DRAM and NAND Prices Rise for Two Consecutive Months

Samsung and SK Expected to Return to Profit Next Year

Expansion of High-Performance, High-Capacity Memory Production Lines

HBM Facility Investment

On-Device AI Response

Although the full-scale cold wave began in December, a spring breeze is blowing in the semiconductor market. With DRAM and NAND prices rising for two consecutive months, the memory semiconductor market appears to be recovering in earnest. Samsung Electronics and SK Hynix, which had been mired in deficits, are also expected to turn profitable next year. Additionally, there are forecasts that demand for high-bandwidth memory (HBM) used in generative artificial intelligence (AI) servers and DRAM specialized for on-device AI will surge. Analysts suggest that the market will start to normalize next year, and if new demand explodes thereafter, a long-term super boom is possible.

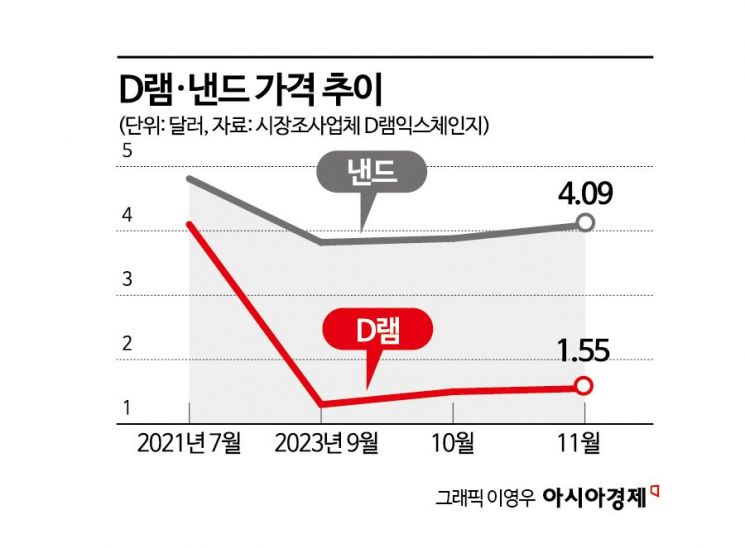

Recently, market research firm DRAMeXchange reported that DRAM and NAND prices have risen for two consecutive months. The average fixed transaction price of general-purpose PC DRAM products (DDR4 8Gb) in November was $1.55, up 3.33% from the previous month. The average fixed transaction price of general-purpose NAND flash products for memory cards and USBs (128Gb 16Gx8 MLC) in November was $4.09, up 5.41% from the previous month.

DRAM and NAND rebounded in October by 15.38% and 1.59%, respectively, marking the first increase in two years and three months since July 2021. With semiconductor manufacturers cutting production and Samsung Electronics and SK Hynix focusing on producing new high-performance, high-priced semiconductors such as HBM, customers began actively purchasing products under the assumption that existing product output would not increase. As a result, both DRAM and NAND flash, which had been sold at rock-bottom prices due to excess inventory, are returning to their proper value. Semiconductor experts explain that the memory semiconductor companies' pricing power has somewhat recovered, and the market is now supplier-driven.

Having passed the worst phase, the performance of Samsung Electronics' Device Solutions (DS) division and SK Hynix is also expected to recover. With the memory market recovering next year, the combined operating profit of the two companies is expected to exceed 20 trillion won. This contrasts with the cumulative losses of 12.69 trillion won and 8.0763 trillion won recorded by each company up to the third quarter of this year. The financial investment sector forecasts Samsung Electronics DS division's operating profit to be between 14 trillion and 15 trillion won next year. SK Hynix's operating profit during the same period is estimated to be around 8.5 trillion won.

Samsung Electronics and SK Hynix are busy preparing to enter a new semiconductor boom cycle. In particular, they plan to focus on expanding production lines for high-performance and high-capacity memory to respond to the growth of AI and high-performance computing markets.

First, capital investment will mainly be made in HBM-related infrastructure. With the boom of various generative AI services, including ChatGPT, expected to continue next year, demand for HBM, the core memory semiconductor used in these services, is projected to increase steadily. Samsung Electronics has decided to increase its HBM production capacity to 2.5 times the current level by next year. Kim Jae-jun, Vice President of Samsung Electronics Memory Business Division, said during the third-quarter earnings announcement, "We have already completed negotiations with major customers regarding supply volumes for next year." SK Hynix, which is gaining an early lead in the HBM market, is also reported to increase its capital investment by about 50% next year compared to this year, focusing on premium products. SK Hynix stated in its third-quarter earnings announcement that "not only HBM3 but also HBM3E production capacity for next year has been 'sold out'." This means all products not yet manufactured have already been sold.

They are also preparing for the era of 'on-device AI technology,' where AI services are applied directly to smartphones or PCs without going through servers or the cloud. Samsung Electronics plans to equip its Galaxy S24 series, scheduled for release in January next year, with its self-developed generative AI called 'Gauss.' From the fourth quarter of next year, Samsung will also begin mass production of low-latency wide (LLW) DRAM specialized for on-device AI. SK Hynix plans to enter the on-device AI memory market starting with supplying high-bandwidth special DRAM to Apple's augmented reality (AR) device 'Vision Pro,' scheduled to be unveiled in March next year.

Market research firm TransForce expects the AI server market to grow at an average annual rate of about 36% until 2027. Until now, the biggest beneficiary of the AI era has been Nvidia, a U.S. company that makes GPUs, which can be considered CPUs for AI, but memory semiconductor companies are gradually starting to reap the benefits of the AI era as well. This has led industry insiders to begin viewing next year as the first year of a memory semiconductor super boom or super cycle. Lee Eun-jae, Deputy Senior Researcher at the International Finance Center, said, "The memory semiconductor market shrank by more than 35% compared to the previous year this year, but a rebound of more than 43% is expected next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)