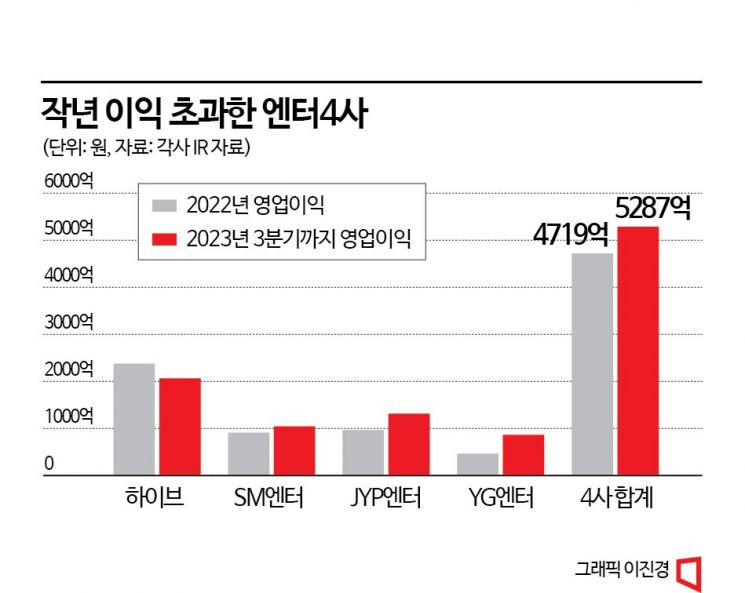

Operating Profit Total of 528.7 Billion KRW for Q1-Q3

Surpasses Last Year's Annual Profit of 471.9 Billion KRW

Strong Performance Expected to Continue from Q4 into Next Year

The Korean entertainment industry continues its record-breaking performance. As of the 13th, with YG Entertainment's Q3 earnings disclosed, all four major entertainment companies have reported their third-quarter results, revealing that their combined operating profits from Q1 to Q3 have surpassed last year's total annual profits. The combined operating profit of the four companies from January to September amounts to 528.7 billion KRW, exceeding last year's total annual profit of 471.9 billion KRW. Their combined revenue for the first three quarters reached 3.1483 trillion KRW, approaching last year's revenue of 3.3656 trillion KRW. This indicates significant growth in the K-pop industry.

From the top left clockwise: HYBE, SM, YG, JYP headquarters

From the top left clockwise: HYBE, SM, YG, JYP headquarters[Photo by Kang Jin-hyung, Asia Economy; provided by SM, YG, JYP]

HYBE Holds Steady During 'Gunbaekgi', SM Rebounds

In Q3, HYBE posted the highest operating profit at 72.6 billion KRW, followed by SM Entertainment (50.5 billion KRW), JYP Entertainment (43.8 billion KRW), and YG Entertainment (21.2 billion KRW). All four companies achieved their highest-ever quarterly results in Q3. Looking at the cumulative operating profits from Q1 to Q3, YG recorded 86.4 billion KRW, an 85.4% increase compared to last year's total annual profit of 46.6 billion KRW. During the same period, JYP Entertainment posted 131.4 billion KRW and SM 104.5 billion KRW in operating profits, representing increases of 36% and 14.7% over last year's annual profits, respectively. HYBE's cumulative operating profit up to Q3 was 206.4 billion KRW, approaching last year's annual profit of 237.6 billion KRW.

Thanks to HYBE's resilience during BTS's 'Gunbaekgi' (a portmanteau of military service and hiatus), the advances of YG and JYP, and SM Entertainment's rebound, the combined profits of the four companies from Q1 to Q3 have surpassed last year's total annual profits. Notably, SM, which ranked third in operating profit in Q1 and Q2, climbed to second place in Q3. Of the parent company Kakao's Q3 operating profit of 140.3 billion KRW, 25.2 billion KRW (17.9%) was attributed to SM's consolidation effect. This was due to the resolution of management disputes and a record-breaking quarterly album sales volume of 8.71 million copies. Album sales accounted for 42.5% of revenue.

It's not just SM. HYBE's album sales accounted for nearly half, at 49.1%, and JYP's were 41.3% in Q3. YG does not disclose sales by segment separately. The growth of the K-pop album market, which continues to set new records daily, has driven these results. From January to September, K-pop album sales reached 85.8 million copies, about 25 million more than the same period last year. This has already surpassed last year's record annual sales of approximately 80 million copies. It is expected that sales will exceed 100 million copies this year.

Logistics Industry Also Enjoys 'Happy Complaints'

The resurgence of offline concerts, which had slowed due to COVID-19 until last year, also contributed to these record-breaking results. HYBE's combined concert revenue from Q1 to Q3 was 269.5 billion KRW, surpassing last year's annual revenue of 258.1 billion KRW. During the same period, SM's concert revenue was 63.7 billion KRW, more than 1.5 times last year's 24.8 billion KRW. JYP also grew by 34% to 33 billion KRW.

The boom in the entertainment companies is expected to continue into Q4. As the year-end peak season approaches, major artists from each company are making comebacks or preparing for them. HYBE's Seventeen recently set a new K-pop record for the highest first-week sales (initial sales) with 5.09 million copies for their mini-album, and BTS's Jungkook set a solo artist first-week sales record with 2.43 million copies. SM has 12 artists scheduled to release albums in Q4, and JYP's flagship group Stray Kids has resumed activities. YG is preparing for the debut of Baby Monster, its first girl group in seven years since Blackpink.

The related industries are also buzzing. The period with the highest export volume coincides with the comebacks of major artists and the release of albums and merchandise. Overseas fans often use the most expensive express shipping services due to concerns about potential damage to products. They are considered 'premium customers' who bring significant revenue. Lee Hwajeong, a researcher at NH Investment & Securities, stated, "The overall increase in album sales and the growing lineup of artists capable of large-scale world tours, including in Western markets, indicate that the entertainment industry's growth trend will continue in 2024."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)