Individual Investors Account for 64% of Total Trading Value, Twice That of the US and Japan

Overconfidence, Preference for Lottery-Type Stocks, Short-Term Herd Trading Reflect Irrational Investment Patterns

Temporary Ban on Short Selling Raises Concerns Over Market Concentration and Stock Price Manipulation Side Effects

#1. Samsung Securities analyzed that from March 16 to June 12, 2020, when the COVID-19 pandemic was at its peak, individual investors maintained net buying while foreign investors engaged in net selling. During this period, short selling was banned. Ultimately, the driving force behind the stock market rise during the short selling ban was individual investors. Samsung Securities explained, "During the short selling ban period, selling pressure was observed more than signs of foreign investors' short covering (buying back shorted stocks)."

#2. ▲Overconfidence ▲Disposition effect ▲Lottery-type stock preference ▲Short-term herd trading. These are the results of analyzing the investment patterns of about 200,000 individual investors from March to October 2020, when short selling was banned. The Korea Capital Market Institute explained that irrational investment behaviors were strongly evident among individual investors during this period.

Members of organizations including the Haeng·Uijeong Monitoring Network Central Association held a press conference on the afternoon of the 9th at Gwanghwamun Square in Seoul, urging institutional improvements to prevent illegal short selling. [Image source=Yonhap News]

Members of organizations including the Haeng·Uijeong Monitoring Network Central Association held a press conference on the afternoon of the 9th at Gwanghwamun Square in Seoul, urging institutional improvements to prevent illegal short selling. [Image source=Yonhap News]

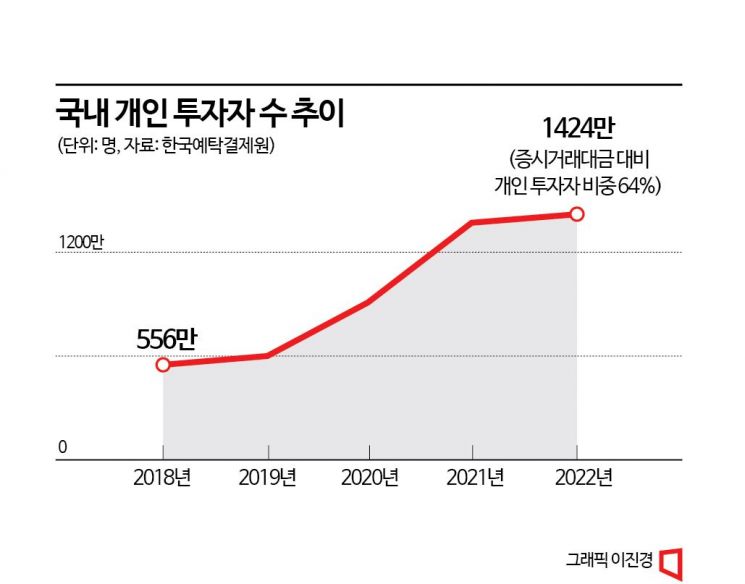

The Era of 14 Million Individual Investors

14.24 million. This is the number of individual investors participating in the domestic stock market as of the end of last year. Before COVID-19, the number was less than 6 million, but the number of stock market investors surged rapidly afterward. According to the Korea Securities Depository on the 10th, individual investors have nearly tripled from 5.02 million to 14.24 million over the past five years. The proportion of individual investors based on total trading volume at the end of last year was 64%, the highest ratio in the global stock market. The average in countries like the United States and Japan is around 30%. A high proportion of individual investors means that individuals are becoming a dominant force in the Korean stock market.

However, experts viewing these stock market changes express concerns. They believe that the high participation of individuals leads to concentration among certain investors and irrational investment behaviors, which reduce market price efficiency. In particular, they warn that the temporary ban on short selling in such an environment could increase market volatility.

However, Jeong Eui-jeong, CEO of the Korea Stock Investment Federation (Hantuyun), argued against concerns about foreign investor withdrawal due to the temporary short selling ban, stating, "Even if some foreign investors exit the domestic stock market, as long as the domestic market rises, the new buying funds from individual investors will increase sufficiently to cover (compensate) for it."

Overconfident Individual Investment Behavior

What experts worry about is the investment behavior of individual investors. The Korea Capital Market Institute evaluated the behavior of individual investors during the COVID-19 period as irrational. They investigated the trading records of 200,000 individual investors from March to October 2020. The Institute analyzed that individual investors were exposed to four behavioral biases: 'overconfidence,' the tendency to overestimate their own information and ability; 'disposition effect,' selling stocks that have risen and holding onto those that have fallen; 'lottery-type stock preference,' a tendency to seek big wins; and 'short-term herd trading,' where many investors trade in the same direction over a short period.

Due to these tendencies, investment returns were low. Their turnover rate reached 1600% annually, but returns did not match the market index. Even in a strong market where the KOSPI rose about 700 points, about 60% of new investors suffered losses. The combined cumulative returns of existing individual investors and high-net-worth individual investors were 18.8%, which was favorable, but the combined cumulative returns of new and small individual investors were only 5.9%. Considering transaction costs (taxes and fees), the returns were 15.0% and -1.2%, respectively, widening the gap further.

A representative from the Korea Capital Market Institute explained, "The poor performance of new and small investors is related to frequent trading, which is associated with overconfidence," adding, "Because stock investment is perceived as a kind of jackpot opportunity, they excessively traded stocks with lottery-like return characteristics."

Financial Services Commission Chairman Kim Ju-hyun is responding to lawmakers' questions at the full meeting of the Political Affairs Committee held at the National Assembly on the 9th.

Financial Services Commission Chairman Kim Ju-hyun is responding to lawmakers' questions at the full meeting of the Political Affairs Committee held at the National Assembly on the 9th. [Image source=Yonhap News]

Bubble Warning Due to Temporary Short Selling Ban

The tendency to exaggerate confidence or seek quick gains ultimately causes bubbles in the market and increases volatility. In fact, since the declaration of the COVID-19 endemic, the domestic stock market has been in a correction phase for two years. The market has been shaken by various external factors such as economic downturn and interest rate hikes, causing liquidity bubbles to burst.

This is why there are concerns that the temporary short selling ban in a stock market environment led by individual investors could further increase volatility. Short selling plays a positive role in preventing stock price manipulation and excessive bubbles. With the temporary ban on short selling, market volatility is inevitably increased, and if individual investors exhibit the same investment behaviors as during the COVID-19 pandemic, the market situation could worsen.

An analyst from a securities firm, who requested anonymity, said, "The impact of the financial authorities' temporary short selling ban, which removed a tool to prevent market bubbles, could be greater than expected," adding, "Considering the unique characteristics of the Korean stock market centered on individual investors, efforts are needed to create an environment that does not trigger such behaviors through education on behavioral biases for investors to advance the market."

A representative from the Korea Capital Market Institute pointed out, "Individual investors are exposed to various behavioral biases leading to irrational decisions, which negatively affect investment performance," and warned, "If poor investment performance accumulates due to behavioral biases, it will be difficult for a market based on individual investors to be maintained in a good direction in the long term."

Professor Lee Jeong-hwan of Hanyang University’s College of Economics and Finance also expressed concerns that if institutions and foreign investors do not increase their stakes and individual investors enter heavily due to the temporary short selling ban, volatility could increase. There are also many worries that the number of targets for stock price manipulation will increase, causing damage to fall entirely on individual investors. In fact, during the CFD (Contract for Difference) incident in April, most of the stocks manipulated by the La Deok-yeon group were stocks under short selling bans.

Enhancing the Sustainability of Individual Investment Performance

To steer the Korean stock market in the right direction, voices are calling for measures to improve the sustainability of individual investors' investment performance, considering their already high participation and unique characteristics. These include ▲improving the performance and cost efficiency of various indirect investment vehicles ▲expanding services for efficient portfolio management for individual investors ▲designing services that can improve inefficient investment behaviors of individual investors.

A representative from the Korea Capital Market Institute explained, "When information about past performance and warnings about behavioral biases are provided, the tendency toward overconfidence decreases," adding, "It can be considered part of investor protection duties for financial investment companies to identify and warn about individual investors' vulnerabilities due to behavioral biases and to create a direct investment environment that minimizes the impact of these biases."

Market experts unanimously agree that considering the positive functions of short selling, its resumption is necessary. On the 9th, Financial Services Commission Chairman Kim Joo-hyun, attending the National Assembly's Finance and Economy Committee plenary session, said, "Short selling has its functional aspects, so we took a cautious stance," and added, "Recently, with unstable domestic and international situations and the war escalating, the Financial Supervisory Service monitored short selling and found serious concerns, leading to the ban."

The Financial Services Commission had been aiming for a full resumption of short selling, considering its positive functions. This is why the recent temporary short selling ban is seen as unusual in the market. Kim Jung-yoon, a researcher at Daishin Securities, diagnosed, "Looking at the overall trend since 2000, the current index is not at a major crisis level but rather a common price correction phase," adding, "The temporary short selling ban during a non-major global crisis period can be considered unusual."

A representative from the Korea Capital Market Institute advised, "Contrary to individual investors' negative perceptions, short selling contributes to price discovery and liquidity provision," and suggested, "It is necessary to operate short selling regulations in a way that maintains its functions while minimizing side effects."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)