Separation of Fund Management and Loan Execution Monitoring

FSS to Establish Internal Control Standards Within the Year... Implementation from Next Year

The Financial Supervisory Service (FSS) will establish internal control measures for credit card companies, capital companies, and other specialized credit finance companies. This is due to concerns that, unlike deposit-taking financial institutions such as banks, industry-specific financial accidents may occur. The plan is to systematize the selection and management criteria for partner companies and to set up a system to block abnormal real estate project financing (PF) loan remittances.

On the 15th, the FSS announced plans to prepare an "Internal Control Improvement Plan for the Specialized Credit Finance Industry." This decision was made due to a recent embezzlement and breach of trust case involving approximately 10 billion KRW at Lotte Card, highlighting a lack of industry vigilance.

Earlier, in August, the FSS detected allegations that two employees of Lotte Card's marketing team embezzled around 10 billion KRW and reported the employees and related parties to the prosecution. According to the investigation, the two marketing team employees colluded with partner companies to sign poor partnership contracts and paid 10.5 billion KRW, which was then siphoned off through paper companies and family businesses to invest in real estate development, purchase automobiles, and gift certificates. During this process, Lotte Card's internal controls were also found to be inadequate.

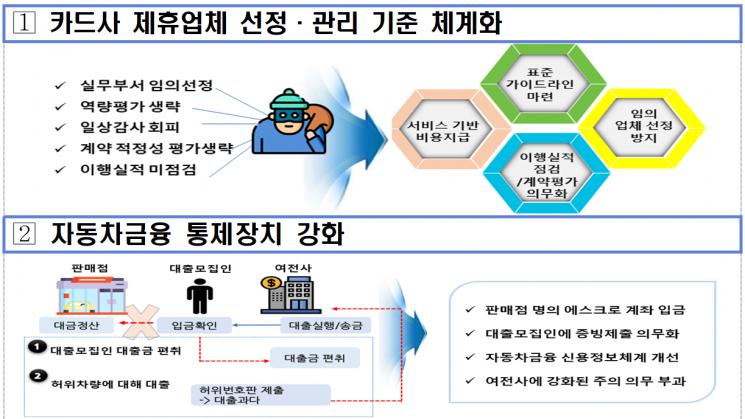

Reflecting the characteristics of the specialized credit finance industry, the FSS plans to establish accident prevention measures for vulnerable areas such as ▲partner company selection and management ▲auto finance ▲PF loans ▲app card authentication ▲embezzlement prevention fund management controls. Additionally, internal control standards, which had been operated differently by each company, will be standardized.

Specifically, to prevent recurrence of cases like Lotte Card, standard regulations for partner company selection and management will be created. Safeguards will be put in place to prevent contract procedures from proceeding if these are not followed. For example, for cases where routine audits have not been conducted, fund execution will be strengthened, and a witness will be required during seal stamping. It will also be mandatory to check the performance of partner companies and evaluate their appropriateness.

Regarding used car financing, the loan process will be revised. Since specialized credit finance companies pay loans to loan solicitors, there is a risk of loan funds being embezzled in the middle, and it may take time for the company to recognize an incident. Accordingly, loans will be paid using safe payment methods such as escrow, and an obligation to immediately collect supporting documents after loan execution will be imposed. Management will also be strengthened for cases where mortgage registration has not been set. Furthermore, the credit information code system will be improved to identify borrowers who lend their names or submit false income proofs due to lack of information, even when using multiple auto-related loans.

PF loan procedures will also be strengthened to prevent accidents caused by the same person or department performing multiple tasks and approving abnormal remittances. Measures to be established include ▲criteria for segregation of duties in PF loans ▲blocking arbitrary changes to recipient names in the system ▲allowing remittances only to pre-registered designated accounts ▲countermeasures to prevent forgery and alteration of fund withdrawal requests. Additionally, fund management will be strengthened to prevent embezzlement, and app card authentication will be enhanced.

Based on these improvement measures, a standard internal control standard for the entire specialized credit finance industry will be established. The model code will be finalized by the end of this year and reflected in individual companies' internal regulations starting from the first quarter of next year. Compliance with these measures will be inspected in the third quarter of next year.

Alongside this, the FSS will actively support the Financial Services Commission's efforts to establish legal grounds for sanctions related to embezzlement and breach of trust by executives and employees of specialized credit finance companies. While laws such as the Banking Act, Insurance Business Act, Capital Markets Act, and Savings Banks Act include provisions allowing financial authorities to sanction executives and employees for legal violations, the current Specialized Credit Finance Business Act lacks such provisions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)