Stock Price Drop Leads to Significant Reduction in Paid-in Capital Issuance Price

Focus on Debt Repayment... Plan Disrupted Due to Decrease in Operating Funds

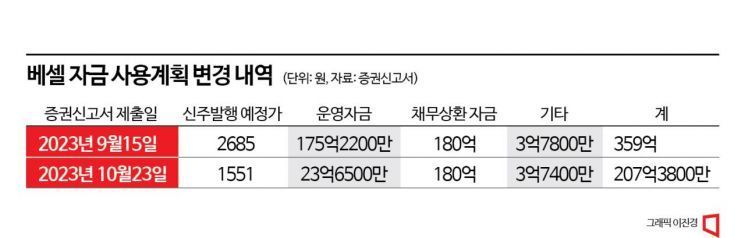

Vessel's plan to raise 36 billion KRW through a paid-in capital increase has encountered setbacks. As the new share issuance price dropped, the planned fundraising amount was reduced to 20.7 billion KRW. While the repayment of borrowings will proceed as originally planned, most of the 14.5 billion KRW intended for company operations starting from the first half of next year has been cut.

According to the Financial Supervisory Service's electronic disclosure system, Vessel set the first issuance price for the paid-in capital increase through a shareholder preferential subscription at 1,551 KRW per share. Vessel will finalize the new share issuance price on the 24th of next month and conduct subscription for existing shareholders from the 29th to the 30th of the same month. If there are any unsubscribed shares, a public offering will be held for general investors over two days from December 4th to 5th.

When the board of directors resolved the capital increase on the 15th of last month, the planned new share issuance price was 2,685 KRW. The plan was to issue 13.37 million new shares to raise 35.9 billion KRW. However, due to the recent sluggishness in the KOSDAQ market and a decline in Vessel's stock price, the first issuance price was about 42% lower than planned. The fundraising scale decreased by 15.2 billion KRW to 20.7 billion KRW.

The funds were planned to be used as follows: 17.522 billion KRW for operating capital, 18 billion KRW for debt repayment, and 378 million KRW for other purposes. However, with the reduced available funds, the plan has encountered difficulties.

In an urgent situation requiring financial structure improvement, Vessel will prioritize debt repayment. Out of a total loan amount of 21.296 billion KRW borrowed from Woori Bank, Industrial Bank of Korea, Kookmin Bank, and others, 19.3 billion KRW will be repaid.

Additionally, the budget for ongoing research and development, including new products which was initially planned to be 3 billion KRW, has been reduced to 1 billion KRW. Vessel is participating as the lead research and development institution in the government project commissioned by the Ministry of Trade, Industry and Energy titled 'PIM Artificial Intelligence Semiconductor Core Technology Development (R&D)' specifically related to 'Mold Wafer Surface Grinder Development.' Through this, the company plans to seek new revenue opportunities in the semiconductor equipment sector.

The largest cut in the fund usage plan is in general operating funds. The company explained in the investment prospectus that "a total net expenditure of about 22.1 billion KRW is expected from the third quarter of this year through the fourth quarter of 2024." Vessel had planned to use 14.522 billion KRW as operating funds starting from the first half of next year. However, this amount has been reduced to 1.365 billion KRW. As a result, the company's operational plans are also expected to face difficulties.

In particular, since Vessel has not secured all the funds it intended to raise, it is expected to seek additional fundraising. The company stated, "If the actual raised funds are less than expected, we plan to secure funds through internal resources, and if internal resources are insufficient, through additional external fundraising."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)