Continued Inversion of Credit Loan Interest Rates

High Credit Borrowers' Rates Rise

Mid- and Low-Credit Borrowers' Rates Fall

Some internet banks are experiencing a phenomenon where, in their efforts to embrace medium- and low-credit borrowers, high-credit borrowers are instead being discriminated against. While high-credit customers are important for stable growth, internet banks are caught in a dilemma under pressure to meet the target proportion of medium- and low-credit borrowers by the end of the year. At K-Bank, the 'reversal phenomenon' continues, where the interest rates on unsecured loans for high-credit borrowers are higher than those for medium- and low-credit borrowers.

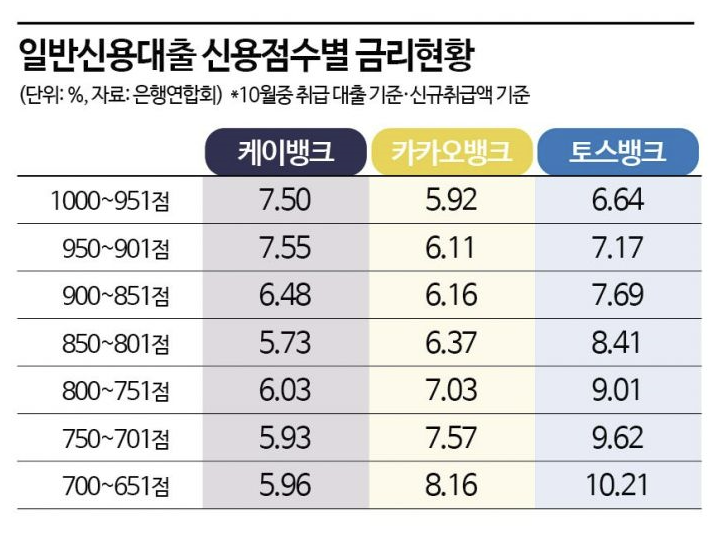

According to the Bankers Association disclosure on the 6th, K-Bank's general unsecured loan interest rate (disclosed in November, based on loans issued in October) was 7.50% in the credit score range of 1000?951. This is 1.77 percentage points higher than the 5.73% rate for the 850?801 range. Compared to 6.03% for the 800?751 range, it is 1.47 percentage points higher, and it is more than 1.5 percentage points higher than the 5.93% and 5.96% rates for the 750?701 and 700?651 ranges, respectively.

The 950?901 range, classified as high credit, also recorded a rate in the 7% range at 7.55%. Compared to the five major banks (KB Kookmin, Shinhan, Woori, Hana, NH Nonghyup), where the interest rates for the same credit score range are between 5.7% and 6.08%, this is more than 1.47 percentage points higher. Compared to KakaoBank (6.11%) and Toss Bank (7.17%), K-Bank has the highest level. This reversal phenomenon at K-Bank has continued for three consecutive months, from loans issued in August through October.

A similar situation is occurring at KakaoBank. While interest rates for high-credit borrowers have risen, rates for medium- and low-credit borrowers have fallen. In October, the unsecured loan interest rates at KakaoBank were 5.92% for the 1000?951 range and 6.11% for the 950?901 range, rising by 0.35 and 0.31 percentage points respectively compared to the previous month. Meanwhile, rates for the 850?801, 800?751, and 750?701 ranges fell by 0.35, 0.12, and 0.09 percentage points, respectively.

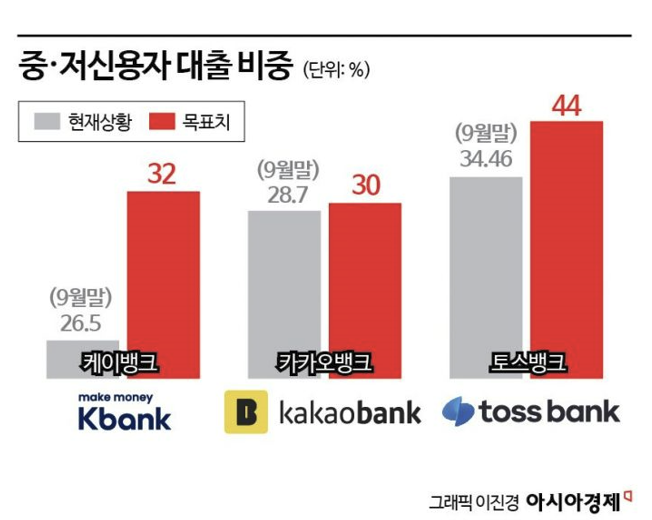

This phenomenon at internet banks is due to the financial authorities continuously lowering interest rates for medium- and low-credit borrowers to accelerate achieving the target proportion of loans to these groups. As of the end of September, the proportion of loans to medium- and low-credit borrowers at K-Bank and KakaoBank stood at 26.5% and 28.7%, respectively. Their year-end targets are 32% and 30%, respectively.

Toss Bank appears to be taking a somewhat independent path. While the average credit scores for unsecured loans issued in October were 835 and 837 at K-Bank and KakaoBank, respectively, Toss Bank's average was 923, indicating a relatively higher proportion of high-credit borrowers. Toss Bank's proportion of loans to medium- and low-credit borrowers was 34.46% as of the end of September, down 4.04 percentage points from 38.5% at the end of June, marking a decline for two consecutive quarters since the end of March (42.06%). However, in terms of numbers alone, Toss Bank has the highest proportion of medium- and low-credit borrowers among the three internet banks. A Toss Bank representative explained, "The timing of repayments by medium- and low-credit borrowers coincided with the implementation of the loan transfer system, leading to an influx of high-credit borrowers."

Even in the case of mortgage loans, the interest rate competitiveness of internet banks is disappearing. Internet banks aggressively increased mortgage loans at lower rates compared to commercial banks, but financial authorities have pointed to this as a cause of household loan growth, causing a slowdown. In October, the average interest rates for new installment mortgage loans issued by K-Bank and KakaoBank were 4.46% and 4.61% per annum, respectively. This is not significantly different from the rates of the five major banks (4.65%?4.79%).

Because of this, internet banks, for which high-credit customers are also important for sustainable growth, are in a difficult situation. An internet bank official said, "From the perspective of high-credit customers, if they feel their loans are being ignored, it can be perceived as reverse discrimination, which is not good for long-term growth." Another internet bank official lamented, "We are told to play the role of a catalyst, but we are stuck in a situation where we can neither do this nor that."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)