Representative Profitability Indicator ARPU Continues to Decline

SKT Fails to Recover After Dropping Below 30,000 Won

LGU+ Experiences 8 Consecutive Quarters of Decline

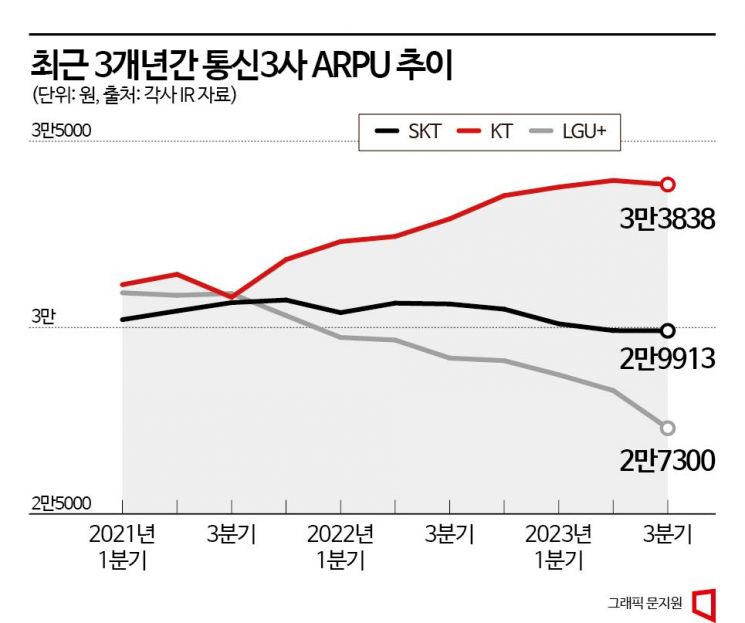

As the combined operating profit of the three major telecom companies surpassed 1 trillion won for the seventh consecutive quarter in the third quarter (totaling 1.0742 trillion won for the three companies), profitability has effectively been declining. This is because the average revenue per user (ARPU), a representative profitability indicator for telecom companies, continues to fall. ARPU is the average monthly communication fee paid by one subscriber.

According to the IR (Investor Relations) materials of the three companies, the third-quarter ARPU was 29,913 won for SK Telecom, 33,838 won for KT, and 27,300 won for LG Uplus. LG Uplus has seen a decline for eight consecutive quarters, and SK Telecom for five consecutive quarters. KT, which is the only company maintaining the 30,000 won level and performing the best in this area, saw its growth trend, which had continued since the second quarter of 2020, break for the first time. It turned to 'negative growth' after 13 quarters.

Since the commercialization of 5G in 2019, it has now entered its fifth year. Compared to the fifth year of LTE commercialization (2014), the ARPU negative growth is even more pronounced. In the third quarter of 2014, SK Telecom had the highest ARPU at 36,417 won, followed by LG Uplus (36,159 won) and KT (34,829 won). Compared to now, nine years later, LG Uplus has decreased by 32.4%, SK Telecom by 21.7%. KT had the smallest ARPU decrease at 2.9%.

In the early days of 5G commercialization, ARPU grew due to high-priced 5G plans. Looking only at 5G subscribers, the average monthly revenue per subscriber is in the 50,000 to 60,000 won range, which is more than 1.5 times that of LTE subscribers. This is also why KT, which has the highest 5G subscriber ratio at 70% among the three companies, ranked first in ARPU. However, as 5G has matured, new subscriptions have slowed. Moreover, with the introduction of the 'mid-tier plan' launched last April starting to be reflected in the results, the downward trend in ARPU has become clear. In particular, SK Telecom recorded an ARPU of 29,920 won in the second quarter, falling below 30,000 won for the first time since its founding. In the third quarter, it again failed to recover to the 30,000 won level and slightly declined.

ARPU for telecom companies is expected to decline further. The government, which has been pressuring for telecom fee reductions since last year, announced measures to ease the telecom fee burden on the 8th. The main points were the introduction of a new 30,000 won-level 5G plan and allowing LTE plans to be used on 5G devices. Both measures are directly linked to a decline in ARPU. Facing a thorny path ahead, telecom companies are focusing on improving profitability through expanding B2B (business-to-business) operations and pioneering new businesses.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)