Loan Maturities Postponed to Q4 for Corporate Bond Issuance Amid High Funding Demand

Many Institutions Completed Fund Execution or in Valuation Loss, Reluctant to Invest in Bonds

Daeyu Group Affiliate Default Sparks Avoidance of Low-Credit Corporate Bonds

Investment Demand Likely Difficult to Secure for Companies Rated A or Below

As market interest rates continue to rise in the second half of the year, companies are facing an emergency in refinancing (reissuing) corporate bonds maturing soon. This is because the amount of corporate bonds maturing in the fourth quarter that need to be refinanced or repaid exceeds 10 trillion won, while institutional investors' standby funds for bond investments are steadily decreasing. Recently, some companies have experienced undersubscription issues in corporate bond issuance, failing to secure investment demand, which is gradually heightening concerns over funding crises. In particular, relatively low-credit non-investment grade companies are in a situation where they must seek alternative funding sources.

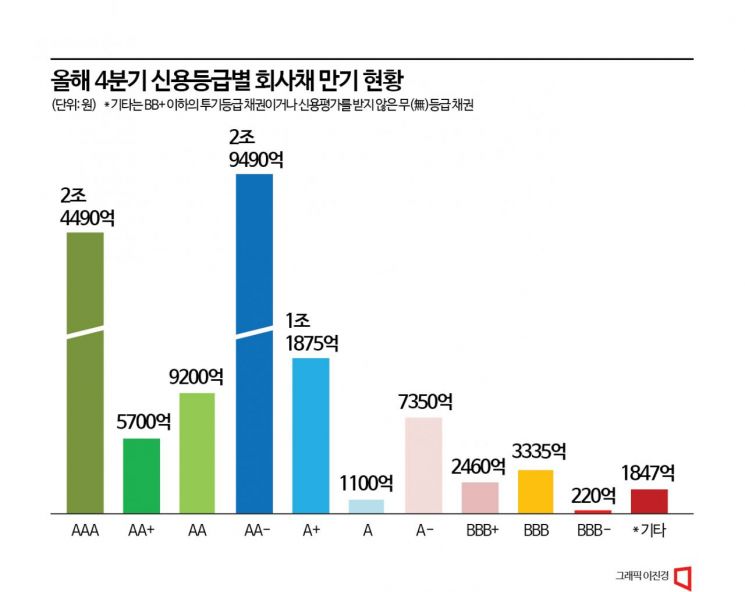

According to the investment banking (IB) industry, the amount of general corporate bonds maturing in the fourth quarter (October to December) that companies (excluding financial institutions) need to refinance is about 10.6 trillion won. Including equity-linked bonds such as convertible bonds (CBs) and bonds with warrants (BWs), option bonds, and redeemable convertible preferred stocks (RCPS) with put options (early redemption rights), the burden of refinancing or repaying corporate bonds for companies approaches 25 trillion won. By month, the largest maturity volume is concentrated in October at 6.1 trillion won, followed by 3.65 trillion won in November and 900 billion won in December, with maturity volumes decreasing toward the end of the year.

If companies do not refinance maturing corporate bonds, they must repay them all in cash. For this reason, most companies that have recently issued public corporate bonds are issuing new bonds to repay maturing bonds. Companies such as SK Telecom, SK On, HD Electric, Lotte Chilsung Beverage, Union Asset Management (UAMCO), and Pyeongtaek Energy Service, which have recently issued bonds or are about to conduct demand forecasts, all stated in their securities registration statements that the purpose of fund raising is to repay maturing corporate bonds.

An IB industry official said, "Companies that need to respond to loan maturities or those that postponed bond issuance in the third quarter expecting interest rates to fall are issuing corporate bonds in the fourth quarter," adding, "Fundraising for corporate bond repayments will continue from October through December."

Although there is an overflowing demand for funds to repay borrowings, the atmosphere in the corporate bond market, a core funding source for settled companies, is not favorable. Institutional investors, concerned about bond losses due to rising interest rates, have shifted to a more cautious stance on bond investments. This is because the U.S. Federal Reserve's high-interest rate policy is continuing the upward trend in market interest rates.

A bond market official said, "Major institutional investors such as pension funds, mutual aid associations, and insurance companies, which invested heavily in bonds expecting interest rates to fall in the second half, are suffering valuation losses due to rising rates," adding, "As the upward trend in interest rates is expected to continue for some time, there is a mood to reduce bond investments."

Moreover, large investment institutions such as pension funds and mutual aid associations, as well as asset management companies, have mostly completed their fund disbursements for this year. There is little room for additional fund deployment in the bond market. A bond market official diagnosed, "While corporate bond supply is increasing, the standby funds for bond investments are steadily decreasing," adding, "As public enterprises and banks increase the issuance of public and bank bonds, there is a possibility of a crowding-out effect where high-quality bonds absorb funds."

Therefore, while high-credit companies rated AA or above may be able to refinance corporate bonds by slightly raising interest rates, it is expected to be difficult for non-investment grade bonds rated A or below to issue refinancing corporate bonds. In the fourth quarter, corporate bonds rated A or below worth 2.82 trillion won will mature. Among these, bonds rated A- or below, which are expected to have difficulty securing sufficient investment demand, have maturities amounting to 1.52 trillion won.

In fact, cases of undersubscription in corporate bond demand forecasts by non-investment grade companies rated A or below have been increasing recently. According to the IB industry, the undersubscription rates in the domestic corporate bond market demand forecasts for September and October were 47% for A-rated bonds and 60.8% for BBB-rated bonds. This means that BBB-rated companies failed to secure even half of the investment demand.

The polarization of investment demand is expected to worsen as November and December pass. In particular, the default incident involving a Daewoo Group affiliate has strengthened the avoidance of corporate bond investments with low credit ratings. Jeong Hye-jin, a credit analyst at Shinhan Financial Investment, forecasted, "With recent increased volatility in government bond yields and investors' strengthened risk aversion, non-investment grade bonds will continue to face downward pressure."

An IB industry official said, "More companies are expected to switch to bank or secondary financial institution loans or be pushed into short-term funding markets such as commercial paper (CP)," interpreting, "The recent rising trend in CP market interest rates is also a result of an increase in companies flocking to the short-term funding market." The official added, "If the maturity of corporate funding shortens significantly, companies could face liquidity risks, so they need to devote considerable attention to their financial strategies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)