'Trillion-Won Scale' Large IPOs Missing... Only Nexteel and Doosan Robotics Listed on KOSPI

EcoPro Materials Scheduled for Listing on 17th Expected to Set KOSPI's Largest IPO Record This Year

High Interest Rate Environment Negatively Impacts Market... Small and Mid-Cap KOSDAQ IPOs Perform Relatively Well

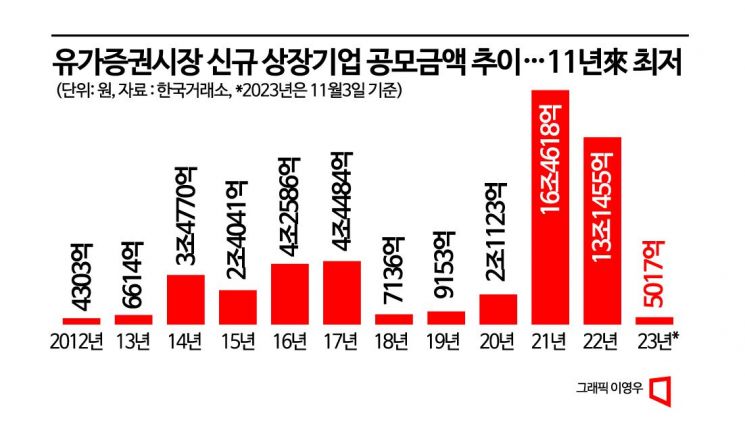

This year, the high interest rate trend has continued throughout the year, causing the initial public offering (IPO) market to struggle to regain momentum. Unlike previous years, no companies have attempted large-scale offerings in the 'trillion-won' range, resulting in the total annual public offering amount hitting its lowest level in 11 years since 2012.

According to the Korea Exchange, the total public offering amount for newly listed companies on the KOSPI market this year was 501.7 billion won (from early January to November 3). Compared to last year's total public offering amount of 13.1455 trillion won, this represents a sharp 96% decline. Excluding re-listings or transfers, only two new companies debuted on the KOSPI this year: Nextil (listed on August 21) and Doosan Robotics (listed on October 5). Among them, Doosan Robotics succeeded in raising 421.2 billion won, marking the larger scale of the two.

Last year, LG Energy Solution succeeded in the largest-ever public offering of 12.75 trillion won at the beginning of the year. During the peak stock market boom in 2021, six companies succeeded in trillion-won scale offerings: Krafton (4.3098 trillion won), KakaoBank (2.5525 trillion won), SK IE Technology (2.2459 trillion won), KakaoPay (1.53 trillion won), SK Bioscience (1.4917 trillion won), and Hyundai Heavy Industries (1.08 trillion won). After only one company succeeded last year, there were none this year.

Even compared to past annual public offering amounts, the KOSPI public offering scale recorded so far is the lowest since 2012 (430.3 billion won). However, if Ecopro Materials, which conducted demand forecasting aiming for listing on the 17th, succeeds in a public offering of 524 billion won, the annual total is expected to barely exceed 1 trillion won. Park Sera, a senior researcher at Daishin Securities, said, "The number of IPO companies this year is expected to be similar to last year, but the public offering scale is expected to remain at the 2019 level."

The cooling of the IPO market is due to the fact that early in the year, expectations for an interest rate cut within the year were alive, but the tightening mode lasted longer than expected, causing U.S. Treasury yields to rise sharply and funds to rapidly flow into safe assets. Unexpected external factors such as the Russia-Ukraine war and the conflict between Israel and the Palestinian militant group Hamas also acted as negative factors. Companies that had raised expectations but withdrew their listing plans include K Bank, Oasis, Seoul Guarantee Insurance, and Hyundai Engineering.

Compared to the struggles of large-cap stocks in the IPO market, the KOSDAQ market, which is mainly composed of small and mid-cap stocks, performed relatively well. The total public offering amount in the KOSDAQ market this year was 2.108 trillion won. Although it has been declining for two consecutive years following 2021 (3.581 trillion won) and 2022 (2.969 trillion won), the decline was less severe compared to the KOSPI.

Another notable point is that this year, the subscription competition rate among general investors was generally higher than that of institutional demand forecasts on a monthly basis. Park Jong-sun, a researcher at Eugene Investment & Securities, analyzed, "Institutions have responded conservatively to the IPO market, showing low competition rates, while general investors, unable to find suitable investment directions, appear to be responding more aggressively to the IPO market compared to institutions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)