Seongdo ENG, Dongmun Construction, Ace Construction, Ilsin Geonyeong, and Others Also Issue Bonds

Shinbo Supports Fundraising of 589 Billion Won by Issuing P-CBO

Several mid-sized construction companies ranked 15th to 100th in domestic construction capability rankings (contract ranking) secured liquidity by issuing option bonds with government support. As rising interest rates and a downturn in the construction market made it difficult to raise funds independently, they reportedly requested bond guarantees from the Korea Credit Guarantee Fund (KODIT) one after another.

According to the investment banking (IB) industry on the 31st, Jeil Construction, ranked 17th in domestic contract rankings and famous for its apartment brand ‘Jeil Punggyeongchae,’ issued option bonds worth 28 billion KRW the day before. The maximum maturity of these bonds is 2 years, and from April next year, six months later, Jeil Construction can exercise a call option (early redemption option) to repay early. Thanks to KODIT’s support, the option bond issuance interest rate was set low at 5.592%.

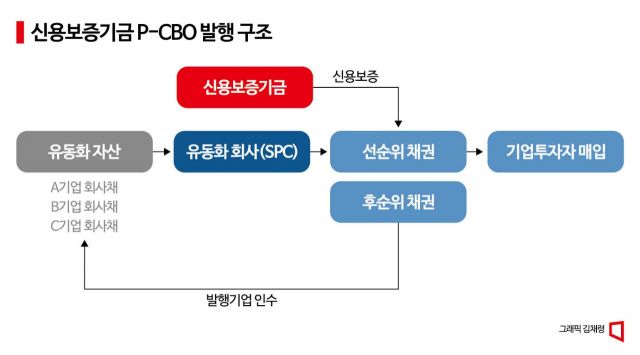

Hyundai Motor Securities, the lead underwriter, acquired Jeil Construction’s option bonds and transferred them as underlying assets for issuing Primary Collateralized Bond Obligations (P-CBOs). KODIT acquired multiple bonds through a Special Purpose Company (SPC) and then provided guarantees to the SPC to issue P-CBOs.

On the same day, construction companies such as Seongdo ENG (ranked 59th, 5 billion KRW), Dongmoon Construction (ranked 61st, 20 billion KRW), Ace Construction (ranked 71st, 30 billion KRW), and Ilsin Geonyeong (ranked 74th, 15 billion KRW) secured funds by issuing option bonds in the same manner. The maximum maturity of these bonds is 3 years, and the issuance interest rate was set at 6.113%. The structure allows early redemption starting six months after issuance. Samsung Securities, KB Securities, Woori Investment & Securities, Kiwoom Securities, and Kyobo Securities participated as lead underwriters for these construction companies’ bond issuances.

An IB industry official said, "Due to rising interest rates and a downturn in the construction market, mid-sized construction companies’ borrowing costs exceed 10%, and it is difficult to find bond investment demand even at double-digit interest rates." He added, "Many construction companies within the top 100 contract rankings applied for KODIT funding support, and some were selected as government-supported targets." The official explained, "All construction companies issued option bonds to allow flexible selection of redemption timing depending on market conditions."

Besides construction companies, large and mid-sized companies such as Homeplus (56 billion KRW), Hansol Paper (80 billion KRW), Hansol Home Deco (10 billion KRW), Socar (50 billion KRW), Poly Mirae (40 billion KRW), Isu Chemical (32 billion KRW), and Hwasung Corporation (15 billion KRW) issued private bonds with KODIT support.

On the same day, KODIT supported fund raising of 589 billion KRW by issuing P-CBOs using the private bonds issued by companies as underlying assets. The Korea Technology Finance Corporation (KOTEC) also selected small and medium manufacturing and technology companies such as Edity, Sungji Steel, Shinseong CNS, and Jinwoo Engineering to support a total of 204 billion KRW in fund raising.

An industry official said, "As the funding environment worsens, the number of mid-sized and small companies that find it difficult to raise funds independently is increasing, leading to more companies applying for funding support projects from KODIT or KOTEC." He added, "There are concerns about rising default rates on KODIT guarantees, making it difficult to increase unlimited support, and competition is intensifying."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.