The domestic gaming industry is undergoing a restructuring. In Korea, game companies have been classified based on sales into ‘3N (Nexon, NCSoft, Netmarble) 2K (Krafton, Kakao Games)’. However, as the center of profits shifted from domestic to overseas markets, this structure has collapsed. While Nexon’s dominance continues, Krafton, once a latecomer, has begun to surpass NCSoft.

Even Combined Operating Profits of the Big 4 Are Half of Nexon’s

Nexon’s dominance continues. While many game companies have recorded negative growth, Nexon has maintained double-digit growth from Q4 last year through Q3 this year. At this rate, it is expected to comfortably surpass last year’s performance.

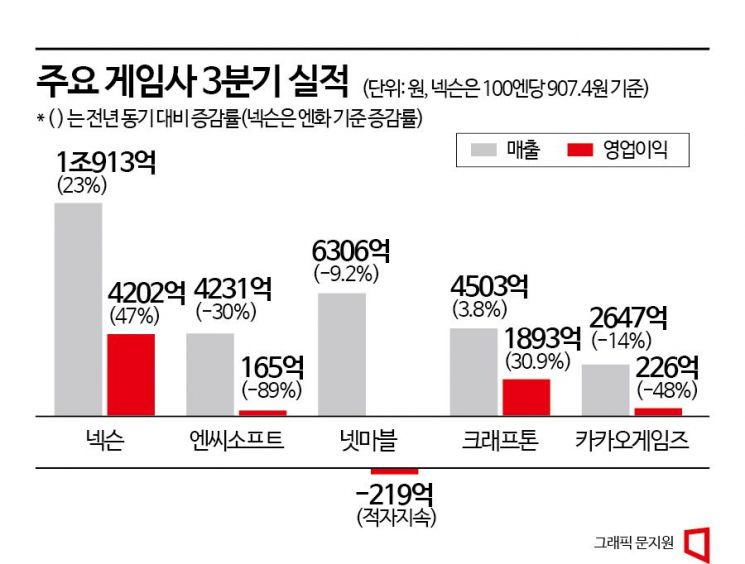

Nexon posted Q3 sales of 120.3 billion yen (1.0913 trillion KRW, based on 100 yen = 907.4 KRW) and operating profit of 46.3 billion yen (420.2 billion KRW). These figures represent 23% and 47% growth respectively compared to the same period last year. This is the best Q3 performance in history. Even when combining the operating profits of the domestic Big 4 game companies (NCSoft, Netmarble, Krafton, Kakao Games), it amounts to only about half of Nexon’s.

Nexon’s dominance is thanks to overseas sales. The domestic gaming market began to slow down after COVID-19. To grow, game companies needed to target overseas markets, and Nexon’s early move to expand abroad proved effective. In fact, last year’s game export value was about 11.51 trillion KRW, accounting for 55% of total sales, with export revenue surpassing the domestic market.

In Q3, Nexon recorded double-digit growth rates across all regions including China, Japan, North America and Europe, and Southeast Asia. Especially, sales in North America and Europe, where ‘Dave the Diver’ received favorable reviews, increased by 78% compared to the same period last year. The China region grew 22% year-on-year, driven by the success of ‘Dungeon & Fighter’ and ‘MapleStory M’.

Krafton Surpasses NCSoft

The sluggishness of NCSoft and Netmarble, which were considered part of the big 3 along with Nexon, continues. NCSoft’s Q3 operating profit fell 89% year-on-year to 16.5 billion KRW. Netmarble recorded an operating loss of 21.9 billion KRW, marking seven consecutive quarters of deficits.

In contrast, Krafton’s progress was remarkable. Krafton posted Q3 sales of 450.3 billion KRW and operating profit of 189.3 billion KRW, representing 3.8% and 30.9% growth respectively compared to the same period last year. Looking at cumulative results through Q3, Krafton has surpassed NCSoft and Netmarble. Unless the two companies achieve a turnaround in Q4, Krafton will rank just behind Nexon.

Krafton’s strong performance stems from overseas markets. ‘PUBG: Battlegrounds’ maintained stable sales, and the resumption of service for ‘Battlegrounds Mobile India’ in India drove results. Krafton’s overseas sales ratio reaches 95%, the highest among domestic game companies.

Domestic game companies plan to rebound their performance by releasing many new titles in overseas markets. NCSoft will target overseas markets with ‘Throne and Liberty (TL)’, scheduled for release next month. TL, which will be released on PC and console versions, will primarily target North America and Europe. At ‘G-STAR 2023’, the international game exhibition opening on the 16th at BEXCO in Busan, many global new titles will also be showcased.

Netmarble is focusing on development for new releases next year. In the first half of next year, it plans to launch six new titles including ‘Arthdal Chronicles: The Three Powers’, ‘Solo Leveling: ARISE’, and ‘Raven 2’. Kakao Games plans to unveil the action RPG ‘Godis Order’ and the cross-platform MMORPG ‘ROM (R.O.M)’, jointly developed by RedLab Games, in the first half of next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)