Japan's Beer Imports Top $42.1 Million This Year, Surpassing China and Netherlands

'Asahi Super Dry Draft Beer Can' Hits Market, Boycott Movement Virtually Disappears

Chinese Beer 'Qingdao' Faces Setbacks, Collapses After One Year

This year, the most imported beer in South Korea was found to be Japanese beer led by Asahi. The demand for Japanese beer, which sharply declined in 2019 due to the 'No Japan' (boycott of Japanese products) movement, has rebounded this year thanks to the emergence of hit products and the near disappearance of the boycott, securing the top spot in the imported beer market for the first time in five years. On the other hand, Chinese beer, which rose to the top last year, lost its throne within a year due to the adverse effect of the so-called 'urine terror'.

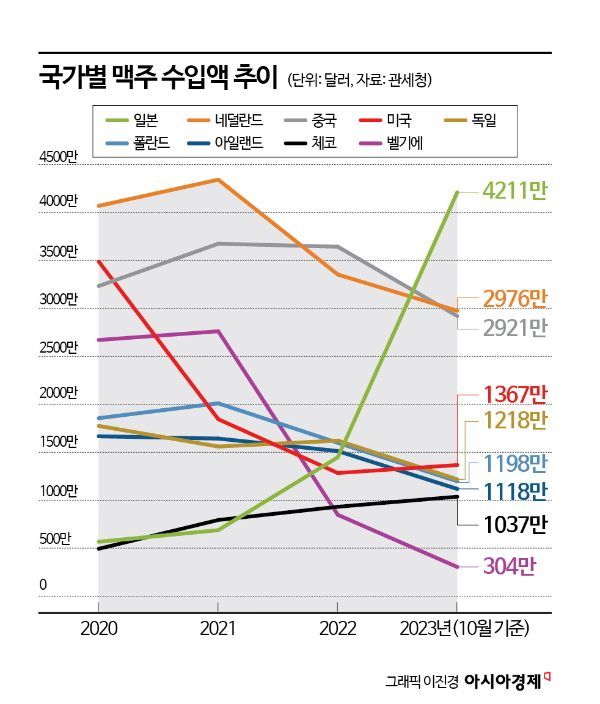

According to export-import trade statistics from the Korea Customs Service as of October this year, the import value of Chinese beer was $29.212 million (approximately 37.7 billion KRW), down 6.3% ($1.949 million) from the same period last year ($31.161 million). This ranked third among beer import values by country, dropping two places from the top spot last year.

The main cause of the decline in Chinese beer is undoubtedly the so-called 'urine terror' incident that occurred in October at the Shandong factory of 'Tsingtao,' one of China's representative beers. Although the importer tried to clarify that the domestic products were unrelated, deep-rooted distrust of Chinese food resurfaced, leading domestic consumers to quickly cut ties with the product. In fact, the import value of Chinese beer in October, when the incident occurred, plummeted by 37.7% to $1.927 million compared to $3.094 million in the same month last year.

However, it seems that even without the urine terror incident, it would have been difficult for Chinese beer to maintain its top position. This is because the recovery of Japanese beer has been very strong this year. The import value of Japanese beer as of October this year was $42.105 million (approximately 54.3 billion KRW), a 264.3% increase from $11.559 million in the same period last year. Considering the current trend, the annual import value of Japanese beer is expected to surpass $50 million for the first time in five years since 2018, and it is certain to reclaim the top spot from sixth place last year.

The import value of Japanese beer peaked at $78.3 million (approximately 101 billion KRW) in 2018, then sharply declined to $39.756 million following the boycott of Japanese products triggered by Japan's export restrictions on South Korea in 2019, and further shrank to $5.668 million in 2020. However, as the boycott gradually faded, it began to rebound significantly from last year, and since June this year, imports have rapidly increased, quickly regaining its status as the strongest imported beer nation.

The return of Japanese beer this year was led by Lotte Asahi Liquor's official launch in July of the 'Asahi Super Dry Draft Beer Can' in South Korea. The Asahi Super Dry Draft Beer Can, first released by Asahi Beer in April 2021, is characterized by soft foam naturally rising when the can is opened. Thanks to its unique product form, it received great response locally and has continued its popularity since its domestic launch. According to market research firm Market Link, from July to October after the launch of the Asahi Super Dry Draft Beer Can, Asahi beer's household market sales reached 104.6 billion KRW, capturing a 7.3% market share. This ranks third, following 'Cass' and 'Terra'.

Looking at the origins of imported beer this year, after Japan, the order was the Netherlands ($29.755 million), China, the United States ($13.665 million), Germany ($12.181 million), Poland ($11.982 million), Ireland ($11.175 million), and the Czech Republic ($10.367 million).

Meanwhile, the overall imported beer market has shown little rebound and remains stagnant. The total beer import value as of October this year was $187.16 million (approximately 241.5 billion KRW), a 12.8% increase from $165.98 million in the same period last year. However, considering that last year's import value was the lowest in five years since 2016 ($181.556 million), this cannot be seen as a significant rebound.

The beer import value, which was $309.68 million (approximately 399.5 billion KRW) in 2018, decreased to $187.16 million (approximately 241.3 billion KRW) last year, showing a steady decline in recent years. During this period, whiskey has emerged as the biggest competitor to imported beer, especially highball, a whiskey-based drink with lower alcohol content that became popular during the pandemic, landing as a substitute for beer rather than a fleeting trend.

This year, whiskey imports reached 26,937 tons as of October, a 26.8% increase from the same period last year, and are expected to break the annual record of 27,379 tons set in 2002. On the other hand, whiskey import value increased by only 1.5% to $221.46 million (approximately 285.5 billion KRW), which is attributed to the rise in demand for highball leading to increased imports of relatively low-priced whiskey.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.