Jerome Powell, Chair of the U.S. Federal Reserve (Fed), stated on the 9th (local time) that "if additional interest rate hikes are necessary, we will not hesitate." This clearly indicated that it is premature to declare an end to the rate hike cycle, which the market had been anticipating. Following Powell's remarks, stock prices widened their losses and Treasury yields surged.

Powell made these remarks while attending the International Monetary Fund (IMF) conference, saying that he is "not confident that the current monetary policy is sufficiently restrictive" to achieve the inflation stabilization target of 2%. He confirmed that despite the recent two consecutive rate hold decisions, the option to raise rates remains on the Fed's table, stating, "If necessary, we can raise rates further." Earlier, the Fed held rates steady at 5.25-5.5% at the Federal Open Market Committee (FOMC) meeting held on the 1st of this month.

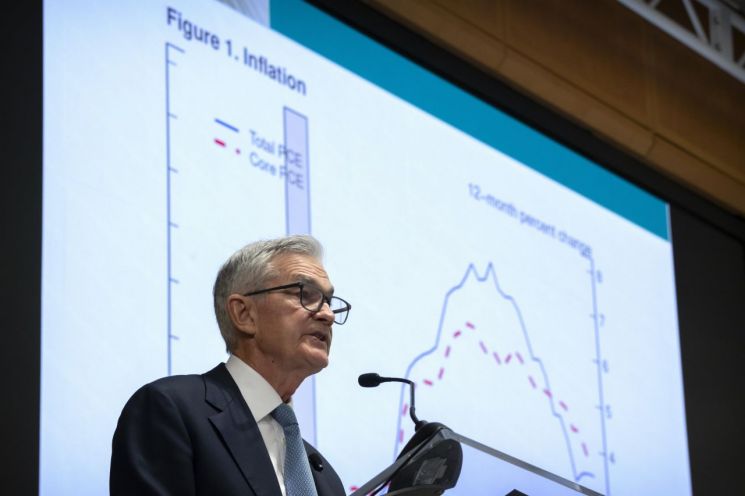

While positively assessing the recently confirmed trend of slowing inflation, Powell warned of the "risk of misjudgment due to several months of solid indicators." The core Personal Consumption Expenditures (PCE) price index, which excludes volatile food and energy prices, has eased from 5.3% in February last year, just before the Fed's rate hike cycle began, to a recent 3.7%. However, he expressed caution, saying, "The fight to restore price stability still has a long way to go," and "We know we cannot guarantee continuous progress toward the 2% target."

In particular, Powell expressed concern that "stronger growth could pose risks by hindering the recovery of labor market supply-demand balance and further progress in reducing inflation." He emphasized, "We will continue to move cautiously," adding, "We can address both the risks of misjudgment and excessive tightening." The next FOMC meeting is scheduled for December 12-13.

The market interpreted Powell's remarks on this day as hawkish (favoring monetary tightening). The S&P 500 index, which had rallied for eight consecutive trading days until the previous day, widened its losses following Powell's comments. Meanwhile, Treasury yields surged. In the New York bond market, the benchmark 10-year U.S. Treasury yield moved around 4.63%, up more than 12 basis points.

Vasiliy Serebriakov, FX strategist at UBS, evaluated, "Powell did not say anything new, but the market took his words somewhat hawkishly." Peter Cardillo, Chief Market Economist at Spartan Capital Securities, said, "(Powell) is again taking a hawkish stance," adding, "Taken together, Powell is telling the market not to get too complacent about the end of rate hikes. This is putting downward pressure on the stock market."

However, some assessments suggest that Powell's failure to provide substantial grounds for additional hikes effectively implies that the rate hike cycle is over. It is explained that his remarks left the "rate hike card" as a safeguard to prevent investors' expectations of an imminent end to rate hikes from leading to a resurgence of inflation. Angelo Manolatos, strategist at Wells Fargo Securities, noted, "The Fed is in the final stage," and said, "At this point, his remarks essentially confirm the end of rate hikes and do not change our view that rate cuts will begin by mid-next year."

According to the CME FedWatch tool at the Chicago Mercantile Exchange (CME), the federal funds futures market currently reflects an over 85% probability of a rate hold. This figure has decreased from the 90% range the previous day. The probability of a baby step hike stood at around 14%, up from about 9% before Powell's remarks were released.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)