Krafton, No.1 in Game Industry Market Cap, Posts 'Surprise Earnings'

Wemade Turns Profitable, Boosting Hopes for Game Stocks

Short Covering in Short Selling Improves Supply and Demand

Upward revisions of earnings forecasts for gaming stocks, which had been sluggish for nearly two years, are continuing. This is largely due to Krafton, the gaming company with the largest market capitalization listed on the domestic stock market, releasing third-quarter results that exceeded market expectations. Wemade also succeeded in turning a profit, increasing overall growth expectations for the gaming industry. With the added effect of the regulatory authorities' temporary ban on short selling, attention has been drawn to gaming stocks.

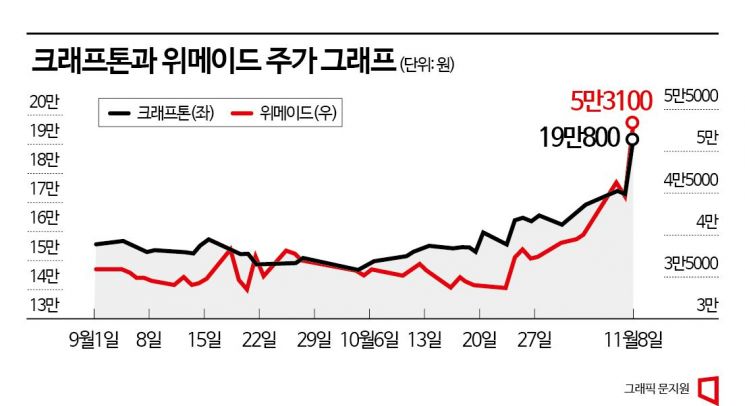

According to the financial investment industry, on the 8th, Krafton's stock price on the KOSPI market closed at 190,800 KRW, up 10.61%. Its market capitalization increased by 880 billion KRW, from 8.35 trillion KRW to 9.23 trillion KRW. On that day, Krafton was the most purchased stock by foreign and institutional investors in the domestic stock market, with net purchases of 42 billion KRW and 18 billion KRW respectively.

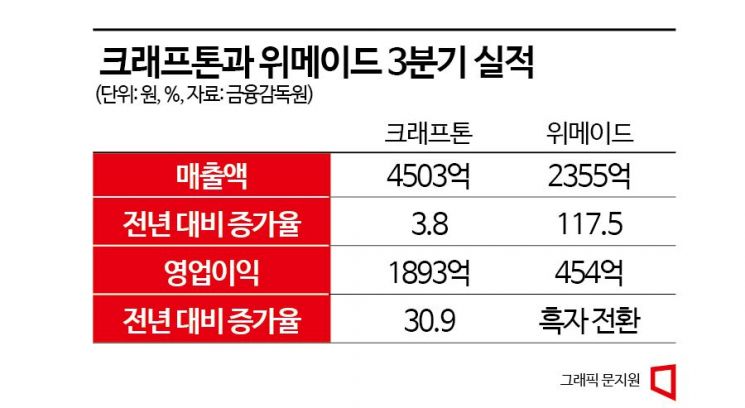

Krafton recorded consolidated sales of 450.3 billion KRW and operating profit of 189.3 billion KRW in the third quarter of this year. These figures represent increases of 3.8% and 30.9% respectively compared to the same period last year. The operating profit exceeded the market expectation of 145.5 billion KRW.

Nam Hyo-ji, a researcher at SK Securities, said, "Sales of 'Battlegrounds Mobile India (BGMI)' recovered faster than expected," and added, "Considering the new mobile titles to be released in the first half of next year, Krafton's mobile segment sales will continue to grow." He further stated, "If the recovery of mobile sales in China is confirmed, overall performance is expected to grow comfortably."

Krafton plans to release five new titles next year, including 'Dark and Darker Mobile' and 'Project inZOI.' Oh Dong-hwan, a researcher at Samsung Securities, analyzed, "Efforts to expand new titles through investments in developer equity and strengthening in-house development studios will bear fruit in earnest from 2025," adding, "In a situation where competing gaming companies' profits are decreasing, Krafton's stable profit-generating ability is a factor that adds premium to its stock price."

Wemade also achieved strong third-quarter results with the success of the Chinese license contract for 'Legend of Mir' and the online game 'Night Crow.' Wemade recorded an operating profit of 45.4 billion KRW on a consolidated basis in the third quarter of this year, successfully turning a profit compared to the same period last year. Sales increased by 117.5% to 235.5 billion KRW. Wemade's stock price rose nearly 20% the previous day.

Jang Hyun-guk, CEO of Wemade, held an investor briefing that day and said, "Sales grew from 335 billion KRW in 2021 to 463.5 billion KRW in 2022," adding, "This year, sales reached 488.7 billion KRW by the third quarter, already surpassing last year's total sales," and predicted, "I believe this growth will continue through next year."

Investors, having confirmed strong third-quarter results, increased their holdings in gaming stocks expecting growth to continue next year. This is why Com2uS Holdings, Neowiz Holdings, Neptune, Netmarble, and NCSoft also showed simultaneous strength.

The regulatory authorities' temporary ban on short selling, implemented from the 6th, also influenced the rebound in the gaming sector. Gaming stocks had been neglected in the domestic stock market for two years. Looking at the leading stock Krafton alone, its price rose to 580,000 KRW in November 2021 but fell below 150,000 KRW last month. NCSoft, which became a 'king stock' by surpassing 1 million KRW in 2021, also dropped to 212,500 KRW last month. Kang Seok-oh, a researcher at Shinhan Investment Corp., explained, "Most domestic gaming companies focused only on specific genres and failed to properly prepare for overseas expansion," adding, "In a situation where overseas performance was desperately needed, they all experienced bitter setbacks."

While the growth potential of the domestic gaming market slowed, overseas results did not materialize. This is the background for the increased proportion of short selling. Im Hee-seok, a researcher at Mirae Asset Securities, analyzed, "The proportion of short selling trading volume for the top six gaming companies by market capitalization increased from 6.3% in 2021 to 12.4% in 2022 and 13.5% in 2023," adding, "The average short selling proportion over the past month was 15%, about three times higher than the overall market average of 5%."

Since the short selling proportion was large, the temporary ban on short selling has the potential to improve investor sentiment. Moreover, as the perception that earnings have bottomed out spreads, short covering (repurchasing stocks to repay short sales) volumes are flowing in. Short covering refers to short sellers buying stocks to return the borrowed shares they sold. On the 3rd, Krafton's short selling trading volume exceeded 2 billion KRW but dropped below 200 million KRW on the 6th. Looking at the loan balance, repayments are also proceeding rapidly. Researcher Im Hee-seok predicted, "From next year onward, the gaming industry will enter a phase of structural improvement," and added, "Even if short selling resumes, the concentration of short selling at past levels will not occur."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)