523.5 Billion KRW Inflow from Equity Restructuring Eases Financial Burden

Interest Expense Reduction and New Releases Expected to Turn Profit Next Year

Netmarble has disposed of a portion of its shares in HYBE, which it acquired in 2018. Netmarble has been facing deteriorating financial conditions due to poor performance of new titles and consecutive mergers and acquisitions (M&A). This share sale is expected to improve its financial structure.

The HYBE shares sold by Netmarble amount to 2.5 million shares (disposal amount of 523.5 billion KRW). The price per share was 209,400 KRW. This price represents about an 8% discount compared to HYBE’s closing price of 227,500 KRW on the 6th, when the block deal was announced. Even after the block deal, Netmarble retains 5,038,813 shares (12.08%) of HYBE, maintaining its position as the second-largest shareholder.

Netmarble became HYBE’s second-largest shareholder in April 2018. At that time, Netmarble invested 201.4 billion KRW in HYBE, acquiring 25.71% (445,882 shares) of the total shares. The acquisition was aimed at strategic investment to enhance business synergy effects. Subsequently, the shareholding was diluted through IPOs and rights offerings.

By acquiring shares in HYBE, Netmarble expected to generate synergy effects across various fields. The company stated at the time that "this investment aims to expand business synergy effects between Netmarble, which is increasing its influence in the global game and music markets, and Big Hit (now HYBE)."

However, the synergy effects did not meet expectations. BTS World, officially launched in June 2019, is scheduled to end service on the 26th of next month. Additionally, 'BTS Universe Story,' released in 2020, ceased service last September. Furthermore, development of 'BTS Dream: TinyTAN House,' which was being developed by Netmarble’s subsidiary Netmarble Neo, was also halted.

Although business effects were limited, the investment profits were substantial. The value of HYBE shares purchased for 201.4 billion KRW increased to 1.7133 trillion KRW based on the closing price on the 6th. Even after partially selling shares through the block deal, the remaining value amounts to 1.1898 trillion KRW.

Netmarble’s partial disposal of HYBE shares is interpreted as an effort to improve its worsening financial structure. Netmarble stated the purpose of the share disposal as "securing liquidity through the sale of held shares." Netmarble has grown through domestic and international M&A and investments, including notable acquisitions such as NCSoft and Jam City in 2015, Kabam in 2017, Coway in 2020, and SpinX in 2021. However, as the company expanded, its financial burden also increased.

In particular, the acquisition of the U.S. social casino game company SpinX for about 2.5 trillion KRW significantly increased borrowings. Short-term borrowings, which were 3.9 billion KRW in 2017, rose to 807.5 billion KRW in 2020 and 1.6192 trillion KRW in the first half of this year. Including long-term borrowings and current portion of long-term borrowings, the total reaches about 2 trillion KRW.

Lee Seonhwa, a researcher at KB Securities, said, "Netmarble is a company that has steadily grown in scale through mergers and acquisitions. While it has succeeded in external growth through consecutive big deals, the annual interest expense of about 130 billion KRW is a burden." She added, "Considering the contingent liabilities of about 330 billion KRW related to the SpinX acquisition in 2021, interest expenses are expected to increase further."

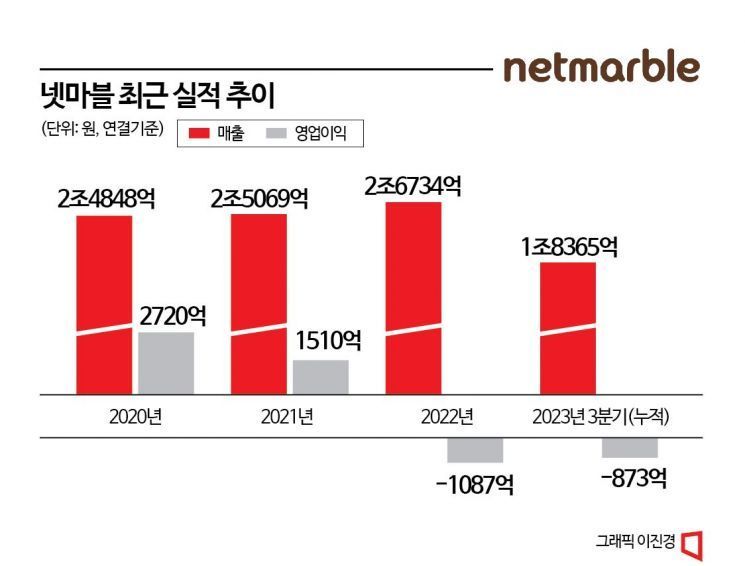

Poor performance has also been a burden. Netmarble has recorded losses for seven consecutive quarters from Q1 last year to Q3 this year. In Q3 this year, sales were 630.6 billion KRW, with an operating loss of 21.9 billion KRW. Sales decreased by 9.2% compared to the same period last year, and losses continued. Due to consecutive losses, cash and cash equivalents, which reached 1.9078 trillion KRW in 2017, decreased to 542 billion KRW in the first half of this year.

However, from Q4, the company’s situation is expected to improve with performance recovery and partial repayment of borrowings through the sale of HYBE shares. Netmarble explained in a conference call on the 9th, "Since there are no new titles in Q4, marketing expenses will decrease compared to Q3. The performance of previous new titles is expected to be fully reflected, so we anticipate a return to profitability."

A game analyst at a securities firm said, "Because Netmarble has so much debt, it has been reflected as non-operating expenses. Reducing the debt burden through share liquidity will definitely have a positive impact on the company." Another securities firm analyst added, "After acquiring SpinX in 2021, borrowings increased significantly, making interest expenses a big burden. This reduction will be positive as it also affected non-operating income."

Moreover, next year, a return to profitability on an annual basis is expected with the release of various new titles. Netmarble plans to launch seven new titles, including the global release of 'Paragon: The Overprime,' currently in early access, 'Arthdal Chronicles: The Three Powers,' 'Solo Leveling: ARISE,' 'Raven 2,' 'King Arthur: Legend Rise,' 'Modoo Marble 2 (Korea),' and one title for the Chinese market ('The Second Country: Cross Worlds'). According to FnGuide, securities firms forecast Netmarble’s sales and operating profit for next year to be 2.979 trillion KRW and 90.1 billion KRW, respectively. This represents a 14.48% increase in sales compared to this year and a return to operating profit.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)