determined whether there was any mis-selling." However, with FSS Governor Lee Bok-hyun stating that banks selling ELS products will be held accountable, the financial industry atmosphere suggests a high likelihood of compensation if losses occur.

In a report titled 'ELS Issue Related' released by eBest Investment & Securities on the 5th, analyst Jeon Bae-seung said, "Considering that compensation measures have continued for a series of financial sector mis-selling issues such as real estate funds and private equity funds until recently, this ELS issue is also likely to proceed in a similar manner," adding, "However, since most ELS investors are reinvestors with prior product subscription experience, the actual compensation ratio is expected to be lower compared to the past DLF incident."

80% Compensation for 79-Year-Old Hearing-Impaired Dementia Patient Four Years Ago

In December 2019, the FSS decided that banks should compensate investors who suffered losses after subscribing to overseas interest rate-linked Derivative-Linked Funds (DLF). The basic compensation ratio was 55%, with adjustments ranging from 40% to 80% depending on compliance with sales procedures and past investment experience. Among the mis-selling dispute resolution cases at that time, there was a case that received the highest compensation ratio of 80%. The investor was a 79-year-old dementia patient with hearing impairment and no investment experience. The FSS judged that, considering the investor's age, health condition, and investment experience, it was difficult to conclude that sufficient explanations had been provided.

In the current review of ELS compensation standards, as with the DLF case, 'elderly investors' and 'reinvestors' are expected to be key issues. If banks are found to have mis-sold to elderly investors, the possibility of compensation is considered relatively high. Even if there is no mis-selling issue, the 'suitability principle' regarding whether it was appropriate to recommend complex ELS products to elderly investors will also be examined.

However, reinvestors who have previously invested in derivative products like ELS are expected to find it difficult to receive compensation, as they are judged to understand the risks and characteristics of the products. Analyst Jeon said, "Among ELS subscribers, 20% are known to be elderly aged 65 or older, and financial authorities have raised the possibility that the suitability principle was not observed," adding, "Whether and how much compensation is provided depending on each investor's case is crucial." However, some within the financial authorities believe it is premature to mention compensation ratios. A Financial Services Commission official said, "It is not too late to discuss compensation after investor losses actually occur and after the FSS inspection is conducted," adding, "The FSS appears to be taking a few steps ahead."

Decrease in Commercial Banks' Trust Fees

The ELS incident is expected to inevitably lead to a decrease in banks' trust fee income. According to eBest Investment & Securities, trust fee income including ELS sales commissions in the banking sector amounts to about 200 billion KRW annually among the four major banks. As of the third quarter cumulative this year, it recorded 147 billion KRW, accounting for about 20% of total bank fee income. Analyst Jeon predicted, "With expected declines in interest income and an overall contraction in financial product sales, it is inevitable that securing fee income will be negatively affected."

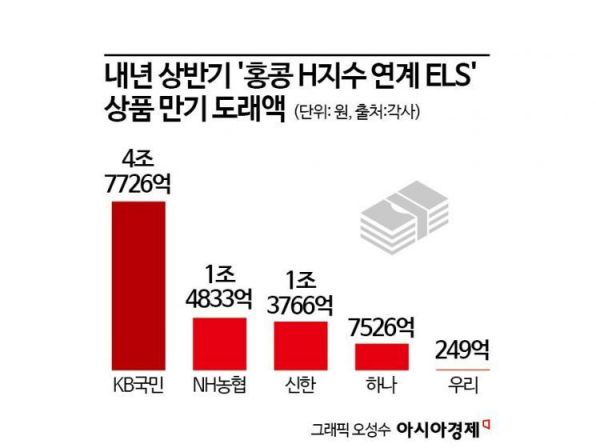

The total outstanding sales balance of Hong Kong H Index-linked ELS maturing in the first half of next year among the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) is 8.41 trillion KRW. By bank, the outstanding sales balances maturing in the first half of next year are KB Kookmin Bank (4.7726 trillion KRW), NH Nonghyup Bank (1.4833 trillion KRW), Shinhan Bank (1.3766 trillion KRW), Hana Bank (752.6 billion KRW), and Woori Bank (24.9 billion KRW), in that order.

Within the financial sector, considering the current H Index and product structure, principal losses of 3 to 4 trillion KRW are expected. ELS incur principal losses if the underlying asset's price falls by 35% to 55% or more at maturity compared to the subscription point. The H Index, which rose to 12,106.77 in February 2021, dropped to 5,203.33 as of the 4th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)