Increase of 500,000 in 10 Months

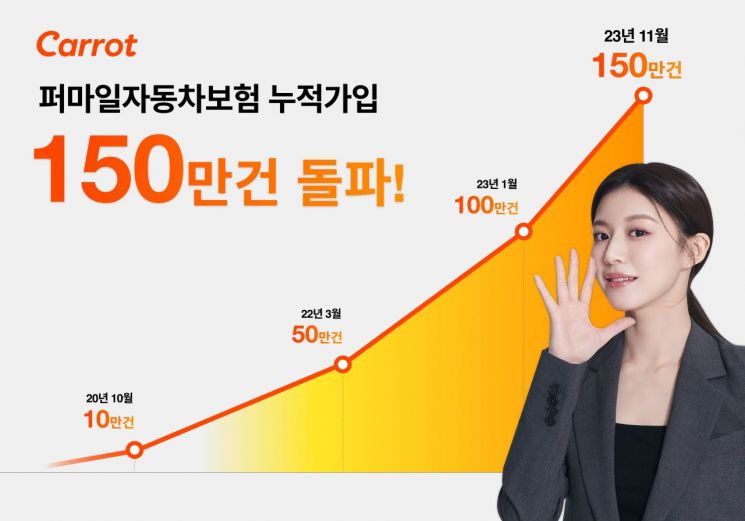

Carrot General Insurance, the largest digital non-life insurer in Korea, announced that its 'Pay-Per-Mile Auto Insurance' has surpassed 1.5 million cumulative subscriptions.

Carrot General Insurance revealed on the 9th that it achieved this milestone 3 years and 8 months after launching the Pay-Per-Mile Auto Insurance in February 2020. Considering that it took 2 years and 3 years respectively to reach 500,000 and 1 million cumulative subscriptions since its launch, the subscription rate is increasing rapidly.

Unlike traditional auto insurance where premiums are paid annually regardless of mileage, the Pay-Per-Mile Auto Insurance allows customers to pay monthly in arrears based on the distance they actually drive, which seems to have gained favorable responses from customers who drive relatively less.

In fact, most customers subscribed to the monthly settlement type of Pay-Per-Mile Auto Insurance drove around 7,000 km during the one-year insurance contract period.

The renewal rate was also significant. In August and October, the renewal rate of Pay-Per-Mile Auto Insurance recorded an all-time high of 91.3%.

Yang Un-mo, Head of Mobility Division at Carrot General Insurance, stated, "We plan to continue innovation by launching innovative insurance products based on plug data next year, leveraging the growth momentum of Pay-Per-Mile Auto Insurance." He added, "We will continuously explore ways to create various added values using driving data and strive for growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)