Kerosene Price for Aircraft Fuel to Rise 28.6% in Second Half

Stock Prices of Korean Air and Jeju Air Fall 18-35% Since July

Airline stocks are flying low after the peak season in the third quarter and the Chuseok holiday. Since the second half of the year, international oil prices have risen by nearly 30%, increasing the operating cost burden for airlines. Additionally, the slower-than-expected recovery of China routes, which was anticipated to help improve earnings, is also believed to have had an impact.

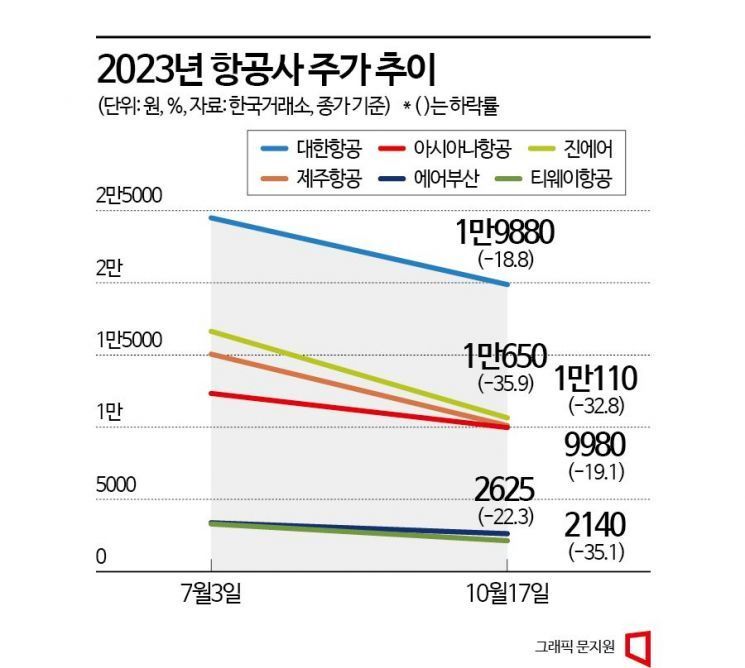

According to the Korea Exchange on the 18th, in the second half of this year (July 1 to October 17), Korean Air's stock price (closing price basis) fell 18.8% from 24,500 won to 19,880 won. Asiana Airlines' stock price dropped 19.1% from 12,340 won to 9,980 won. The 10,000 won (closing price basis) level was broken.

Low-cost carriers (LCCs) also saw similar declines. During the same period, Jin Air's stock price plunged 35.9% from 16,640 won to 10,650 won. Jeju Air fell 32.8% from 15,060 won to 10,110 won. T'way Air and Air Busan dropped 35.1% (3,300 → 2,140 won) and 22.3% (3,380 won → 2,625 won), respectively.

The factor pulling down airline stocks was the rebound in international oil prices. Oil prices, which seemed to have stabilized, have been fluctuating again due to the Israel-Palestine conflict that erupted earlier this month. As a result, the international kerosene price, known as a gauge for jet fuel prices, rose 28.6% from $90.55 per barrel (July 3) to $117.20 per barrel.

Aircraft are preparing for departure at Gimpo International Airport. Photo by Korea Airports Corporation

Aircraft are preparing for departure at Gimpo International Airport. Photo by Korea Airports Corporation

When international oil prices rise, the operating cost pressure on airlines increases. In the case of Korean Air, a $1 increase in international oil prices results in an additional annual cost of $26 million (approximately 35.2 billion won). Asiana Airlines also incurs an additional expense of 8.7 billion won.

Researcher Bae Se-ho from Hi Investment & Securities stated, "Although there was high demand and fares on international routes, the rise in fuel prices caused cost pressure," adding, "The expanded volatility in oil prices has worsened investment sentiment toward the airline sector."

Furthermore, the slower-than-expected recovery speed of China routes negatively affected stock prices. China routes, along with Japan, are considered lucrative routes. Researcher Jeong Yeon-seung from NH Investment & Securities said, "China routes have increased by 55% compared to the 2019 average," but pointed out, "Although the recovery trend continues, domestic airlines' supply increase on China routes in September was limited, so the recovery speed is slower compared to other routes." Researcher Yang Seung-yoon from Eugene Investment & Securities also analyzed, "Attention should be paid to the recovery of China routes and the continuation of travel demand after the fourth quarter," adding, "Although the number of passengers on China routes by domestic carriers is low, there is potential for recovery due to same-day issuance of Chinese tourist visas."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)