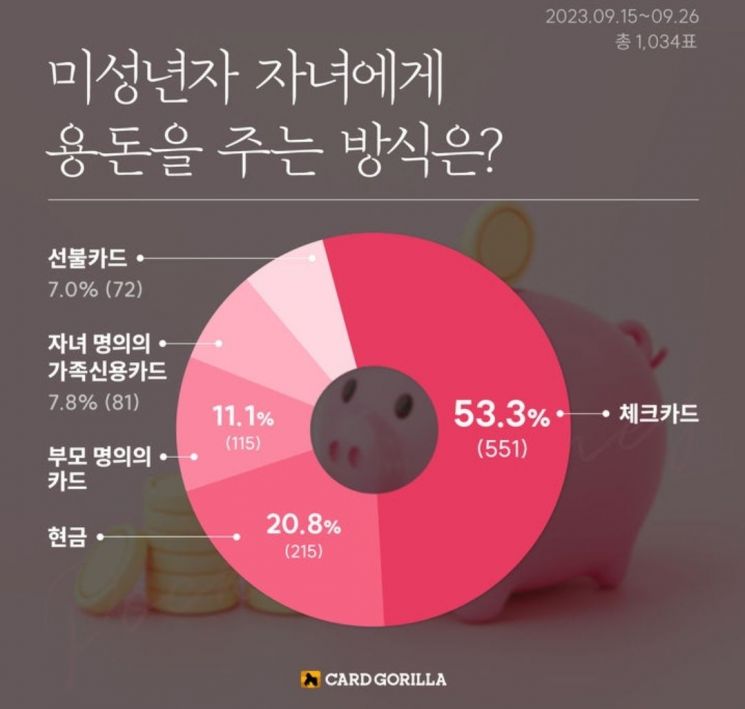

Card Gorilla Survey of 1,034 Participants

Higher Issuance Convenience Leads to Preference for Check Cards

One out of two parents uses a 'check card' when giving allowance to their minor children.

On the 4th, Korea's largest credit card platform, Card Gorilla, announced the results of a survey titled "How do you give allowance to minor children?" The survey was conducted over about two weeks from September 15 to 26 on the Card Gorilla website, with a total of 1,034 participants.

According to the survey, more than half of the respondents (53.3%, 551 votes) said they give allowance to their minor children using a 'check card,' making it the most common response. The second most common method was 'cash' (20.8%, 215 votes), followed by 'parent's name card' (11.1%, 115 votes). The 'family credit card in the child's name,' designated as an innovative financial service in 2021, accounted for 7.8% (81 votes), and 'prepaid cards' accounted for 7.0% (72 votes).

Credit cards are generally issued only to adults, but since 2021, minors aged 12 and older have been able to own credit cards in their own names. This was made possible by the designation of the 'family card service for minor children' as an innovative financial service, aimed at improving the illegal practice of credit card transfer and lending and enhancing the convenience of financial transactions for minors. Currently, cards using this service include 'Shinhan Card My TeenS' and 'Samsung iD POCKET Card.'

For minor credit cards, parents can set a monthly card limit of up to 500,000 KRW, and payments at youth-harmful businesses are restricted. In April, the Financial Services Commission revised the innovative financial service designation to remove the single transaction limit and expand the types of businesses where the card can be used. Additionally, in June, Woori Card and Hyundai Card were also designated for this service, which is expected to expand the credit card market for minors in the future.

Go Seung-hoon, CEO of Card Gorilla, said, "Although check cards, which are easier to issue, currently dominate as the allowance payment method for minors, the issuance of credit cards for minors is expected to increase the number of credit card users." He added, "For card companies, this is a great opportunity to secure loyal future customers, so they will continue marketing targeting the so-called 'Jalpa Generation (Z·Alpha Generation, born from the mid-1990s to early 2010s)' by launching exclusive services for minors and expanding character plates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)