Korea Financial Group, Mirae Asset Securities, Samsung Securities, NH Investment & Securities, Kiwoom Securities Perform Well

Operating Profit Total Up 32.79%, Net Profit Up 39.08% YoY

Challenges Include Overseas Commercial Real Estate Valuation Losses and Preemptive Compensation for Bond Wrap and Trust Products

The third-quarter earnings of major domestic securities firms have been announced. Despite the deteriorating business environment, they showed an overall favorable increase compared to the same period last year. However, the business environment is expected to become even more challenging in the fourth quarter, which may lower expectations for securities stocks' performance.

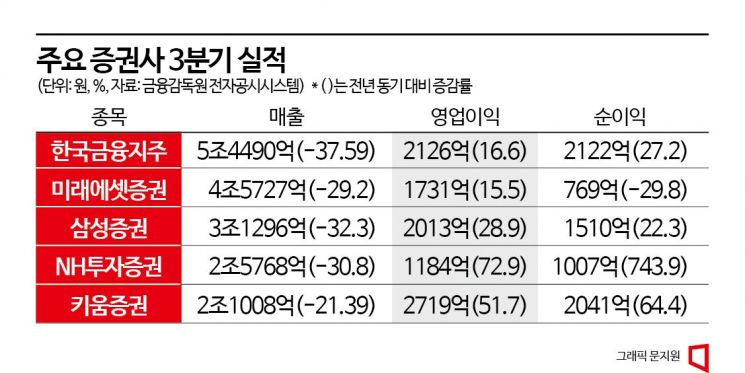

According to the Financial Supervisory Service's electronic disclosure system on the 13th, the combined operating profit on a consolidated basis for the third quarter of this year of five securities firms?Korea Financial Group, Mirae Asset Securities, Samsung Securities, NH Investment & Securities, and Kiwoom Securities?was 977.3 billion KRW, a 32.79% increase compared to the same period last year. Net profit rose by 39.08% to 744.9 billion KRW.

The third-quarter results are considered better than expected. Korea Financial Group's third-quarter net profit was 212.2 billion KRW, up 27.2% year-on-year, and Samsung Securities also increased by 22.3% to 151 billion KRW. NH Investment & Securities surged by 743.9% to 100.7 billion KRW, and Kiwoom Securities rose 64.4% to 204.1 billion KRW. Mirae Asset Securities decreased by 29.8% to 76.9 billion KRW. Park Hyejin, a researcher at Daishin Securities, said, "Except for some securities firms reflecting valuation losses, the third-quarter results recorded better-than-expected profits."

Korea Financial Group's performance improved as interest income and expenses recovered. Jeong Taejun, a researcher at Yuanta Securities, analyzed, "Korea Financial Group's third-quarter net income attributable to controlling shareholders was 212.2 billion KRW, exceeding the market consensus of 198.1 billion KRW," adding, "This was due to the simultaneous improvement in interest income rates and interest expense rates, which improved net interest income." He further noted, "The fact that interest expense rates declined even as market interest rates rose indicates an improvement in Korea Financial Group's liquidity situation." The recovery of corporate finance (IB) and reduction in provisions also contributed to the improved performance. Kang Seunggeon, a researcher at KB Securities, explained, "The IB division's performance, which had been recovering since the second quarter, continued its recovery trend in the third quarter, and the reduction in provisions and impairment related to overseas real estate led to third-quarter results exceeding expectations."

Samsung Securities is evaluated as delivering stable results despite the difficult business environment. Researcher Park Hyejin said, "Despite the challenging operating environment for securities firms in the third quarter, they achieved quite balanced results," adding, "It is estimated that there were no valuation losses related to domestic and overseas real estate, which has recently been an issue, and trading profits are coming out steadily." Im Heeyeon, a researcher at Shinhan Investment Corp., also assessed, "Despite the difficult business environment, conservative risk management compared to competitors and the industry's position in brokerage and asset management sectors demonstrated stable profit-generating capability."

Kiwoom Securities posted results that significantly exceeded consensus, supported by increased brokerage revenue. Ahn Youngjun, a researcher at Hana Securities, said, "Kiwoom Securities' third-quarter results greatly exceeded expectations due to increased brokerage revenue from the rise in domestic stock market trading volume and expanded participation of individual investors, stable operating profits, and minimal profit-damaging factors such as provisions."

NH Investment & Securities' third-quarter results showed a significant increase compared to the same period last year but fell short of consensus due to one-off costs. Park Yongdae, a researcher at Mirae Asset Securities, analyzed, "NH Investment & Securities posted a third-quarter net profit of 100.8 billion KRW, falling 15% short of consensus," adding, "One-off costs such as valuation losses on alternative investment assets, preemptive compensation related to bond-type wrap and trust products, and litigation costs related to derivatives had a significant impact."

Mirae Asset Securities also recorded results below consensus due to overseas real estate valuation losses and others. Jeong Minki, a researcher at Samsung Securities, explained, "Mirae Asset Securities' third-quarter consolidated net income attributable to controlling shareholders was 77.4 billion KRW, marking an earnings shock by falling 38.1% short of consensus," adding, "The poor performance was mainly due to the deterioration of asset management conditions caused by rising interest rates and increased market volatility, with approximately 120 billion KRW in valuation losses and provisions related to the CJ CGV convertible bond investment and overseas commercial real estate."

In the fourth quarter, securities stocks' performance is expected to fall short of expectations due to the worsening business environment. Woo Dohyung, a researcher at IBK Investment & Securities, predicted, "The third-quarter results of securities firms will vary depending on their risk management capabilities," adding, "The operating environment for the securities industry is deteriorating in the fourth quarter, and upward momentum will be limited for the time being."

Concerns related to overseas real estate may also affect performance until the first quarter of next year. Researcher Park Hyejin said, "Securities firms are preparing for the revaluation of non-marketable assets in the fourth quarter, highlighting concerns related to overseas real estate, and trading profits are inevitably decreasing due to significantly increased interest rate volatility since October," adding, "For these reasons, expectations for fourth-quarter results should be lowered, and the related impact is expected to continue until the first quarter of next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)