PEF Won Asia Chairman Jangbae Ji Summoned for Investigation Over Purchase of Estem Shares

Investigation Expands to Companies Funded by Won Asia Fund

Kim Beom-su, head of Kakao Future Initiative Center, is appearing at the Financial Supervisory Service on the 23rd to be investigated regarding allegations of market manipulation during the acquisition process of SM Entertainment. Photo by Kang Jin-hyung aymsdream@

Kim Beom-su, head of Kakao Future Initiative Center, is appearing at the Financial Supervisory Service on the 23rd to be investigated regarding allegations of market manipulation during the acquisition process of SM Entertainment. Photo by Kang Jin-hyung aymsdream@

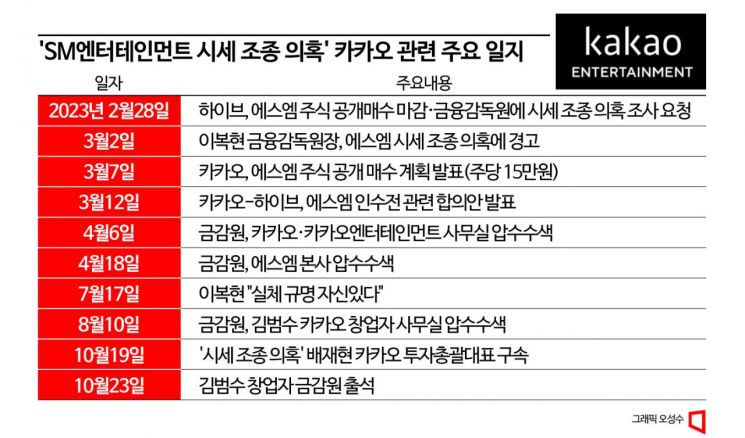

On the 19th, the second-in-command overseeing Kakao's investment activities and subsidiary management, Bae Jae-hyun, the CEO of Kakao Investment, was arrested. On the 23rd, Kim Beom-su, the founder of Kakao and head of the Future Initiative Center, appeared before the Financial Supervisory Service (FSS). He is suspected of having been informed about or having directed market manipulation to block HYBE's public tender offer for SM Entertainment (SM). Around 10 a.m. that day, Kim Beom-su appeared as a suspect but remained silent when asked whether he admitted the charges or if he had ever instructed or been informed about market manipulation related to Bae Jae-hyun, who was detained on charges of violating the Capital Markets Act. He briefly responded, "I will cooperate sincerely with the investigation," but otherwise refrained from commenting.

Considering that the FSS's Capital Markets Special Judicial Police (Special Judicial Police) conducted a search and seizure at Kim Beom-su's office before summoning him, it is presumed that they have secured clues related to market manipulation. This is further supported by FSS Chairman Lee Bok-hyun's confidence in uncovering the truth. Moreover, the arrest warrant application for Bae Jae-hyun contains detailed allegations. Sources familiar with the legal and financial authorities believe that it will be difficult for Kim Beom-su and Bae Jae-hyun to escape the market manipulation charges. As the investigation gains momentum, attention is focused on where the investigative focus will be directed.

Targeting Kakao's Top Management... Difficult to Escape Charges

The investigative and financial authorities are targeting Kakao's top management. Since this is still before indictment, it is premature to determine the guilt of Kakao executives such as Bae Jae-hyun. However, legal circles believe it will be difficult to easily evade market manipulation charges. The reason for the strong measure of detention is also aimed at Kim Beom-su. The Special Judicial Police applied for arrest warrants for three individuals, including Bae Jae-hyun, the head of Kakao's Investment Strategy Office, and the head of the Investment Strategy Division at Kakao Entertainment. The court issued an arrest warrant for Bae Jae-hyun. The Seoul Southern District Court explained that there was a concern about evidence destruction and flight risk.

The FSS is also confident in uncovering the truth. The FSS stated, "Bae Jae-hyun was detained due to significant concerns about flight and evidence destruction and is currently held in custody," adding, "The Special Judicial Police will investigate while he is in custody and plan to transfer the case to the prosecution within 10 days." It is reported that the Special Judicial Police questioned Kim Beom-su on the 23rd about whether he had instructed or been informed regarding the market manipulation suspicions.

The authorities have already secured phone call recordings and text messages containing evidence of market manipulation from Kakao's working-level staff's mobile phones. Regarding the head of Kakao's Investment Strategy Office and the head of the Investment Strategy Division at Kakao Entertainment, whose arrest warrants were dismissed, the authorities emphasized, "The objective facts have been substantially clarified based on the investigation results," and "additional investigations will continue for processing." The court also dismissed the arrest warrants for the two but stated, "Based on the evidence secured so far, the objective facts appear to have been substantially clarified." This means that a significant part of the criminal charges has been substantiated.

Investigation into Collusion with One Asia Unavoidable

Kakao is suspected of artificially inflating SM's stock price during the acquisition process. It is also accused of colluding with a private equity fund that maintains a close relationship with Kakao. The arrest warrant application for Bae Jae-hyun contains specific details that during the market manipulation process, he colluded with the private equity fund management company and even mobilized affiliated companies jointly invested with this management company. It states that they conspired with One Asia Partners, a private equity fund management company with close ties through multiple joint investments, to purchase large quantities of SM stock and maintain SM's stock price above HYBE's tender offer price of 120,000 KRW.

In the case of tender offers conducted over-the-counter, if the stock price is higher than the tender offer price, it is difficult to attract investors. This is why HYBE's tender offer failed. Around February 16-17, about a week after HYBE announced the tender offer, One Asia used its own funds and the funds of the 'Helios No.1' fund it manages to execute more than 300 market manipulation orders such as 'high-price buying, volume depletion, and closing price intervention.' This is a typical trading technique of a manipulative group. On February 27, one day before the tender offer closed, Kakao Entertainment and One Asia jointly invested company Graygo's account was also used to place high-price buying orders. The investigative and financial authorities believe these trading activities were conducted with the purpose of fixing or stabilizing SM's stock price above 120,000 KRW and violated Article 176 of the Capital Markets Act, which prohibits market manipulation. If it is proven that these companies that purchased SM stock are related to Kakao, it would constitute a violation of the 5% rule.

Accordingly, an investigation into One Asia is expected to intensify. A legal insider said, "One Asia's large-scale share purchases were made in collusion with Bae Jae-hyun, and effectively, the investigative and financial authorities' position that Kakao and One Asia should be regarded as a single acquisition entity, thus violating the 5% rule, will be strengthened."

Earlier, the Special Judicial Police summoned and investigated Ji Chang-bae, chairman of One Asia Partners. However, no arrest warrant was requested for Ji Chang-bae. There is still a possibility that the Special Judicial Police may apply for additional arrest warrants. One Asia, which was merely a fledgling private equity fund, frequently appeared in major Kakao transactions without competitive bidding due to its connection with Kim Tae-young, president of One Asia, who had built a friendship with Bae Jae-hyun when both were part of CJ Group's Future Strategy Office. Therefore, Kim Tae-young may also become a subject of investigation. The FSS Special Judicial Police stated, "The accumulation of shares by the private equity fund is also subject to investigation," and "the investigation is ongoing."

Expansion of Investigation Targets Possible

Korea Zinc may also become a subject of investigation. Korea Zinc is the source of funds for the fund in which One Asia accumulated shares. During the active period of SM's tender offer, Korea Zinc was the largest limited partner (LP) of the fund managed by One Asia, holding over 90% of the fund's shares. A Korea Zinc official said, "Korea Zinc makes various financial investments through multiple asset management companies, including various funds and bonds, but we have no knowledge of the detailed operations or methods of each management company."

The relationship between SM's management and Align Partners may also come under investigation. If the scope of the investigation expands to cover the entire process surrounding SM's acquisition, it will be possible to examine whether there was any communication between SM's management, Kakao's management, and Align Partners. During the tender offer period, SM's management is suspected of market manipulation for mentioning the possibility of purchasing treasury shares. There is also room to investigate whether Align Partners, which triggered the management rights dispute, had communication with Kakao's management.

Align Partners has raised concerns about SM's governance issues since early 2022. This year, SM's board of directors made a breakthrough by accepting Align Partners' 'governance improvement plan.' However, Align Partners later faced controversy over dual-track actions.

Lee Chang-hwan, CEO of Align Partners, sold all 10,000 shares of SM stock held through his personal corporation Align Holdings (formerly CHL Investment) in March this year. The average purchase price of SM shares by Align Holdings is known to be in the mid-50,000 KRW range. Considering SM's stock price at the time, it appears that he made a capital gain of more than double. Additionally, Align Partners provided all its held shares for securities lending transactions that could be used for short selling, earning commission income. The timing of the transaction became controversial. The transaction was conducted shortly after HYBE's withdrawal from the acquisition battle confirmed Kakao's victory and SM's stock price decline became clear.

Align stated, "It was a decision based on our investment strategy and followed proper procedures." However, there was public criticism that this contradicted their previous stance of enhancing shareholder value. Align explained, "The share sale was for financial reasons such as covering operating costs," and "after Lee Chang-hwan's appointment as a director of SM, transactions would be practically restricted and administratively cumbersome, so we wanted to settle it as soon as possible." Regarding securities lending, they said that for activist funds, lending shares to increase client profits is not unusual behavior.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)