Next Year's KOSPI Outlook: 10 Securities Firms' Average Lower Bound 2237, Upper Bound 2760

Expecting N-Shaped High-Low Index Fluctuations... Focus on Interest Rate Cut Path

Leading Stocks Expected to Be Semiconductors, Pharmaceutical & Bio Stocks... Foreign Investor Demand Strengthening Anticipated

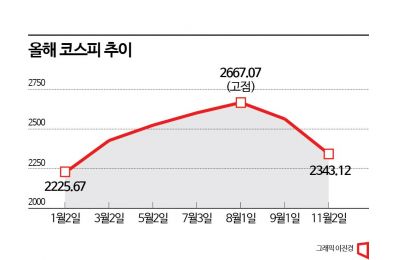

As the year-end approaches, interest in next year's stock market trends is growing. In particular, with the KOSPI recently declining and almost giving back this year's gains to return to the level at the beginning of the year, whether it can resume an upward trend next year has become important. There are numerous factors that could negatively impact the stock market next year, making it difficult to be optimistic about a bull market. The securities industry expects the KOSPI to move between 2200 and 2800 points next year.

According to the Korea Exchange, the KOSPI has risen 4.77% so far this year. However, compared to the peak in August, it has fallen 12.15%. The KOSPI, which was close to the 2700 level in August, has dropped to the 2300 range, returning to the level seen at the beginning of the year.

Recently, securities firms have been releasing their stock market outlooks for next year one after another. The lower average of the expected KOSPI bands presented by 10 securities firms was 2237, and the upper average was 2760. Overall, it is expected to move between 2200 and 2800 points.

The KOSPI is forecasted to show an N-shaped pattern next year. Kim Yong-gu, a researcher at Samsung Securities, said, "The expected KOSPI band for next year is between 2200 and 2750 points, and a stock price trend above neutral is expected as the market recovers from the tightening-induced panic at the end of this year." He added, "Quarterly, the index is expected to fluctuate in an N-shaped pattern with highs and lows: 1Q at 2200?2600, 2Q at 2350?2750, 3Q at 2250?2650, and 4Q at 2300?2700."

Lee Jae-man, a researcher at Hana Securities, also forecasted an N-shaped index trend next year. He said, "In the first quarter, the index is expected to decline due to credit risks from the aftereffects of high interest rates and weak U.S. consumer demand. Until the end of the second quarter, the index will rise based on expectations of expansionary policies, improvement in the Chinese economy, and improved profitability of domestic companies. From late 2Q to early 3Q, the index will fall reflecting concerns over a Fed interest rate cut and reduced aggregate demand. From mid-3Q to the end of 4Q, the index will rise as lower market interest rates stabilize and corporate profit growth is reflected in expected returns."

Since a high-low pattern is expected, it seems advantageous to increase stock holdings in the first half of the year. Kim Dae-jun, a researcher at Korea Investment & Securities, explained, "The KOSPI is expected to rise in the first half and remain sideways in the second half, so it is advantageous to increase holdings in the first half from an investment perspective." He added, "In the second half, due to the lack of upward momentum, the index is likely to move sideways, requiring trading focused on individual stocks."

Uncertainty over interest rate cuts and the U.S. presidential election are expected to increase volatility at year-end and early next year. Han Ji-young, a researcher at Kiwoom Securities, forecasted, "Uncertainty about the timing of Fed rate cuts in the first quarter and political landscape changes after the U.S. presidential election in the fourth quarter, including policy uncertainties related to green energy and trade, will create stock price volatility at the beginning and end of the year."

The U.S. interest rate path, which has influenced the stock market throughout this year, is expected to remain a volatility factor next year. Although the Fed's interest rate cuts within 2024 are considered a given, market participants have differing views on the timing due to concerns over prolonged high interest rates. Han Ji-young said, "It is expected that the Fed will cut rates at the June or July Federal Open Market Committee (FOMC) meeting, but during the first quarter, as key economic indicators slow and inflation trends are confirmed, debates over the timing of Fed rate cuts will spread." She added, "During this process, the stock market will experience a phase of increased volatility."

From a supply and demand perspective, the influence of individual investors is expected to weaken, while foreign investors' supply and demand will strengthen. Lee Jae-sun, a researcher at Hyundai Motor Securities, analyzed, "The growing possibility of U.S. insurance-related rate cuts in the second half and the resulting weakening of the dollar combination may induce stronger foreign investor demand centered on large-cap KOSPI stocks." He added, "Foreign investors typically showed a net buying advantage of about 10 to 20 trillion won during phases of domestic export recovery." He further noted, "If excess savings decrease and real wage growth slows compared to 2023, the influence of individual investors, who have led the market, may somewhat weaken."

Labor Gil, a researcher at Shinhan Investment Corp., said, "With the share of individual and institutional investors gradually decreasing, foreign investors are likely to become the key supply and demand players next year." He explained, "From a full economic cycle perspective, the weak dollar factor is dominant, and as the gap between manufacturing and service sectors narrows, foreign investors are expected to prefer markets outside the U.S."

Leading sectors next year are expected to include semiconductors and pharmaceutical/biotech stocks. Researcher Lee Jae-man said, "The conditions for leading sectors next year are a reduction in debt ratios and improvement in operating profit margins. Since real interest rates are likely to remain high for a considerable period, it is necessary to increase the proportion of sectors with free cash flow (FCF) growth rates higher than net profit growth rates." He added, "Semiconductors, pharmaceuticals/biotech, chemicals, software, IT hardware, and energy are expected to be leading sectors."

Researcher Kim Dae-jun said, "In the first half, attention should be paid to the semiconductor and shipbuilding sectors, which share the commonality of having solid profits that can withstand adverse economic environments." He continued, "In the second half, focus will be on pharmaceuticals/biotech and refining stocks. The mere possibility of an improved high-interest-rate environment is positive for pharmaceutical/biotech investment, and large pharmaceutical/biotech companies have positive catalysts scheduled for the second half." He added, "For refining, cracks in the green energy trend and fossil energy supply shortages could drive strong oil prices and refining margins. Additionally, as the economy recovers toward the second half, increased crude oil demand is also positive."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)