Raising 100 Billion KRW Through Rights Offering

All Funds to Be Used for Facility Investment... Expanding Transformer and Cable Production Capacity

Iljin Electric, which has decided on a large-scale expansion investment, will raise funds through a rights offering. The board of directors of Iljin Electric judged that expansion is inevitable as demand is rapidly increasing in overseas markets, including the United States.

According to the Financial Supervisory Service's electronic disclosure system on the 5th, Iljin Electric is promoting a rights offering by allocating 0.229 new shares per one existing share. It will issue 10,605,000 new shares to raise 100 billion KRW. The planned issue price of the new shares is 9,430 KRW. The issue price will be finalized on the 18th. The subscription period for existing shareholders is from the 22nd to the 23rd. If there are any unsubscribed shares, a subscription will be conducted targeting general investors, and any remaining unsubscribed shares will be underwritten by the lead manager, Mirae Asset Securities.

20% of the total issuance volume, 2,121,000 shares, has also been allocated to the employee stock ownership association. According to the securities registration statement, there are 878 employees, and each is allocated an average of 2,416 shares.

The largest shareholder, Iljin Holdings, holds 56.97% of Iljin Electric’s shares. It is scheduled to be allocated 4,834,099 new shares in the rights offering, amounting to approximately 45.6 billion KRW based on the planned issue price. The participation scale has not yet been decided, and the final subscription quantity will be determined through a resolution of Iljin Holdings’ board of directors. If it subscribes to all allocated new shares, the largest shareholder’s stake will decrease from the current 56.97% to 54.43%.

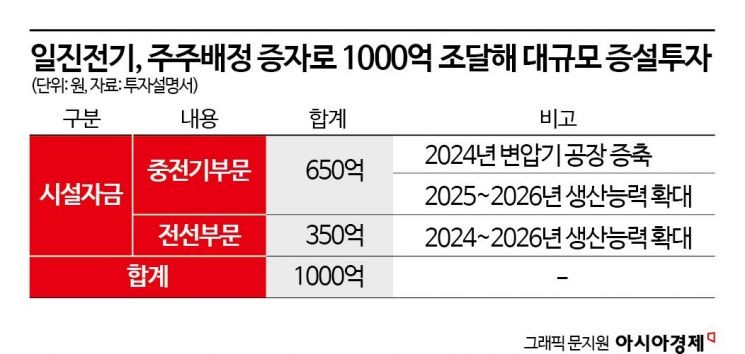

Iljin Electric will use all the funds raised from the rights offering for facility investment. It will expand the production capacity of medium-voltage electrical equipment and wires, including transformers and circuit breakers, which are essential facilities for substations. As of the end of September this year, the order backlog in the medium-voltage equipment sector was 383.446 million USD, which corresponds to the supply capacity when the production plants operate at 100%. The board of directors judged that after 2025, demand in the Americas will surge, making it difficult to cope with the current production capacity, and on September 8th, decided to expand the transformer factory. To meet the market demand, it will invest 65 billion KRW. The production capacity of the transformer factory is expected to grow from 260 billion KRW at the end of this year to 433 billion KRW by the end of 2026, based on sales conversion.

The order backlog for the wire sector is 58.014 million USD. It will invest 35 billion KRW in expansion. The production capacity of the wire factory will be expanded from 380 billion KRW at the end of 2023 to 620 billion KRW by the end of 2026.

Based on replacement demand in advanced countries such as the European Union (EU) and the United States, as well as the increase in demand for renewable energy, global investment in power infrastructure is increasing. Global electricity generation is expected to increase from 29,033 TWh (terawatt-hours, 1,000 GWh) in 2022 to 38,207 TWh in 2030 and 59,111 TWh in 2040. Considering that the increase in power generation leads to demand for power cables, the wire market is also expected to grow steadily.

Iljin Electric’s main production facilities are located in Hwaseong and Ansan in Gyeonggi Province, and Hongseong in Chungcheongnam-do. As of the end of the third quarter this year, it spent approximately 11.1 billion KRW on facility investment on a consolidated basis. The total expected investment for this year is 25.1 billion KRW. The total expected investment amount corresponds to 79.7% of last year’s consolidated operating profit of 31.5 billion KRW.

The wire industry is a capital-intensive industry requiring large-scale facility investment as a large-scale equipment industry. Market competitiveness depends on facility efficiency. Due to the nature of the industry, Iljin Electric has steadily made facility investments and its debt has also increased. As of the end of the third quarter on a consolidated basis, total borrowings amounted to 207.5 billion KRW, with a debt ratio of 143.2% and a current ratio of 113.5%. The debt dependency ratio was 22.9%, and the net debt dependency ratio was 19.2%. As of the end of the third quarter this year, short-term borrowings on a consolidated basis were 53.5 billion KRW, exceeding cash and cash equivalents of 34 billion KRW. If the burden of working capital increases due to the rise in the price of raw material copper, it could negatively affect financial stability.

In the early stages of entering overseas markets, Iljin Electric secured orders at low prices to overcome lower recognition compared to competitors, but as its technological capabilities have been recognized, profit margins have increased. To achieve external growth and profitability in overseas markets, it has strengthened activities of its existing Americas corporation and Singapore branch, and in July this year, it also established a London branch. This is an investment to expand orders not only in the Americas and Asia but also in Europe.

A financial investment industry official said, "If Iljin Electric’s stock price maintains its current level until the subscription deadline, the subscription rate is expected to be high," adding, "The possibility of new shares acquired by the largest shareholder being sold on the market is low." He also added, "The fact that the underwriting fee rate for remaining shares is only 0.5% shows confidence in the subscription success."

Iljin Electric’s stock price fell more than 9% on the trading day following the board’s resolution for the rights offering but has since recovered to the level before the resolution. This is due to the fact that the funds will be used entirely for facility investment and the recent news of a long-term supply contract worth 431.8 billion KRW for ultra-high voltage power transformers with an energy specialist company in the eastern United States. It appears that investors agreed on the necessity of the rights offering, leading to the stock price recovery.

The lead manager explained, "Considering Iljin Electric’s stable business capabilities based on long business experience, favorable market position in the domestic market, and proven technological and quality competitiveness through the expansion of orders for ultra-high voltage cables and transformers overseas, Iljin Electric is expected to maintain a sound business foundation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)