3Q Mortgage Loan Balance Net Increase of 19 Trillion Won

Largest Increase Ever for 3Q

August Mortgage Loan Net Increase Largest Since February 2020

Rise in Capital Region Housing Prices is the Cause

On the 23rd, as domestic market interest rates and bank loan interest rates rapidly rise, a banner displaying loan interest rates is hung on the exterior wall of a commercial bank in Seoul. Photo by Jinhyung Kang aymsdream@

On the 23rd, as domestic market interest rates and bank loan interest rates rapidly rise, a banner displaying loan interest rates is hung on the exterior wall of a commercial bank in Seoul. Photo by Jinhyung Kang aymsdream@

The net increase in outstanding mortgage loans in the third quarter of this year reached 19 trillion won, marking the largest scale for any third quarter on record. Following increases of 2 trillion won in the first quarter and 8.5 trillion won in the second quarter, the amount surged sharply in the third quarter. The continued rise in housing prices, especially in the Seoul metropolitan area, was the main cause.

On the 28th, KB Financial Group's Management Research Institute released the 'KB Housing Market Review,' stating, "Despite the nationwide monthly average housing transaction volume stagnating around 50,000 units, mortgage loans continued to increase due to eased lending regulations and a rise in apartment transactions in the metropolitan area," and analyzed this as the "largest scale for any third quarter on record." In September, the nationwide housing sales price rose by 0.06% compared to the previous month, with the metropolitan area leading the increase at 0.15%.

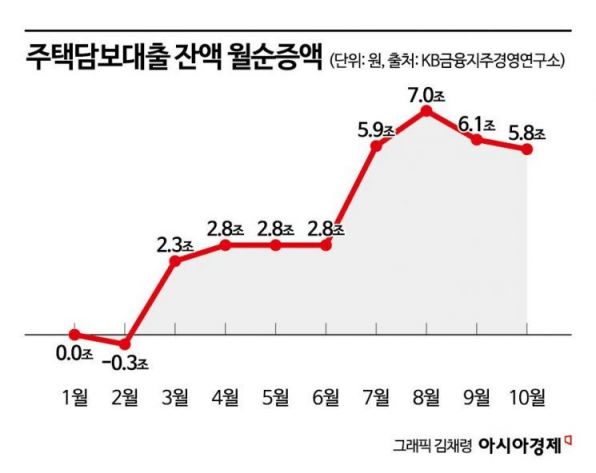

Looking at the monthly net increase in mortgage loans, it is evident that the amount has risen significantly since the second half of this year. From January to June, the increase was only 10.4 trillion won in total. However, starting in July (5.9 trillion won), the amount jumped sharply and maintained a similar upward trend in August (7 trillion won), September (6.1 trillion won), and October (5.8 trillion won).

Notably, the net increase of 7 trillion won in August was the highest since February 2020 (7.8 trillion won). The years 2020 to 2021 saw explosive growth in household debt due to the so-called "Yeongkkeuljok" (people who borrowed to the limit, even to the extent of their soul) who took advantage of low loan interest rates and rising housing prices.

The report stated, "Despite the mortgage loan interest rates rising for four consecutive months, new loans increased," adding, "Market interest rates continued to rise due to the prolonged high interest rate trend in the U.S. and increased loan demand from households and businesses." The mortgage loan interest rate (newly issued amount) at domestic banks rose continuously to 4.35% in September from 4.21% in May.

Since entering the fourth quarter, the upward trend in housing sales prices has somewhat eased. The report noted, "In October, nationwide housing sales prices rose by 0.06%, the same as the previous month, but the increase in the metropolitan area and the top 50 apartments slowed down," adding, "Price increases in Seoul, Gyeonggi, and Daejeon have decelerated, and except for Busan, the decline in other metropolitan cities has also slowed, resulting in an overall reduction in price volatility."

It was assessed that the housing price outlook remains cautious, leading to reduced expectations for price increases. The report said, "The nationwide housing sales price expectation index fell in October for the first time in 10 months since the beginning of the year due to diminished optimism," and "Due to still high purchasing burdens, buying demand has not quickly recovered, which also lowers sellers' expectations."

Nevertheless, the upward trend in mortgage loans at banks has not stopped even toward the end of the year. As of November 24, the outstanding mortgage loan balance at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) was recorded at 524.6207 trillion won, an increase of 3.3943 trillion won from 521.2264 trillion won at the end of October.

Financial authorities have also requested banks to slow the pace of household debt growth. On the 26th, at a meeting with bank presidents, Financial Services Commission Chairman Kim Joo-hyun said, "Household debt, which has increased to one of the highest levels in the world, is lowering growth potential, and the ability of households to generate income for debt repayment may not recover quickly, so appropriate management is necessary," adding, "Please consider not only borrowers' repayment capacity but also the appropriate scale of household debt from a macroprudential perspective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)