Preparing for Mortgage Refinancing Ahead of 5 Major Banks

Interest Rate Competition Expected Once Launched

Internet Banks Also Strong Competitors

Apartment listings with prices are posted in a real estate-dense shopping district in Songpa-gu, Seoul. Photo by Jin-Hyung Kang aymsdream@

Apartment listings with prices are posted in a real estate-dense shopping district in Songpa-gu, Seoul. Photo by Jin-Hyung Kang aymsdream@

"A single unsecured loan typically amounts to about 10 million KRW, whereas a single mortgage loan exceeds 100 million KRW. Since it's more than ten times larger, if you let your guard down, you could lose hundreds of billions, or even trillions in the worst case." (Practical officer in charge of mortgage loans at a commercial bank)

The Financial Services Commission plans to launch a service as early as the end of this year that allows users to compare mortgage loan and jeonse deposit loan interest rates by bank through their smartphones non-face-to-face, and switch to loans offering lower interest rates. This is an expansion of the 'one-stop refinancing loan service' launched in May this year for unsecured loans.

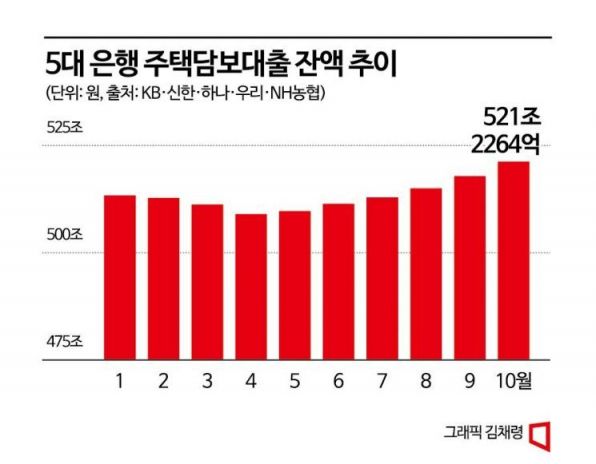

As of October, the combined mortgage loan amount of the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup), including jeonse loans, is 521.2264 trillion KRW. Once the refinancing loan service starts, users will be able to compare interest rates and loan limits by bank at a glance. The possibility of a 'major shift in mortgage loans' is increasing. The amount used for the existing unsecured loan refinancing service exceeded 2 trillion KRW in just five months. Since mortgage loans are much larger in scale, banks are more tense than ever.

The five major banks have already launched non-face-to-face mortgage loan products. KB Kookmin Bank offers the 'KB Star Apartment Mortgage Loan,' Shinhan Bank recently introduced a refinancing loan-exclusive mortgage product called 'Bank Switching Special Interest Rate' on its app SOL. Hana Bank has the Hana One Q Apartment Loan, Woori Bank operates the Woori WON Housing Loan, and Nonghyup Bank plans to release products aligned with the launch of the mortgage refinancing loan service.

The key factor is the interest rate. Once the mortgage refinancing loan service begins, banks will inevitably compete on interest rates. Currently, there is no difference between the interest rates of the five major banks' non-face-to-face mortgage loan products and face-to-face mortgage loan products. As of the 13th, the fixed-rate (convertible to variable after 5 years) interest rates of the five major banks ranged from 4.13% to 6.25% per annum, and variable rates ranged from 4.58% to 7.20%. Recently, financial authorities have been cautious about the increase in household loans, so lowering interest rates just because a product is non-face-to-face is not easy. However, the banking sector expects that once the refinancing loan service is unveiled at the end of the year, interest rate competition will intensify.

An official from a commercial bank said, "When the unsecured loan refinancing service started, Hana Bank and Woori Bank immediately launched exclusive products and lowered interest rates to respond aggressively, while other banks initially did not respond and lost customers. This time, how each bank sets its initial interest rate policy for the mortgage refinancing service will determine their success or failure."

Internet banks like KakaoBank and K Bank are also strong competitors. They have already surpassed commercial banks in terms of interest rates. As of the 14th, KakaoBank's variable interest rates ranged from 4.00% to 5.89%, and fixed rates from 4.18% to 5.56%. K Bank's lowest rates were in the 3% range (variable 3.97% to 6.79%, fixed 4.29% to 5.92%). Notably, KakaoBank's mortgage loan balance grew rapidly to 8 trillion KRW (7.958 trillion KRW) as of Q3 this year, a 16-fold increase from about 504 billion KRW in Q3 last year. Half of this amount came from refinancing loans transferred from commercial banks.

An internet bank official said, "The start of the refinancing loan service could be another opportunity for internet banks to grow their mortgage loan portfolios." Toss Bank is also preparing mortgage loan products aiming for launch next year.

Until now, to refinance a mortgage loan, people had to visit banks in person. Going forward, the core of this service is to allow easy switching through 19 loan comparison platform apps such as Toss, Naver Pay, Kakao Pay, SOL, and Finda. A total of 32 financial companies, including banks, insurance companies, and savings banks, will participate. For mortgage loans, the service covers nationwide apartment purchase funds and living stabilization funds. Jeonse loans are available regardless of housing type.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)