Improvement of Short Selling System Min-Dang-Jeong Council

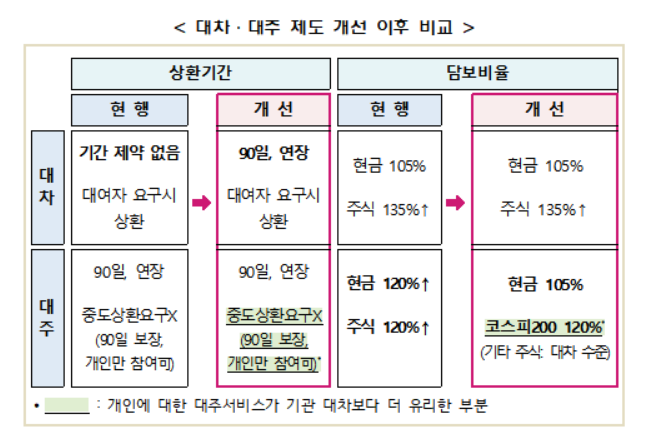

Foreign and Institutional Stock Repayment Period Limited to 90 Days

Individual Collateral Ratio Reduced from 120% to 105%

The People Power Party and the government are correcting the tilted playing field of the short-selling system. The short-selling repayment period for foreign and institutional investors will be changed to 90 days, the same as for individual investors. The collateral ratio for individual short sellers will also be changed to 105%, the same as for foreign and institutional investors. However, for individual investors, the collateral ratio will remain at 120% only for KOSPI 200 stocks.

Yu Eui-dong, Chairman of the Policy Committee of the People Power Party, is speaking at the Min-Dang-Jeong Council on Directions for Improving the Short Selling System to Restore Investor Confidence held at the National Assembly on the 16th. Photo by Hyunmin Kim kimhyun81@

Yu Eui-dong, Chairman of the Policy Committee of the People Power Party, is speaking at the Min-Dang-Jeong Council on Directions for Improving the Short Selling System to Restore Investor Confidence held at the National Assembly on the 16th. Photo by Hyunmin Kim kimhyun81@

On the 16th, Yoo Ui-dong, the Policy Committee Chairman of the People Power Party, announced this plan at the 'Short-Selling System Improvement Direction Inter-Party and Government Council' held at the National Assembly.

Chairman Yoo explained, "We have decided to fundamentally resolve the tilted playing field," adding, "Practically, we will create more favorable conditions for individual investors who face restrictions in short-selling transactions compared to institutions."

Kim So-young, Vice Chairman of the Financial Services Commission, emphasized, "In Korea, due to stock market volatility and a high proportion of individual investors, concerns about unfairness were greater, which led to a temporary full ban on short selling. It is most important to restore public trust in the securities market through fundamental institutional improvements during this ban period."

Kim So-young, Vice Chairman of the Financial Services Commission, is speaking at the Min-Dang-Jeong Council on Directions for Improving the Short Selling System to Restore Investor Confidence held at the National Assembly on the 16th. Photo by Kim Hyun-min kimhyun81@

Kim So-young, Vice Chairman of the Financial Services Commission, is speaking at the Min-Dang-Jeong Council on Directions for Improving the Short Selling System to Restore Investor Confidence held at the National Assembly on the 16th. Photo by Kim Hyun-min kimhyun81@

She continued, "I expect that specific details and follow-up measures will be prepared through a public discussion process. I hope active discussions will take place centered on the National Assembly in the future."

The main contents of the improvement plan announced that day include the limitations on the short-selling repayment period for foreigners and institutions and the establishment of a borrowed short-selling monitoring system, which were raised in the National Assembly's public petition.

The legal basis for short-selling contracts differs between foreigners/institutions and individuals. Foreigners and institutions enter into a 'loan' contract based on civil law, while individuals enter into a 'margin loan' contract based on the Capital Markets Act. Simply put, foreigners and institutions have contracts between the lender and borrower of stocks, whereas individuals use credit extended through securities firms. Because of this, there were strong voices that equalizing the repayment period would be unfair.

Nevertheless, the People Power Party and the government plan to limit the loan repayment period for foreigners and institutions to the same '90 days + extension' as individuals (margin loans). A fine of 100 million KRW will be imposed for violating the repayment period. If the loan period is extended beyond 90 days, the reporting obligation to the Financial Supervisory Service will remain as before.

Foreigners and institutions who enter into loan contracts have the obligation to repay at any time upon the lender's request. In contrast, individuals have no mid-term repayment obligation. The government decided to impose the mid-term repayment obligation only on foreigners and institutions as before. As Chairman Yoo said, this effectively becomes more favorable to individuals.

The collateral ratio for individuals (margin loans) will also be lowered. It will be reduced from the current 120% to 105%, the same as foreigners and institutions. The same ratio will apply to cash, and for stocks, the collateral ratio will be set considering discounted valuation. However, for KOSPI 200 stocks, the 120% ratio will be maintained. The Financial Services Commission explained, "If forced sales occur due to the lowered collateral ratio, losses may be realized immediately, so we will strengthen investor guidance."

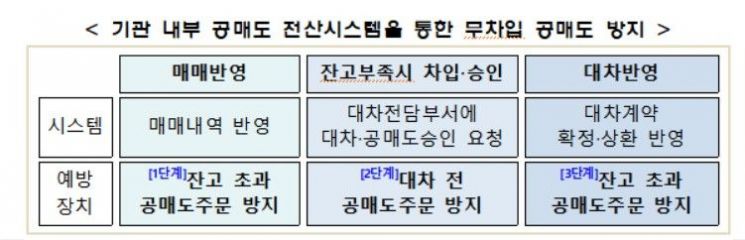

Regarding the establishment of a computerized short-selling system, the plan is to mandate system construction only for institutional investors. As of 2023, foreign (21 firms) and domestic (78 firms) institutions combined account for about 92% of short-selling transactions. Exceptions apply if the short-selling transaction is small-scale or if proof of loan contracts is submitted to securities firms for each short-selling order.

The system will be built so that institutional investors internally manage the available short-selling balance electronically. When a trade record is first reflected in the system, the loan department will request approval for loan and short-selling in a second step, and in the third step, the loan contract confirmation and repayment records will be reflected.

In this regard, securities firms can only place short-selling orders after verifying the institutional investor's computerized system. There will be an obligation to verify the actual computerized system of institutional investors. After an additional annual verification, the results must be reported to the Financial Supervisory Service.

Meanwhile, the real-time blocking system for naked short selling will undergo further feasibility review. This was judged to be practically impossible by the National Assembly's Political Affairs Committee's bill review subcommittee in 2020. Nevertheless, the Financial Supervisory Service and the Korea Exchange plan to form a joint task force (TF) with related agencies, experts, investors, and the industry to conduct a public discussion process again.

Son Byung-doo, Chairman of the Korea Exchange, said, "The Korea Exchange and related agencies will closely cooperate with the government to improve the short-selling system," adding, "We will do our best to prepare reasonable measures that market participants can accept."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)