Hyundai Motor Likely to Rank 1st in Operating Profit Among All Listed Companies in Q4

Samsung Electronics Operating Profit Expected at KRW 3.4842 Trillion Due to Semiconductor Sector Recovery

'Sangjeohago' Economic Outlook Proved Empty Promise After Poor Performance Until Q3

Possibility of Entering Low-Growth Phase Next Year Amid Global Recession Concerns

Major listed companies in South Korea are expected to emerge from the tunnel of poor performance and achieve a rebound in the fourth quarter of this year. The operating profit of listed companies in the fourth quarter is estimated to be three times that of last year. While Hyundai Motor and Kia recorded record-breaking strong performances this year, Samsung Electronics, which suffered severe losses, is also expected to achieve operating profits in the 3 trillion won range in the fourth quarter, supported by a recovery in the semiconductor sector. However, there is cautious skepticism about whether this rebound trend will continue into next year.

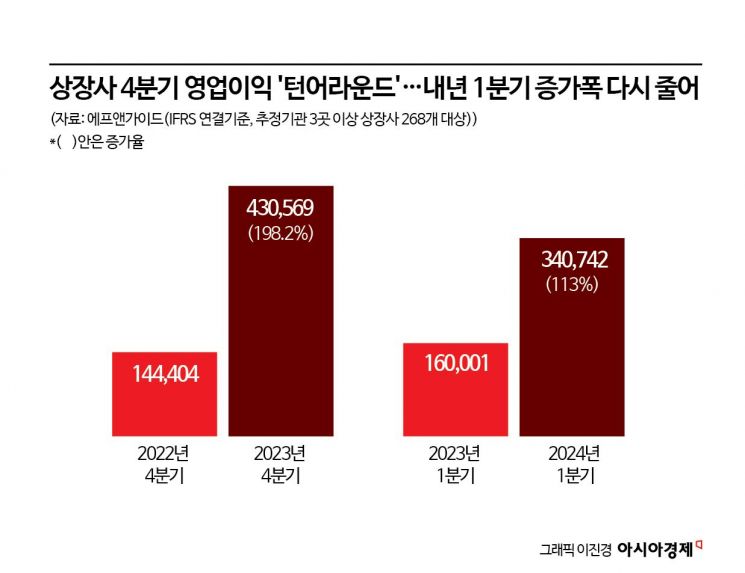

On the 24th, financial information provider FnGuide compiled the estimated operating profits for the fourth quarter of this year for 268 listed companies with estimates from three or more institutions, totaling 43.0569 trillion won. This is about three times (a 198.2% increase) compared to the same period last year (14.4404 trillion won).

The key point of the fourth-quarter performance rebound is semiconductors. Samsung Electronics’ operating profit, which was sluggish at around 600 billion won in the first and second quarters, recovered to 2.4334 trillion won in the third quarter and is expected to reach 3.4842 trillion won in the fourth quarter. It is anticipated to rise to the high 4 trillion won range in the first quarter of next year. Kim Kwangjin, a researcher at Hanwha Investment & Securities, said, "Next year, Samsung Electronics’ profits are expected to increase thanks to a sharp improvement in the semiconductor sector driven by improved memory market conditions. The upward trend in memory prices is expected to continue at least until the second quarter of next year, and despite economic uncertainties, front-end demand for PCs and smartphones is expected to be better than this year."

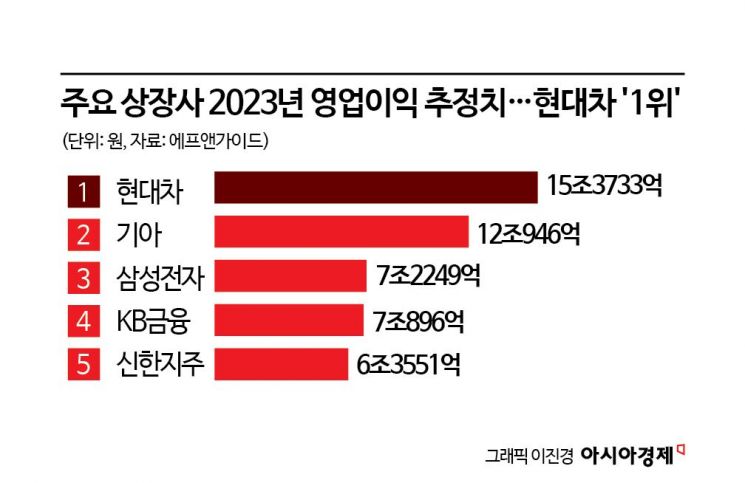

Hyundai Motor, which has been continuing its record-breaking strong performance this year, is expected to rank first among all listed companies by posting an operating profit of 3.849 trillion won in the fourth quarter, surpassing Samsung Electronics. Kia is expected to record an operating profit of 3.0129 trillion won. KB Financial Group (2.0577 trillion won), Shinhan Financial Group (1.828 trillion won), and others, which enjoyed a record boom this year due to the high-interest-rate environment, are also expected to rank high in operating profits.

However, despite the rebound in the fourth quarter, the annual operating profit of listed companies is estimated to decrease by about 14.5% compared to last year. This is due to the prolonged external uncertainties throughout the year and the high-interest-rate environment lasting longer than expected, which significantly worsened cumulative performance through the third quarter.

According to the Korea Exchange, the operating profit of listed companies on the KOSPI market (613 consolidated companies) in the third quarter was 94.6982 trillion won (cumulative consolidated basis), down about 38% from the same period last year (152.6891 trillion won). The KOSDAQ market (1,112 consolidated companies) also recorded operating profits of 8.5146 trillion won, about 34% less than last year’s 12.8237 trillion won. As the timing of the performance rebound was delayed, the early-year economic outlook predicting a "low in the first half and high in the second half" turned out to be incorrect.

On an annual basis this year, Hyundai Motor is expected to achieve a record-high operating profit of 15.3733 trillion won, ranking first among all listed companies. Kia follows in second place with 12.0946 trillion won, and Samsung Electronics is estimated to rank third with 7.2249 trillion won. Kim Guiyeon, a researcher at Daishin Securities, said, "If there are no major fluctuations in exchange rates or the financial sector, the visibility of Hyundai Motor’s fourth-quarter performance is considered high," adding, "Achieving an annual operating profit margin of 8-9% should not be difficult." He further noted, "Although concerns about declining average selling prices (ASP) due to weakening automobile demand and increased incentives are growing, the easing of raw material cost burdens is positive," and added, "In 2024, we expect to confirm qualitative growth in profits."

Whether the rebound trend in the fourth quarter of this year can continue into next year remains uncertain. This is due to concerns about China’s slowing economic growth and rising fears of a global economic recession. FnGuide compiled operating profit estimates for 105 listed companies with estimates from three or more institutions for the first quarter of next year, totaling 34.0742 trillion won, which is expected to increase by 113% compared to the first quarter of this year (16 trillion won). Although this is more than double the first quarter of this year, the increase is smaller compared to the fourth-quarter performance rebound. Especially excluding Samsung Electronics, which is expected to increase operating profits more than sevenfold compared to the extremely poor first quarter of this year, the operating profit growth of other listed companies is about 90%, further reduced.

Shinhan Bank S&T Center research team leader So Jaeyong pointed out, "While the U.S. economy’s relatively good performance is positive, concerns about global recession and financial instability are rising, along with worries about slowing economic growth in major countries such as China. With sticky inflation and the effects of tightening, advanced countries and South Korea are expected to maintain economic growth rates around 1%, and if credit risks expand, further contraction cannot be ruled out." Regarding the domestic economic outlook, he predicted, "Exports, centered on semiconductors, are expected to increase due to inventory reduction, but domestic demand is likely to remain sluggish due to household debt, resulting in a low-growth trend."

Park Hee-chan, a researcher at Mirae Asset Securities, also said, "The short-term global economic cycle after the COVID-19 shock has ended for now, but the world economy is returning to a long-term low-growth phase due to concerns about the new Cold War and supply chain fragmentation," and predicted, "The U.S. Federal Reserve is expected to start cutting interest rates by mid-next year." He added, "South Korea is also facing worsening employment conditions and declining disposable income, making interest rate cuts inevitable. Although exports have recently been recovering, the global environment is unfavorable, making it difficult to view this as sustainable growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)