Announcement of 'Banking Sector Internal Control Inspection Results' on the 12th

Introduction of Job Rotation and Segregation for Employees in Charge of 'Corporate Finance, Foreign Exchange & Derivatives'

Follow-up Measures After Highlighting Issues of Long-term Employees in Our Report

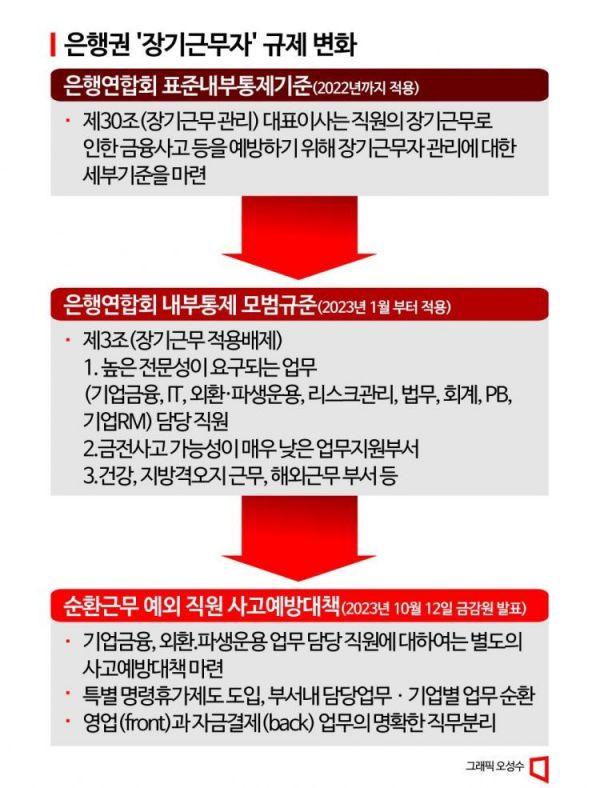

The Financial Supervisory Service (FSS) has established accident prevention control measures for long-term employees to strengthen internal controls at commercial banks. This is a follow-up action after Asia Economy pointed out issues regarding long-term employees in the article '[Current Status of Internal Control]② Embezzlement after 15 Years of Service... Long-Term Service in Specialized Fields 'Widely Allowed' (September 21)'.

Another term for long-term employees is 'employees exempted from rotation.' According to the model regulations of the Korea Federation of Banks, effective from January this year, employees in highly specialized roles can serve long-term without rotation. Our publication pointed out, "Long-term service is one of the most critical aspects of internal control, yet the model regulation provisions allow long-term service for employees in key areas such as corporate finance, IT, foreign exchange and derivatives operations, risk management, legal affairs, accounting, asset management (PB), and corporate RM, which is problematic."

'Introduction of Job Rotation and Segregation of Duties in Corporate Finance, Foreign Exchange & Derivatives'

We also examined the sharp decline in the number of long-term employees at each bank as of the end of last year and July this year (Woori Bank 399 → 6, Shinhan Bank 1681 → 52, Kookmin Bank 2295 → 842, Hana Bank 1466 → 702). On the surface, the reduction in long-term employees seems desirable, but this phenomenon occurred because the FSS exempted key operational staff from long-term service application. This created an 'optical illusion' where the numbers appeared to have decreased.

In response to these criticisms, the FSS has also devised countermeasures. According to the 'Results of Internal Control Inspection in the Banking Sector for Accident Prevention' announced by the FSS on the 12th, special preventive measures have been established for employees exempted from rotation, particularly in high-risk areas such as 'corporate finance' and 'foreign exchange and derivatives operations.' An FSS official stated, "We will introduce a special ordered leave system for rotation-exempt employees in these fields and implement job rotation within departments by task and by client company."

Additionally, they said, "We will introduce clear segregation of duties between front-office (sales) and back-office (fund settlement) operations." Employees working on the front lines in 'corporate finance' and 'foreign exchange and derivatives operations' manage large-scale funds. Internal control in financial institutions is divided into a 'three lines of defense' system (1st line: sales, 2nd line: risk management and compliance support, 3rd line: internal audit). This means creating mechanisms for mutual checks among employees in the 1st line sales, where the likelihood of incidents is highest.

Management Ratio of Long-Term Employees to be Within 5% by End of Next Year

The FSS has decided to accelerate the implementation timeline of key tasks to ensure that internal control innovation measures are quickly established in the banking sector. The deadlines for achieving goals for tasks requiring time due to personnel management and IT system development have been shortened by 6 months to 1 year.

First, the 'management ratio of long-term employees' was to be reduced to within 5% by the end of 2025, but this has been moved up to the end of 2024. The 'compliance department personnel' was to be expanded to at least 0.8% by the end of 2027, but this has been changed to the end of 2025. The introduction of PW replacement authentication methods for 'strengthening IT system controls' was scheduled for the end of 2024 but has been moved up to the end of June 2024. The obligation to verify important matters in the 'fund withdrawal system' was to be completed by the end of 2024 but has been shortened to the end of June 2024.

The FSS also plans to reform the management evaluation system to supervise internal controls. First, the weight of internal control evaluation will be increased. The internal control section, currently a sub-item under management, will be separated into an independent item. The evaluation weight will be expanded to 10% (previously 5.3%). The inspection manual will also be revised. The checklist used during FSS inspections will incorporate evaluation items on the adequacy of internal control innovation measures and accident prevention devices.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)