Lowest Daily Trading Volume of the Year... One-Fifth of the Peak

Significant Decline in Foreign Investor Trading Volume... Hopes for Secondary Battery Stock Supply Improvement Dashed

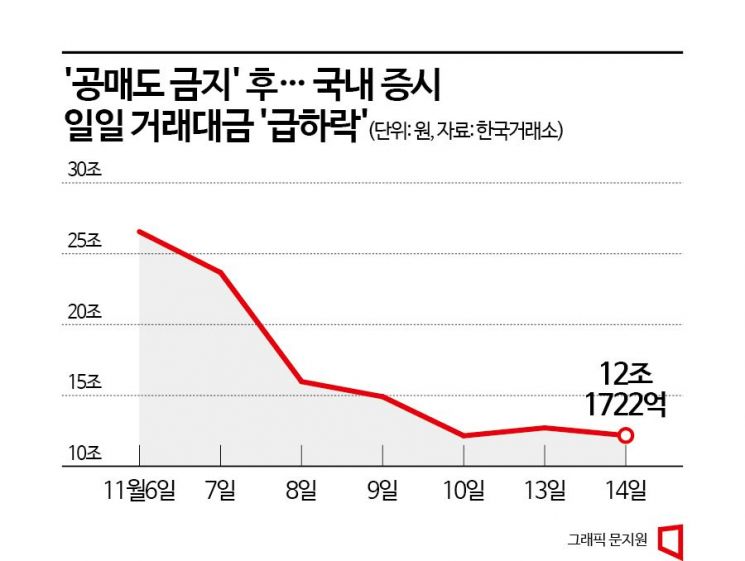

The domestic stock market is rapidly losing momentum. The daily trading volume, which had a surprise rebound immediately after the announcement of the 'temporary ban on short selling,' has quickly declined sharply and is converging to the lowest level of the year. Not only was the policy effect practically 'ultra-short-term,' but concerns have also been raised in the securities industry that the side effects may be greater.

According to the Korea Exchange on the 15th, the previous day's domestic stock market trading volume was recorded at 12.1722 trillion won, the lowest level of the year. Since January 20 (11.1738 trillion won), the daily trading volume of the domestic stock market had never fallen below 13 trillion won, but since early last month, the market has rapidly lost momentum and is on a downward trend. Compared to the highest daily trading volume of the year recorded on July 26 (62.8333 trillion won), it is only about one-fifth.

On the day after the financial authorities suddenly announced the 'temporary ban on short selling' on the 5th (the 6th), the trading volume temporarily increased to 26.56 trillion won. However, the effect lasted only two days and soon dropped to the low 12 trillion won range, halving in just six trading days. In particular, the trading volume of foreign investors sharply decreased. Looking at the changes in trading volume by investor type, compared to the 6th, the trading volume of institutions and individuals decreased by 44% and 53%, respectively, while the decrease in foreign investors' trading volume was the largest at 62%.

The market capitalization turnover rate, which shows the level of trading activity in the domestic stock market, has also sharply declined since the announcement of the 'temporary ban on short selling.' The market capitalization turnover rate, which was 1.10% on the 6th, fell to 0.52% the day before. The market capitalization turnover rate is the total trading volume divided by the average market capitalization. This means that after a surge in short-term trading during the two days immediately following the short selling ban, the market quickly lost momentum due to trading contraction.

Lee Kyung-min, a researcher at Daishin Securities, said, "The unexpected short selling ban issue during the global stock market rebound phase caused confusion in the domestic stock market," adding, "Following a surge that will be recorded in history, the continued decline has raised doubts about the effect of the temporary short selling ban, and the disappointment is growing as expectations were high." He continued, "Since the impact involves both pros and cons, it is necessary to refrain from vague expectations or concerns," but pointed out, "The possibility of foreign investors' activity weakening is a part that should be watched carefully."

The expectation that the temporary ban on short selling would improve the supply and demand of secondary battery stocks was completely different from reality. From the 6th to the previous day, the top stocks in net purchases by foreign investors were Samsung Electronics with 506 billion won, followed by HYBE (407 billion won), SK Hynix (289 billion won), LG Energy Solution (114 billion won), and Celltrion (99 billion won).

Jo Jun-gi, a researcher at SK Securities, said, "Last week, there were few secondary battery-related companies among the top net purchases by foreigners, while they were concentrated among the top net sales," adding, "(After the temporary ban on short selling) foreign investors are rather buying a lot of semiconductor, internet, and bio companies." He also commented on the short selling ban, saying, "The expectation of short covering is still valid, but judging from the market's reaction last week, it is better not to have too high expectations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)