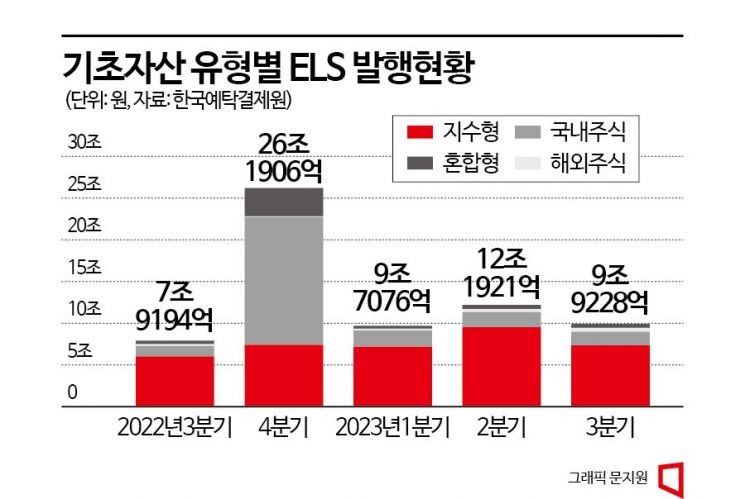

3Q ELS Issuance Volume Down 18.6% QoQ

Hong Kong H Index-Linked ELS Issued Jan-Feb 2021 Maturing Jan-Feb Next Year

Hong Kong H Index, Above 11,000 Then, Now Below 6,000

As the stock market continues to underperform, equity-linked securities (ELS), a representative 'medium-risk medium-return' product, are also shrinking. This is due to factors such as the rise in U.S. Treasury prices and the war between Israel and the Palestinian armed faction Hamas.

According to the Korea Securities Depository on the 23rd, the issuance amount of equity-linked securities (ELS), including equity-linked bonds (ELB), in the third quarter of this year was 9.9228 trillion won, down 18.6% from 12.1921 trillion won in the previous quarter. By issuance type, publicly offered ELS accounted for 9.0747 trillion won, making up 91.5% of the total issuance volume.

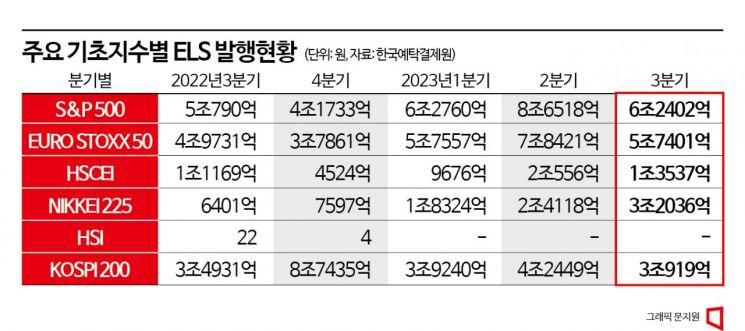

The issuance volume of ELS based on the Nikkei 225 index increased by 32.8% compared to the previous quarter. ELS issuance based on overseas indices such as the S&P 500, Euro Stoxx 50, and Hong Kong H index (HSCEI) decreased by 27.9%, 26.8%, and 34.2%, respectively. ELS based on the domestic KOSPI 200 index decreased by 27.2% from the previous quarter, with 3.0919 trillion won issued.

The total redemption amount of ELS in the third quarter was 11.9813 trillion won, down 12.2% from 13.6393 trillion won in the previous quarter. By redemption type, early redemption amounted to 9.7375 trillion won, accounting for 81.3% of the total redemption amount.

ELS are derivatives based on stock indices or specific stock prices. If the underlying asset moves within a certain range until maturity, the principal and profits are paid. The majority of products have a 3-year maturity. If certain conditions are met, early redemption occurs every six months. There are five opportunities for early redemption and one for maturity redemption. Because profits can be made even if the underlying asset price falls, depending on subscription conditions, ELS are preferred by investors seeking medium risk and medium returns.

One of the reasons for the stock market's sluggishness in the third quarter was the rise in government bond yields, which led to a decrease in the attractiveness of ELS. Researcher Jeong In-ji from Yuanta Securities explained, "Since May, as government bond yields have risen, the relative attractiveness of bonds has increased."

In August, the redemption amount of ELS was 3.37 trillion won, an increase of 530 billion won compared to the previous month, while the issuance amount was 2.11 trillion won, a decrease of 150 billion won from the previous month. In August, redemptions exceeded issuances by 1.26 trillion won, marking the third consecutive month where redemption amounts surpassed issuance amounts.

In addition to the relative decline in attractiveness, the possibility that the number of ELS locking in losses will increase from next year is also cited as a factor in the ELS market downturn. The early redemption amount in August was 3.37 trillion won, 980 billion won more than the issuance amount of 2.39 trillion won in February this year, six months earlier. This means that most ELS issued six months ago succeeded in early redemption at the first interim evaluation, and some ELS issued a year ago were also early redeemed through the second interim evaluation.

Notably, the amount of mid-term redemptions increased in August. Mid-term redemptions in August were 52 billion won, more than double the previous month. Generally, mid-term redemption results in receiving an amount reduced by 5% of the ELS evaluation amount, making it a disadvantageous choice for investors.

Most of the Hong Kong H index-related ELS issued in 2021 did not receive early redemption. The issues issued in January and February 2021 have already undergone five interim evaluations conducted every six months. They must now wait for maturity redemption in January and February next year. If the underlying Hong Kong H index falls below a certain level compared to the base price at maturity, losses are inevitable. The Hong Kong H index, which was above 11,000 points in January-February 2021, has fallen below 6,000 points after two years and eight months.

Researcher Jeong said, "Most of the Hong Kong H index-related ELS issued in 2021 have not received early redemption, and significant principal losses are expected at maturity redemption next year. The volume of Hong Kong H-related ELS issued in the first half of 2021 will burden the market throughout the first half of next year starting January."

Although the proportion of Hong Kong H index-related ELS is lower than that of ELS based on other overseas indices, it is sufficient to trigger investors' caution about ELS losses. This could lead investors seeking medium risk and medium returns to increase their bond investment ratios.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)