Correction in Secondary Battery Stocks After August... POSCO Holdings and POSCO Future M Q3 Earnings Decline

Q4 Earnings Also Uncertain... Securities Firms Lower Target Prices for POSCO Group Stocks One After Another

POSCO Group stocks are struggling as adjustments in secondary battery stocks and poor earnings overlap. Market capitalization has evaporated by as much as 45 trillion won compared to the peak in July. The first POSCO Group stock exchange-traded fund (ETF) recently listed also shows a sluggish performance.

According to the Korea Exchange on the 26th, POSCO Holdings closed at 445,500 won, down 6.01% from the previous day. POSCO Future M fell 10.16%, POSCO International 9.05%, POSCO M-Tech 7.11%, POSCO DX 6.29%, and POSCO Steelion 5.12%, respectively.

The combined market capitalization of these six POSCO Group listed companies was 77.025 trillion won based on the previous day's closing price, which means 45 trillion won has disappeared over three months compared to the all-time high of 122.4024 trillion won on July 25.

Since August, as secondary battery stocks have been adjusting, POSCO Group stocks have also shown weakness. Additionally, the third-quarter earnings of POSCO Group stocks this year fell short of expectations, pushing the stock prices down further. On the 24th, POSCO Holdings announced third-quarter consolidated sales of 18.961 trillion won and operating profit of 1.196 trillion won. Due to the global steel market downturn and price declines in battery materials such as lithium and nickel, sales decreased by 5.5% and operating profit by 7.7% compared to the previous quarter. The eco-friendly future materials business, including secondary batteries, achieved sales of 1.313 trillion won but turned to an operating loss. POSCO Future M, which operates the secondary battery materials business, recorded quarterly maximum sales of 1.2858 trillion won in the third quarter, but operating profit decreased by 54.6% year-on-year to 37.1 billion won.

With expectations that fourth-quarter earnings will also fall short, securities firms have consecutively lowered their target prices for POSCO Holdings. Samsung Securities lowered the target price from 700,000 won to 630,000 won. Daishin Securities cut it from 640,000 won to 570,000 won, Hyundai Motor Securities from 745,000 won to 664,000 won, Shinhan Investment Corp. from 700,000 won to 660,000 won, and Kiwoom Securities from 590,000 won to 560,000 won. Baek Jae-seung, a researcher at Samsung Securities, explained, "While the steel market is bottoming out, strong earnings recovery is unlikely until the first quarter of next year, and the secondary battery materials business will also require waiting for inventory depletion in the value chain. Since the key factors constituting POSCO Holdings' corporate value are currently affected by sluggish market conditions, a conservative approach is inevitable in the short term, reflecting which we lowered the target price by 10% compared to the previous level."

Target price cuts have also continued for POSCO Future M. Meritz Securities lowered POSCO Future M's target price from 450,000 won to 390,000 won. SK Securities cut it from 670,000 won to 406,000 won, and NH Investment & Securities from 560,000 won to 430,000 won. Noh Woo-ho, a researcher at Meritz Securities, said, "A somewhat conservative approach is needed regarding POSCO Future M's profitability outlook. Due to the expected prolonged decline in selling prices caused by falling major raw material prices, we present a lowered target price."

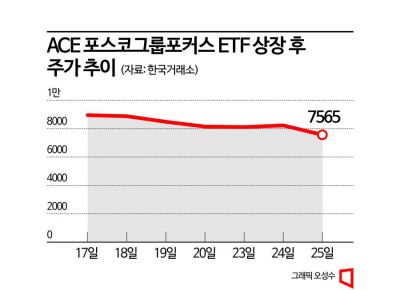

Due to the sluggishness of POSCO Group stocks, the recently listed POSCO Group stock ETF is also downcast. The first domestic POSCO Group stock ETF, ACE POSCO Group Focus ETF, closed at 7,565 won, down 8.02% from the previous day. The ACE POSCO Group Focus ETF, listed on the 17th, started at 9,165 won on the first day of listing but has since continued a downward trend, falling below 8,000 won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)