Galaxy Flagship and Display Sales Expansion

Harman Achieves Record Quarterly Performance

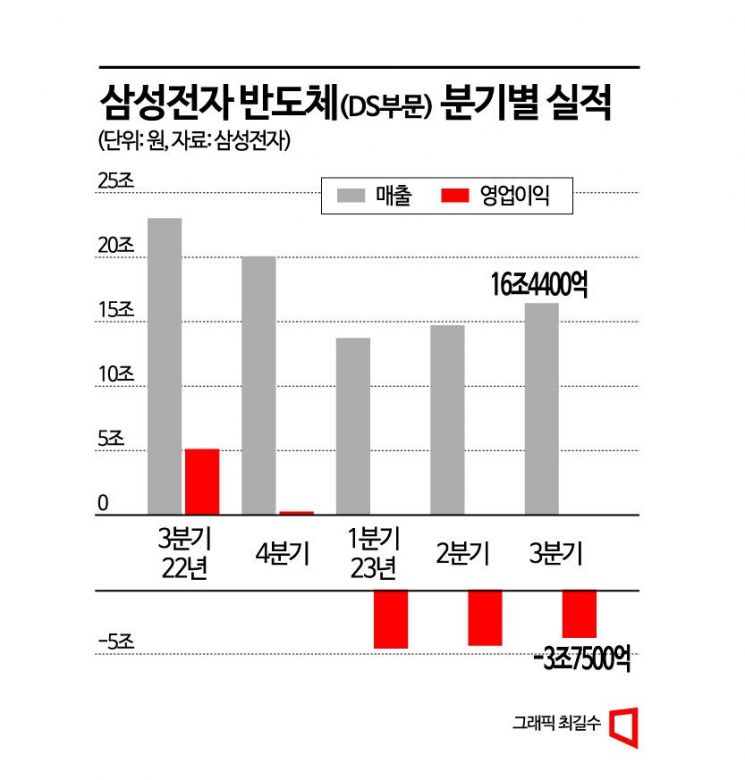

Semiconductor Deficit Hits 3 Trillion Won Range... Memory Bottom Confirmed

3Q Foundry Orders Reach Quarterly Record High

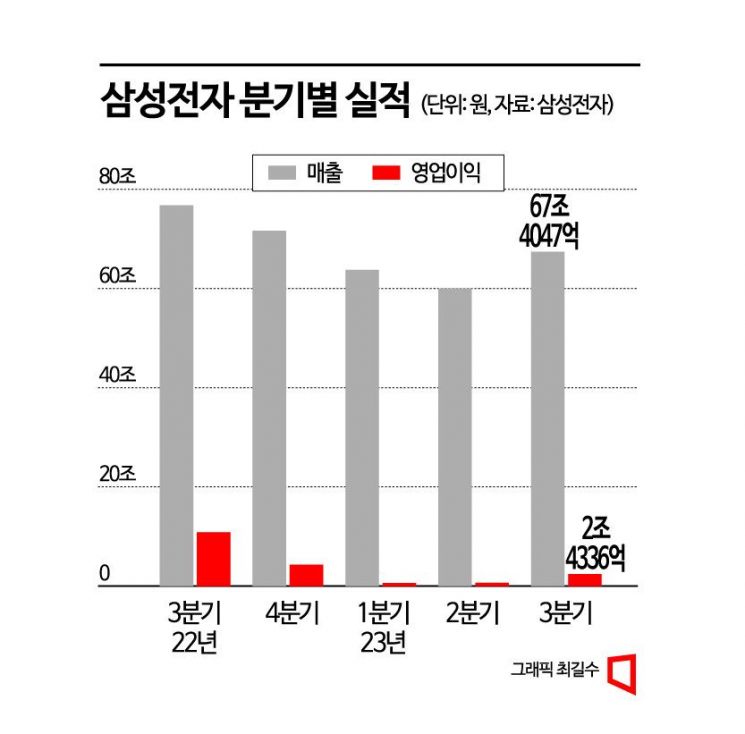

The background behind Samsung Electronics' ability to recover trillion-won level operating profit in the third quarter includes the launch of new flagship smartphone models and the expansion of premium display product sales. Although the semiconductor deficit did not decrease as much as expected, the confirmation of the memory market bottom and the resulting performance improvement are viewed positively. The underperforming foundry achieved the largest quarterly orders ever, raising future expectations.

Steady Growth of 'Performance Drivers' Mobile and Display

The Mobile Experience (MX) division played a key role in driving profits this quarter despite the semiconductor (DS) deficit situation, thanks to the successful launch of the foldable smartphones 'Galaxy Z Flip5' and 'Galaxy Z Fold5' released in August.

The MX division's third-quarter operating profit was 3.3 trillion KRW, surpassing the same quarter last year (3.24 trillion KRW). Sales volume of the Galaxy Z Flip5 and Fold5 exceeded that of the previous models released last year, and domestic pre-orders reached about 1 million units, marking the highest level among foldable phones ever. The securities industry estimates Samsung Electronics' smartphone shipments in the third quarter at approximately 58 million units.

The Display (SDC) division also performed well, supported by favorable new product launches from client companies. Display recorded sales of 8.22 trillion KRW and operating profit of 1.94 trillion KRW. Samsung Display supplies small- and medium-sized organic light-emitting diode (OLED) panels to Samsung Electronics' Galaxy and Apple's iPhone, and it is interpreted that the third quarter benefited from new product launches this year. In particular, the start of some supply of OLED panels for laptops further contributed to improved profitability.

In the Video Display (VD) segment, global TV demand decreased compared to the same period last year, but by focusing on sales of high-value-added products such as Neo QLED and OLED, Samsung expanded its premium market leadership and improved profitability compared to the previous year. However, home appliances recorded results at the previous year's level due to a decrease in peak season effects.

Harman, responsible for the automotive electronics business, achieved record quarterly results with sales of 3.8 trillion KRW and operating profit of 450 billion KRW. This was influenced by expanded orders from automotive customers and increased sales of consumer audio and car audio products such as portable speakers.

Semiconductor Deficit in the Trillion-KRW Range... Clear Signals of Memory Recovery

Samsung Electronics recorded sales of 16.44 trillion KRW in the DS division in the third quarter. This is a 28.58% decrease from the same period last year but an 11.61% increase from the previous quarter. Among this, the memory business division's sales were 10.53 trillion KRW, a 17% increase from the previous quarter. The memory market downturn, which began in earnest in the second half of last year, appears to be showing signs of recovery starting in the second half of this year.

Samsung Electronics stated that alongside the memory industry's production cuts, recognition of the market bottom centered on DRAM has expanded, leading to increased inquiries from customers to secure component inventory. Additionally, increased sales of high-value-added DRAM, including High Bandwidth Memory (HBM), also contributed to the performance. Samsung is currently focusing on expanding production cuts mainly for legacy (older) products to reduce inventory levels.

Samsung Electronics expects the market recovery to accelerate entering the fourth quarter. The company believes that the expansion of high-value-added product sales and price increases can occur rapidly. Going forward, Samsung plans to increase the proportion of high-profit products such as automotive sales and to actively expand mass production and sales of the fourth generation of HBM (HBM3). The securities industry forecasts that Samsung may supply HBM3 to Nvidia in the United States within this year.

The System LSI and Foundry divisions, which showed relatively sluggish performance improvement in the third quarter, are focusing on business opportunities in the fourth quarter. The System LSI division expects increased performance due to higher component supply for new products from major customers as mobile market demand recovers. The Foundry division, which achieved record quarterly orders centered on high-performance computing (HPC) in the third quarter, anticipates performance improvement in the fourth quarter due to the effect of new product launches by customers.

Meanwhile, Samsung Electronics' DS division executed 1.02 trillion KRW in capital expenditures in the third quarter. The total capital expenditure for this year is expected to be 1.02 trillion KRW. In the memory sector, to respond to mid- to long-term demand, Samsung is proceeding with the completion of the third plant and structural investment of the fourth plant at the Pyeongtaek campus, while increasing research and development (R&D) investment to strengthen technological leadership. In the foundry sector, Samsung plans to expand production capacity at the Pyeongtaek campus and increase investment in infrastructure at the Taylor plant in the United States to meet demand for advanced processes, thereby increasing investment scale compared to the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.