Uncertainty in LG Household & Health Care's Performance Grows Due to Weak Chinese Market

Amorepacific Acquires Stake in COSRX... Effect of Increased Non-China Sales

There are diverging evaluations in the securities industry regarding Amorepacific and LG Household & Health Care, the two giants in the cosmetics sector. While LG Household & Health Care is assessed to face increased performance uncertainties due to sluggishness in the Chinese market, Amorepacific is analyzed to have found new growth drivers in regions excluding China. For these reasons, securities firms are raising the target price for Amorepacific, whereas the target prices for LG Household & Health Care are being lowered one after another.

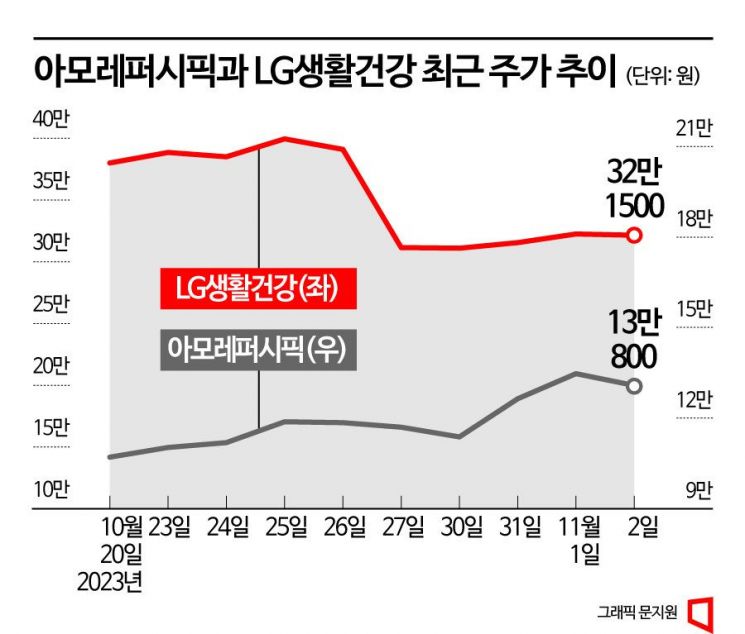

Amorepacific's closing price rose continuously after recording 107,100 KRW on the 20th of last month, reaching 130,800 KRW on the 2nd. The increase rate during this period was 22.13%. In contrast, LG Household & Health Care's price fell 15.39%, from 380,000 KRW to 321,500 KRW over the same period.

The third-quarter earnings of Amorepacific and LG Household & Health Care were similar, as both companies fell short of market expectations. Amorepacific posted consolidated third-quarter sales of 888.8 billion KRW and operating profit of 17.3 billion KRW, down 5% and 8% respectively from the same period last year. LG Household & Health Care recorded sales of 1.7462 trillion KRW and operating profit of 128.5 billion KRW, decreasing 7% and 32% year-on-year. The cosmetics division's sales were 670.2 billion KRW, and operating profit was 8 billion KRW, down 15% and 88% respectively.

However, the securities industry's reactions to the poor performance differ. Following Amorepacific's earnings announcement on the 31st of last month, 12 securities firms including Korea Investment & Securities and KB Securities published reports by the 1st. Among them, 10 raised their target prices. After LG Household & Health Care's earnings announcement on the 26th of last month, a total of 10 securities firms released reports. Nine of them lowered their target prices, and among these, six downgraded their investment opinions to neutral or Marketperform.

The differing views on the two companies stem from contrasting future outlooks. The securities industry expects LG Household & Health Care's cosmetics sector to remain sluggish for some time. Eun-kyung Park, a researcher at Samsung Securities, analyzed, "Currently, there is a global preference for cost-effective cosmetics, including in China, which is expected to continue for a while. Even with the renewal of the high-end brand 'The History of Whoo,' which accounts for more than 50% of cosmetics sales, and increased marketing investments, it is difficult to expect short-term results."

Researcher Eun-jung Park of Hana Securities also explained, "In the fourth quarter, cosmetics profits are expected to plunge due to expanded marketing investments in China and offline restructuring in Canada. As China, a significant contributor, is unstable and investments accompany this, a decrease in profit stability seems inevitable for the time being."

In the case of Amorepacific, there is high anticipation for the newly acquired COSRX. On the 31st of last month, Amorepacific announced it would acquire 288,000 shares of COSRX for 755.1 billion KRW. Including previously acquired shares, it will secure a total stake of 93.2%. Myung-joo Kim, a researcher at Korea Investment & Securities, evaluated, "COSRX has strengths in high-margin skincare products and currently ranks first in the cosmetics category on Amazon US. Next year, overseas business sales growth centered on COSRX in non-China regions is expected to offset the slow recovery of the Chinese subsidiary, driving overall performance improvement."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.