Public Companies' Treasury Stock Acquisition and Disposal Scale Increased by About 30% Compared to Same Period Last Year

Cases Showing Stock Price Boost Effect as of End of October Accounted for Only 38%

In Korea, Stock Cancellation Is Needed for Positive Stock Price Impact... Disclosure System Also Needs Improvement

So far this year, the scale of listed companies' treasury stock acquisitions and disposals has approached 7.7 trillion won. This represents an approximately 30% increase compared to the same period last year. Despite the overall sluggish stock market, listed companies have actively pursued shareholder-friendly policies. However, the effect on boosting stock prices fell short of expectations.

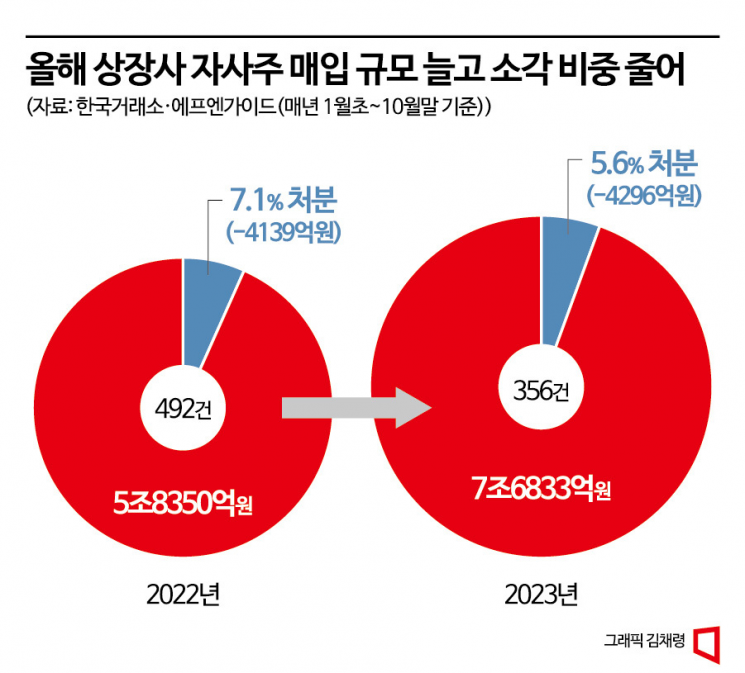

According to the Korea Exchange and financial information provider FnGuide on the 3rd, from the beginning of the year until the end of last month, there were a total of 356 disclosures of treasury stock acquisitions and disposals (144 on KOSPI, 211 on KOSDAQ), with a total reported amount of 7.6833 trillion won. Compared to the same period last year (January 3 to October 31, 2022, 492 cases, 5.835 trillion won), the number of cases decreased, but the scale increased by about 30%.

The listed company with the largest treasury stock purchase scale this year was Celltrion. So far this year, it has acquired or disposed of treasury stock worth a total of 666.5 billion won over six occasions. Celltrion Healthcare also announced plans to purchase treasury stock worth 265 billion won, bringing the combined total of the two companies to 931.5 billion won. On the 23rd, when the merger plan between Celltrion and Celltrion Healthcare was approved, they announced a treasury stock purchase plan worth 500 billion won. They also plan to retire the shares later. This is a measure taken by Celltrion Chairman Seo Jung-jin to defend the exercise price of the stock purchase rights while promoting the merger of the two companies. Other companies with large treasury stock purchases include Samyoung ENC (526.3 billion won), Miwon Sangsa (408.5 billion won), and Wysiwyg Studios (310 billion won), in that order.

However, contrary to expectations, the effect of boosting stock prices by listed companies engaging in treasury stock acquisitions and disposals was not significant. Among the 356 treasury stock-related disclosures this year, based on the closing price on the 31st of last month, in 220 cases (62%), the stock price actually fell. Analyzing the stock price fluctuation rate for 243 cases where three months had passed since the treasury stock acquisition disclosure date, about 50% (122 cases) showed a decline in stock price. Even among the 146 cases where acquisition or disposal had already been completed, 57% (83 cases) experienced a downward trend in stock price. Generally, acquiring or disposing of treasury stock reduces the number of shares circulating in the market, which acts as a positive factor for stock prices, but due to the sluggish stock market, this effect was not fully realized.

The situation was not much different last year. Among 492 treasury stock acquisition and disposal disclosures from January to October last year, 429 cases were completed, and analyzing the fluctuation rate based on the disclosure date and completion date showed that in 57% (245 cases) of cases, the stock price fell.

There are also criticisms that the reason for the diminished effect of treasury stock purchases is that they are limited to 'simple acquisitions.' In fact, although the total scale of treasury stock purchases increased by 30% compared to last year, the proportion of disposals (retirements) actually decreased. Last year, treasury stock retirements amounted to 413.9 billion won, accounting for 7.1% of the total treasury stock purchase scale, but this year it was only 429.6 billion won, about 5.6%. Kim Dong-young, a researcher at Samsung Securities, said, "In the U.S., stock prices rise solely from treasury stock purchases, whereas in Korea, stock prices tend to rise only after the retirement stage following the purchase." He added, "For treasury stock repurchases to become an important shareholder return policy, efforts are needed to improve practices such as the easy resale (disposal) of repurchased treasury stock for major shareholders or management." He further noted, "There is also the issue of market capitalization being treated as if treasury stock is a tangible asset. Institutional reforms, such as changing the market capitalization basis to the product of the number of circulating shares and stock price as in the U.S., could be one way to improve the treasury stock system."

Another reason why clear effects of treasury stock purchases are not found is criticism that the effectiveness of disclosures is low. Kang So-hyun, a research fellow at the Korea Capital Market Institute, said, "There are many cases where insiders continue to sell shares despite companies' treasury stock acquisition disclosures, making it difficult to trust corporate disclosures." She emphasized, "To provide investors with clear information on treasury stock acquisitions, it is necessary to enhance the effectiveness of disclosures, which are currently nominal." She added, "Disclosure requirements should be strengthened so that detailed explanations are provided regarding the specific purpose or basis for judgment of treasury stock acquisitions, criteria and procedures for determining acquisition scale, trust contracts, other acquisition disclosure statuses, and their impacts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)